Are you a loan officer reading this article because you want to generate more leads, get more referrals, and significantly improve your overall digital marketing strategy?

Did you know that 31% of homeowners conducted mortgage research online first? Around 21% found their mortgage lender through an online search.

Yes, referrals are still important, but when you think about it — your online mortgage marketing strategy is a referral system that works 24/7.

When you’re publishing blogs on mortgages, you’re referring yourself to potential new clients.

Additionally, the COVID-19 pandemic changed everything about the online mortgage application process — people want a streamlined way to get their mortgage and will continue searching online until they find it.

In this comprehensive guide on mortgage marketing, I’ll go over our proven marketing framework to help loan officers improve their web presence, boost website traffic, get referrals, and close deals.

Why mortgage websites are critical for loan officers’ success

As a loan officer, your mortgage website is your main lead generator. It’s the central hub where your online audience funnels in and fills out a contact form.

And the main traffic source for your website will be your blog posts, which hopefully, are easily discoverable in a Google search.

When prospective buyers and home refinancers search Google for mortgage advice, it will be your website that they’ll ultimately land on, because you’ll be regularly blogging on mortgage advice and mortgage scenarios. Blogs like “How Do I Get an FHA Home Loan?” or “How to Get My First Mortgage.”

Google any mortgage-related terms, and you’ll see the top websites are mortgage companies trying to attract readers to convert them into new leads. This is called “content marketing” and it works!

Focus on targeting the right keywords to attract traffic in Google searches

By focusing on the most important keywords related to your mortgage business (FHA loans, how to apply for a loan, etc.) you’ll be able to create blog posts that get clicked on in Google searches.

In addition to blogging, you’ll also need to focus on search engine optimization (SEO).

SEO is the practice of using searchable keywords throughout your website’s landing pages and other content that make them easy to find in a Google search.

A no-brainer would be to add a bio page for yourself so that when people Google your name, they’ll go straight to your mortgage lending website where they can reach out to you directly.

Also, for SEO purposes, be sure to include separate landing pages (these are just separate web pages on your site) for each of your loan products to further increase your SEO—a page for FHA loans, Fixed-Rate loans, VA loans, etc.

The more mortgage-related keywords your website has on its pages, the easier it is for Google and prospective homebuyers to find your website in a Google search.

Beware of keyword stuffing

Be careful not to do the spammy approach known as “keyword stuffing” which involves typing the words “mortgage lender” or “loan officer” a hundred times on every single page.

Google is smarter than that and it will punish your website if you’re caught keyword stuffing.

Instead, you can legitimately add mortgage-related keywords to your website by writing and publishing blogs regularly. The more blogs and keywords your website has, the higher your website will rank for mortgage-related Google searches.

Learn more: The Complete Guide to Mortgage Marketing.

12 ways to promote yourself as a loan officer and build your online presence

Building your online presence will be crucial in today’s consumer-direct mortgage industry where people are accustomed to comparing rates using mortgage calculators and filling out online applications online.

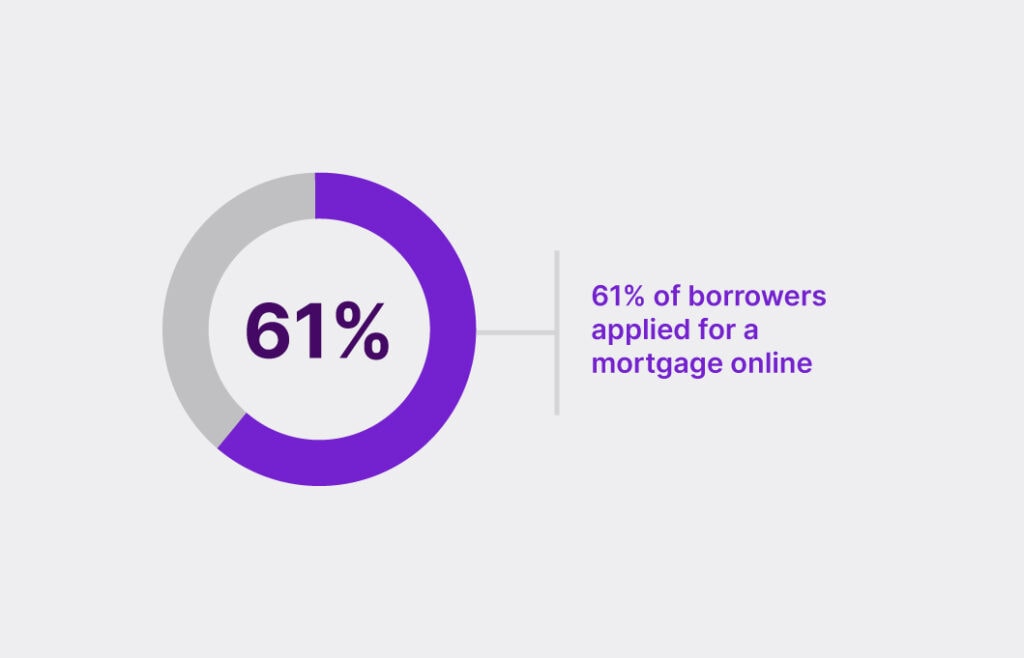

In 2020, 61% of borrowers use an online application for their mortgage process, and it’s assumed they found these applications first through a Google search.

Follow these steps to promote yourself online and build up your personal brand as a loan officer.

1. Create and optimize a personally branded website

Your professional mortgage website is the foundation for your online presence and the most effective marketing tool you have in the online mortgage space, particularly for lead generation.

All of your mortgage-related blogs and content will be housed on your website and will act as the main hub that attracts readers from across multiple sources online (social media, LinkedIn, blog posts, directories, Google Business account, etc.)

Also, when potential homebuyers and home refinancers Google you by name, it will be your website they’ll ultimately click on and visit.

Be sure to include a bio page for yourself so visitors will be warmed up to reaching out to you, making it easier for you to follow up with them in the future.

Once your website gains new visitors, you’ll need to impress them with your brand and services, making sure to have a website that’s visually appealing, easy to navigate, and also optimized for search engines. If you don’t, they’ll bounce immediately, never to return again to your website.

By being active on social media, publishing blogs consistently, answering questions on forums, or buying PPC ads, you’ll attract more visitors to your website.

Related Reading: The Essential Guide to Mortgage Websites

2. Develop your niche

Every mortgage loan officer has their own target market or niche. What is your niche?

Perhaps you’re a military veteran. Reach out to a referral network of veterans and families of active-duty soldiers to help them with VA loans.

If you’re a golfer and part of an exclusive country club, why not network with an older and affluent crowd to help plan their retirement?

If you live in a college town, why not specialize in mortgages for first-time buyers or physicians who work at the local university?

Remember, you’re not bound by your specific niche, and you should continue to help all of your customers. But having a niche to market in can give you the competitive edge over other local loan officers, and give you an “in” with the type of audience you’re the most familiar with.

3. Use social media to grow your social network

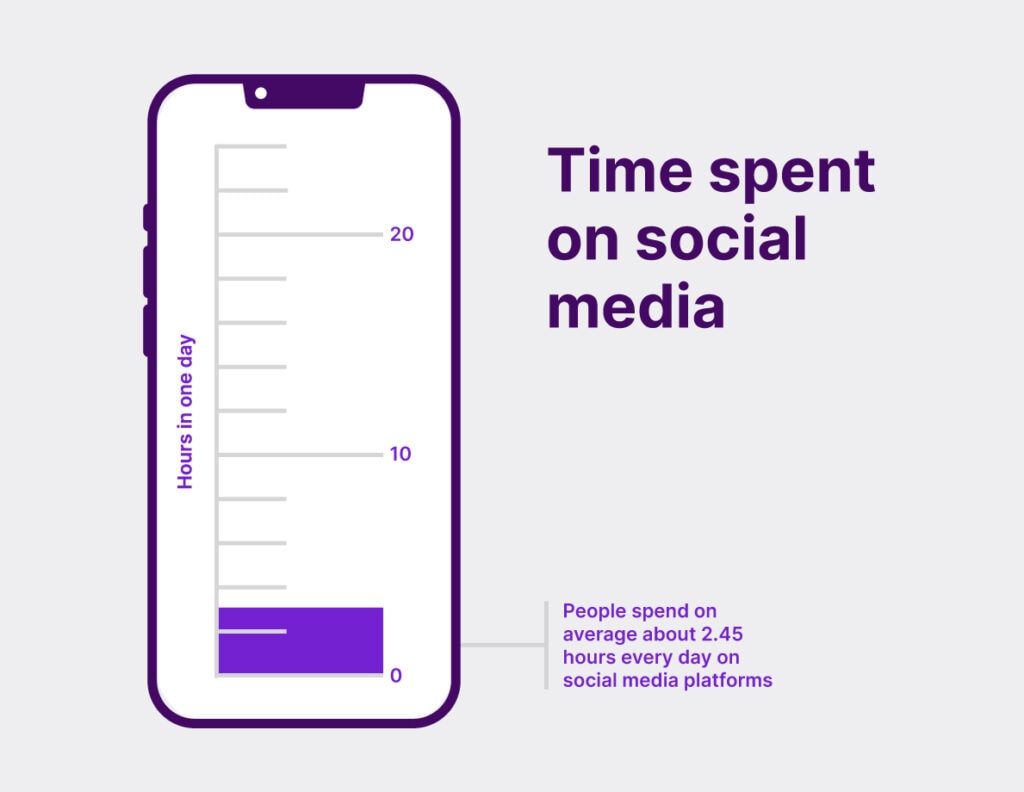

People spend on average about 147 minutes, or 2.45 hours every day consuming social media on sites like Facebook, Instagram, LinkedIn, Twitter, TikTok, Snapchat, YouTube, etc.

The trick to getting noticed is creating mortgage content that fits each of these platform’s natural strengths, such as:

- Facebook-sponsored posts or videos related to mortgages

- LinkedIn to share industry news and updates

- Instagram posts using graphics or educational infographics for greater reach

- Twitter updates related to mortgage news or links to recent blog posts on your website

Do you have to be a master of every social media platform? No, find the platforms you’re the most familiar with and start there.

Some mortgage officers find Facebook is their best platform, while others find LinkedIn more professional and targeted.

Trying to reach a young audience? Invest in a TikTok marketing plan, where there’s less competition. You may also have a better shot at reaching millennials and Gen Z borrowers who are looking to buy a home.

4. Share your expertise online and be the trusted advisor

Mortgages are really confusing for the average person. That’s why most mortgage processes start with Google research.

Put your answers and expertise on the internet, and your future customers will find it.

Maintaining a blog and social media are the obvious choices for sharing your expertise and getting attention online. But have you considered guest blogging on another popular website?

Guest blogging is a form of cross-promotion. You and the guest blogger both get something out of it. It’s a win-win. But it doesn’t have to be blogging either.

Partner up with a local real estate agent on social media and run cross-promotional content. Share their content and ask them to share yours.

You can also answer questions on Q&A sites like Reddit, Quora, and other popular websites with mortgage forums. A well-written answer might take 20 minutes to write, but it can get thousands of views over the years (again, just make sure to link it back to your website).

If you’re so inclined, you can even create a podcast on mortgages and bring in influencers with their own large followings to improve your reach.

5. Learn copywriting to produce better-written content

Always consider your audience when writing blogs. Try to be mindful of the questions your readers will have and answer those questions throughout your blogs because it’s questions that people search for most often.

Use keyword-finding tools and proofreading apps for better blogs

Learn to speak your audience’s language, including the specific keywords they’re searching for online.

To get an idea of the keywords and search terms your audience is searching for, consider using the Google Keyword Planning tool that shows you common search terms and estimated search volume. Make sure to write content based on keywords that get traffic, and avoid terms that will underperform.

Brush up on your grammar and spelling, or else you’ll raise red flags for your readers and Google, they may think your website is illegitimate otherwise.

Personally, I use Grammarly, which is a writing tool that proofreads content and makes sure there are no embarrassing grammar mistakes.

Don’t feel the need to make your articles too academic or include too much jargon. You’ll confuse your readers.

Aim for clarity and use lots of examples to illustrate your points. Break up your content using different headers to help readers and Google discovers your content more easily.

And always end your blog posts with a call to action to tell your reader to contact you.

6. Create SEO-optimized content for better visibility in Google searches

If you want your mortgage website to be discovered in Google search engine results pages (SERPs), you better make sure you have enough mortgage-related keywords sprinkled throughout your website. This is known as search engine optimization (SEO).

The more mortgage-related terms you have on your website (conventional loans, home refinancing, homebuying, etc.), the more Google will say “This must be a mortgage website. I’ll recommend this in the search results for mortgage-related queries.”

All of your web pages need to be optimized for SEO, not just your blog articles, but regular pages such as your About Us, Contact, and Loan Products pages.

As I mentioned before, the trick to adding more keywords to your website legitimately (and avoiding keyword stuffing) is by blogging and uploading other forms of mortgage content, such as:

- Lead magnets, usually free eBooks or downloadable PDFs, such as “The Ultimate Guide to Mortgage Types”

- Embedded videos that use important keywords in their video titles like “How to Get Your First Mortgage”

- Images that have been renamed with important keywords (mortgages-first-time.jpg)

- Separate web pages for each of your loan products—Conventional Purchase page, Conventional Refinance page, Mortgage Rates page, etc.

- A bio page that has your name, qualifications, and company name

- Home page with a detailed description of your company, your products, and your experience

7. Create PPC ads for a fast track to Google’s first page of search results

SEO and content marketing are both long-term tactics that will take some time to get your website and blogs showing high up in a Google search. It can take a few months just for a blog article to start showing in search results.

This is why many mortgage loan officers use Google Ads to streamline the process.

When you purchase Google Ads, you’re potentially giving yourself the fast track to being listed at the top of Google’s SERP page — however, it will cost you.

To use Google Ads, you’ll need to bid on valuable keywords that people are searching for, so when they search for “mortgages” your ad will appear at the top of the results.

Unsurprisingly, mortgage-related keywords are among the most expensive keywords found on Google.

PPC ads aren’t limited to Google — Facebook, LinkedIn, Twitter, and LinkedIn all have their own paid ad platforms, giving you access to millions of their users and demographic information.

8. Start a blog to answer mortgage-related questions

You cannot expect to build a website and have it organically generate a ton of traffic.

Blogging is the main traffic generator for websites. Without a blog, there would be no traffic, unless you want to depend on paying for ads indefinitely.

You need to constantly be publishing new content for Google’s crawler bots to sift through, sort, and index into their search result catalog.

Blogging has multiple benefits for mortgage websites:

- Improved authority

- Improved ranking

- More traffic generated

- More leads generated

- Better visibility

- Better targeting to reach your audience

9. Produce videos for an instant connection and increased visibility

Do you know who I want to do business with? Somebody who shows their face and voice and has some personality. Somebody who proves they’re a real human being and not a bot posting information about mortgages.

The quickest way to do this is to post a video of yourself!

Record a short clip introducing yourself and put this on your website, YouTube channel, and other social media pages. You can embed it into your automatic welcome emails once people fill out a form on your website.

Your production value doesn’t have to be spectacular, but it should be adequate. Make sure your camera isn’t smudgy, shaky, or crooked and you’ll be fine.

Mortgage sales, and all sales, are a people-to-people business. If you can show your face and voice to your audience, they’ll feel more comfortable reaching out or talking with you for the first time.

Sometimes posting a quick video on social media is all it takes, such as a 30-second clip of you explaining something about the mortgage process.

If you really want to fuel your video marketing efforts, try hosting free webinars and see what kinds of leads you attract. Or start creating mortgage how-to videos and posting them to YouTube.

Videos posted to YouTube stay there indefinitely, and if your video is particularly good, it can attract thousands of views. Just make sure to put a good description below your title (using good keywords) and put your contact info so it’s easy for people to reach out after watching your video.

10. Showcase your reviews to build up trust

Instead of having people go to Yelp or other review sites to get more information about you, post your reviews on your own website. There are a couple of good reasons why you’d want to do this:

- It keeps users on your website longer

- It provides “social proof” that you’ve helped real people and that you can help your prospective borrower too

- When people Google reviews, your website will appear in the search results and they’ll end up clicking on your website anyway

- You have more control over the reviews you show

Once people get to your website, you need to keep them there before they bounce off. Bouncing off just means you land on a website and immediately leave it (usually within 30 seconds).

Everybody needs social proof or else they’ll be scared off before they submit their contact info.

Would you want to submit your contact information to a nameless, faceless website with no proof that it’s a real company? Neither will your web visitors unless you can establish some trust and reliability!

11. Build a referral engine

Hopefully, at this point, you’ve been able to add tons of highly qualified leads to your CRM.

All you have to do now is produce a steady flow of referral emails, text messages, call reminders, or a mix of all three to produce a simple referral message:

“Do you know anyone that needs help with or has questions about purchasing a new home?”

Your referral ask doesn’t need to be any more complicated or pushy than that. If you’ve already provided exceptional service, then there’s no reason why previous contacts wouldn’t refer you to their friends and family.

Schedule a strategy session with Kaleidico’s mortgage marketing team today.

12. Adopt a multi-channel approach to sales

Have you ever noticed how sometimes you email a person and they never respond, but when you text them, you’ll get a response instantly?

This is the power of a multichannel approach to sales. Every person has their preferred contact method and least preferred contact method.

To increase your odds of getting a response, vary your approach to sales, for instance:

- When somebody fills out a contact form on your website, send them an automated SMS message

- Mail out a physical card when a lead gives you their address in a contact form

- After leaving a voicemail, instantly send an email as well saying “I just left a voicemail, but wanted to email you in case this is easier for you.”

Social media marketing for loan officers

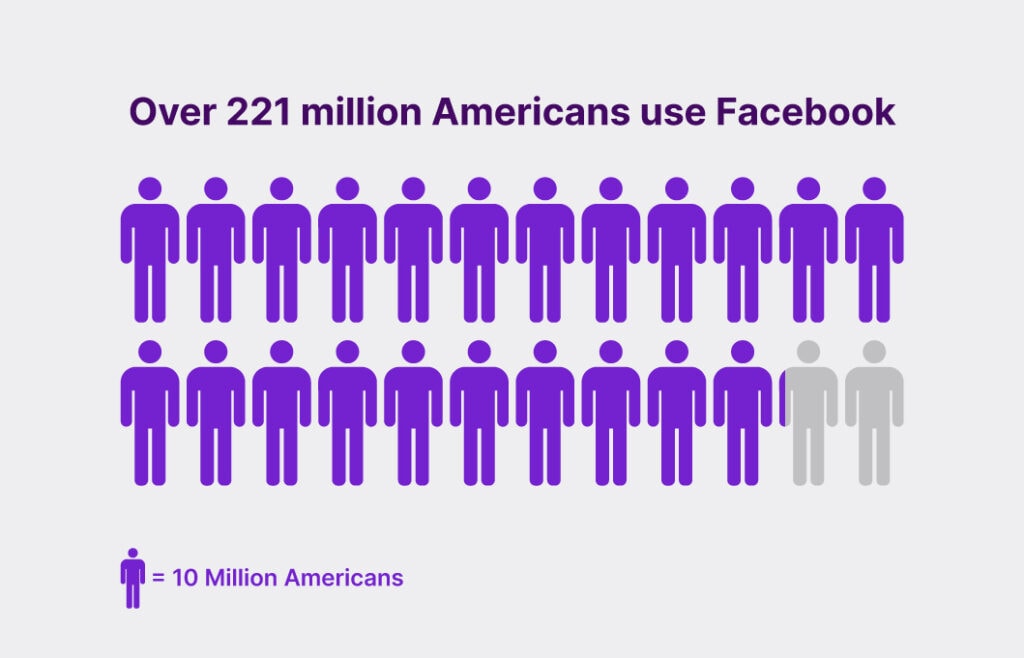

Facebook pages are a free way to market your mortgage business and increase your social media presence among potential clients. Over 221 million Americans use Facebook, so you’d be hurting yourself by not forming a page. Why not create one?

If you’ve blogged about mortgages (which you really should be doing) then you can post these blogs as engaging content on your business page.

Or you can share your opinions on the latest mortgage news to become an influencer or thought leader. These kinds of posts can really spread your reach, particularly if they’re shared by numerous people.

Over time, your followers will begin recommending you to their friends and family, further boosting your page likes and your post’s impressions to meet a larger audience.

Once you’re ready for paid advertisements, Facebook Ads Manager makes it pretty simple to set up advertising campaigns. You can target people specifically by geographical location, interests, demographics, income information, and basically any other demographic you want to narrow down.

How to use mortgage email marketing to generate more leads

Past mortgage broker strategies included sending out bulk direct mailers and sitting back and waiting for a week or two until the leads came in.

These days, email marketing is the better route, and I’ll tell you why: It’s so much cheaper, quicker, and gives you way more information about who’s opening them!

You’ll need to invest in an email marketing platform such as MailChimp, Constant Contact, or Drip. These platforms can also send out automated text messages!

Built-in analytics to track email open rates and effectiveness

When you send out mass emails using these platforms, they’ll show when somebody opens up an email. If you send an email and notice several people have opened it, call those leads right away because you’ve already warmed them up.

This open rate information is also pretty useful because it can let you know which emails are more popular, and unpopular, so you can refine your approach.

If you notice you’re getting traction with certain email headlines or titles, double down on producing more emails like that to ensure more people will open them.

Inside your emails, you can embed video links, send out PDFs, or add links to your website’s new blog posts. Each of these actions is trackable to inform you of your email’s success rate.

Closing a mortgage takes many points of contact between the broker and borrower, and with every email you send, you’re creating more touchpoints.

Maybe your lead filled out a form on your website two months ago and has been getting emails occasionally from you. Several months down the line when they’re finally ready to buy, they’ll remember you and contact you via your emails.

That’s the goal, anyway.

MailChimp: the ultimate email marketing platform

Mailchimp, now called Intuit Mailchimp, is an email marketing, sales automation, and CRM service used across all industries, especially for mortgage sales.

Loan officers use MailChimp as their primary CRM and email marketing platform to create, send, and analyze their email marketing campaigns.

Automate messages to follow up and re-engage with cold leads. You can also use its drag-and-drop email builder to customize your email designs.

Audience segmentation is made simple so you can mass-email portions of your leads based on where they are in the sales funnel. And you can even set up and manage Facebook and Instagram ads within its platform.

Mailchimp offers four different pricing tiers:

- Free

- Essential ($13 a month)

- Standard ($20 a month)

- Premium ($350 a month)

Compared to another popular mortgage CRM ActiveCampaign, Mailchimp is seen as the more intuitive and user-friendly option.

How to set up a successful email drip

Drip campaigns are automated email campaigns used by loan officers to create a consistent flow of emails to prospective customers over a set period of time.

Drip marketing creates inviting, long-term exposure to your personal brand, and hopefully also provides value to your would-be customers.

Let’s examine a basic drip campaign.

Related Reading: How to Generate Mortgage Leads with Email Drip Campaigns.

The first email

The first email is your greatest opportunity for establishing a proper relationship with your potential client.

Introduce yourself, and your company, and briefly touch on how your services can benefit your client.

Make sure the first email is simple and concise and not pushy!

A single short paragraph with bullet points and a call-to-action (CTA) is all it takes.

The second email

If you don’t get a response from your first email, don’t worry quite yet — people are busy!

It’s likely they aren’t avoiding you at this point, but they haven’t made it a priority to respond to you either.

Your second email should refer back to your first email a bit more gently and add some additional valuable information such as relevant mortgage data or news.

Again, end with a CTA to encourage them to take the next steps to get a mortgage.

Additional emails

Don’t be afraid to send multiple emails. Everyone is accustomed to this at this point, and you probably won’t end up offending your reader.

If they’re still not opening up your emails, vary your approach to send more interesting emails, such as embedding a short video or helpful infographics.

Still not getting them to open up your emails? Perhaps you need to write more interesting subject lines!

The best thing about drip campaigns is your emails will sit in your leads’ inboxes for a long time, keeping the door open for future opportunities months, or even years down the road.

Scheduling your mortgage email marketing campaign

Once your drip campaign has been set up, it will automatically run itself, and begin the process over and over again each time a new lead submits their contact info.

The question you gotta ask yourself is, when do you send the emails?

When to send the emails

Every person you contact has their own unique schedule — some people read emails first thing in the morning, at night, or throughout the day.

Use your CRM to determine the best times that have the highest open rates. Perhaps weekends are when you see the best results?

Check your CRM’s results and adjust accordingly.

The frequency of sending emails

It’s better to start aggressively and then taper off, rather than ramp up emails over a period of time. This makes sense since your potential client is the most interested immediately after filling out their contact info.

Here’s a recommended timeline for sending each of your emails in your drip campaign:

- Your follow-up email should be sent a couple of days after the initial email

- Wait a week to send your third email

- Wait another week to send your fourth email

- Then slow down the frequency to sending one or two emails a month

Stand out with effective email marketing

First, you want to make sure your email isn’t considered spammy or raises any red flags with your client’s email system. This means proofreading and making sure there are no misspellings. Misspellings are one of the easiest indicators of spam or low-quality content.

Next, keep your tone friendly and conversational. There’s no need to intimidate your reader with jargon they won’t understand. Mortgages are complicated enough, you don’t need to confuse them anymore.

Keep your content relevant and timely by sending out updates on new mortgage rates, or helpful advice on how to navigate recent industry mortgage news to educate and inform your audience.

Lastly, don’t forget to send those birthday emails! Remembering birthdays and anniversaries can go a long way to maintaining a human connection with your potential clients.

Content marketing tips for loan officers

Mortgages are complex and difficult to understand. It’s why so many people spend time online researching mortgages before contacting loan officers.

Content marketing, then, is about providing answers to mortgage-related questions online.

Have you noticed how every site explaining mortgages is a mortgage lender’s website?

It’s because they know if they provide free, helpful content, it creates a foot in the door for prospective clients to fill out a contact form and eventually work with that company.

Most people consider content marketing to be the same as blogging — they’re mostly right, but there are tons of other forms of content you can create to reach your audience.

Before writing your content, you should first understand who you’re writing the content for.

Don’t have time for content? Hire a mortgage content marketing agency.

Create buyer cases and user personas

Because you’re selling multiple loan products, you’ll need to create multiple buyer personas to help you write content for each type of audience.

For example, the people who land on your website will most likely be:

- First-time buyers

- People looking to purchase a smaller home to downsize

- People looking to relocate and purchase a new home

- People who need to refinance their homes

- People who need a home equity loan for debt consolidation

You’ll want to cover every mortgage-related scenario that you deal with so you can create relevant content that will answer your audiences’ questions online.

Mortgage blogs

Write an article focused on a specific topic and keyword. For example, “Who Qualifies for VA loans.”

Make sure to use that keyword in the article’s title, headlines, and throughout the text. Just avoid overdoing it, because that’s known as “keyword stuffing” and can actually hurt your search result rankings.

Start by writing loan scenarios that you deal with, such as:

- “How to get a bridge loan when moving across the country”

- “VA Loans: What Veterans Need to Know Before Applying”

- “FHA loans vs Conventional Loans: Explained”

Infographics

Think of an infographic as a visual blog post. Everything that could be written into a 1,000 article can also be formed into a simple illustration, graph, or chart.

Really want to enhance your blog posts? Summarize the information, create an infographic, and then embed that infographic into your post.

This way, people will save the image itself, and refer back to it later.

A final word on content marketing for loan officers

When you combine content creation with SEO, you’ll develop one of the strongest mortgage marketing strategies to attract traffic and generate leads from your website.

Through constant blogging and content marketing, you’ll position yourself as an authority in the mortgage business, make your website easier for clients to find, answer their questions, and expand your existing customer base.

Not to mention, all of your content can be recycled, reused, and repurposed across multiple channels. For instance:

- A blog post can become an infographic

- A blog post can be turned into a video

- A video can be summarized as a blog post

- Blog posts can be embedded in drip email campaigns

- Facebook surveys can be summarized and turned into blog posts

Essential loan officer tech stacks and website builders

A “tech stack” is a combination of technologies, tools, and software platforms that work together to perform certain processes.

In this instance, loan officers use their tech stacks to combine CRMs, their website, lead management systems, and messaging platforms to automate the sales outreach and follow-up process.

Additionally, loan officers are building their own mortgage websites using all-in-one mortgage marketing platforms that can set up, design, and run their own custom mortgage websites.

Below is a more in-depth discussion on the rise of microsites and marketing tools you should be aware of as a loan officer.

The rise of the microsite website for loan officers

The emerging trend of 2023 for loan officers is the rise of microsites — mini-websites that promote loan products, and loan officers, and are used primarily for lead generation.

Microsites are seen as a quicker and cheaper alternative compared to a fully fleshed-out mortgage website.

A mortgage microsite can be used for:

- Promoting individual loan products on separate pages

- Used as a landing page for Google Ads and Facebook Ads

- Collecting contact info and converting web visitors into new mortgage leads

- Uploading blogs to attract visitors through Google searches

Kaleidico’s quick launch lead generation website

Kaleidico has been building mortgage lead-generation websites for two decades. Now we’re offering a new service that even the smallest mortgage shop can afford — quick launch mortgage lead generation websites.

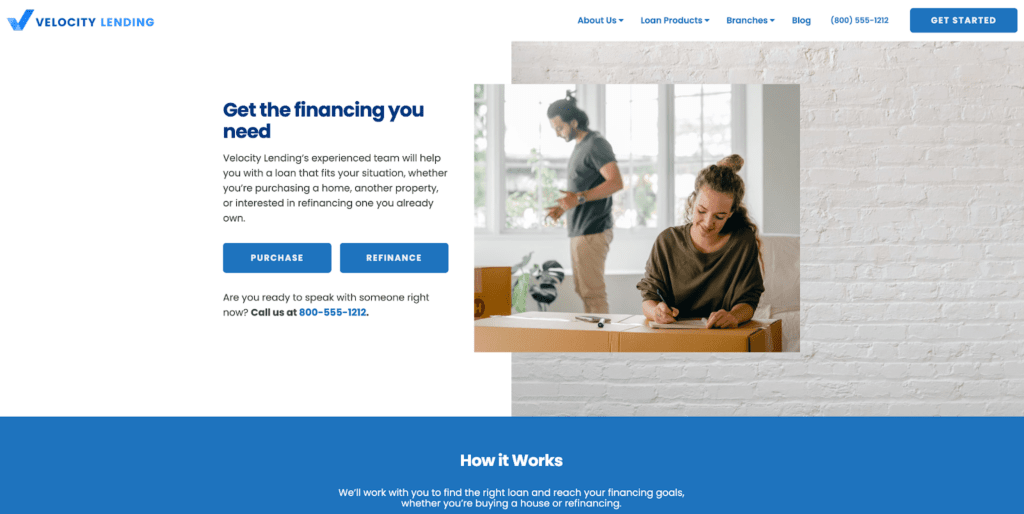

Below is an example of one of Kaleidico’s quick launch websites for VelocityLending.com.

Normally, a full-fledged mortgage website would take a couple of months to build, but with our quick launch websites, we can customize and deploy your mortgage website in about 2-3 weeks.

Quick launch mortgage website benefits include:

- A lead generation website that’s up and running quickly. No more buying leads, you’ll be generating your own exclusive leads.

- Get a modern and mobile-responsive website build for lead generation.

- High-converting lead funnels and lead paths to turn visitors into new mortgage leads

- Compelling loan officer bio pages that integrate with your POS system (online 1003 application)

- SEO-optimized loan program landing pages built for conversions and ready for Google and Facebook Ads

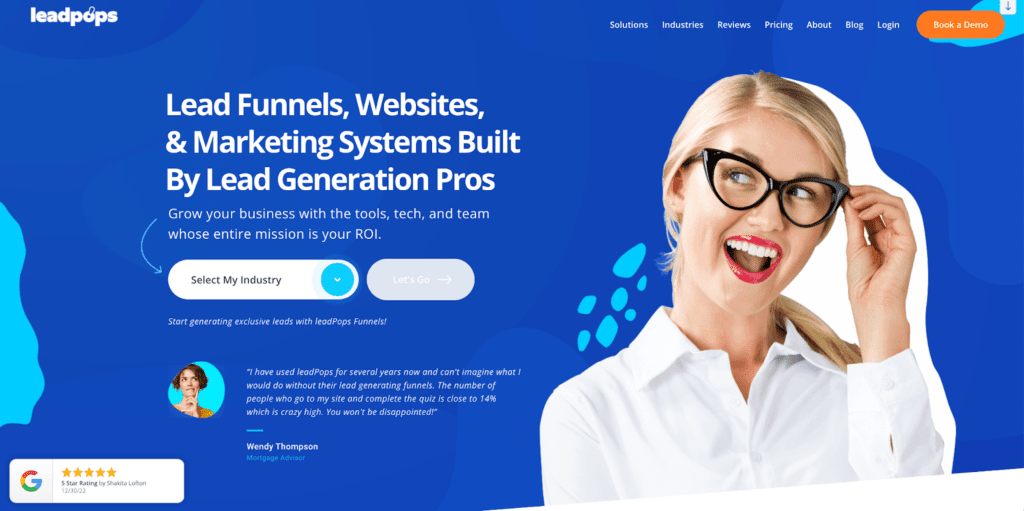

leadPops

leadPops is a marketing company for mortgage companies, loan officers, and real estate agents that creates websites, lead funnels, and offers marketing services.

One of leadPops main features is its lead funnels, which are attractive and stylish pop-up questionnaires that convert more leads than standard contact forms.

Loan officers use leadPops in a number of ways:

- Just using their lead funnels to add-on to an existing mortgage website

- Purchasing their ConversionPro website filled with tons of built-in features such as lead funnels, landing pages, and more

- Hiring their expert marketing services for running PPC ads, retargeting ads, SEO, content marketing, and more

Essential mortgage marketing tools and platforms for loan officers

As a loan officer, you are highly dependent on the tools and software programs you use.

That’s why it’s crucial to take advantage of digital tools, programs, platforms, and apps that can give you a competitive edge.

As you know, competition is fierce for loan officers. Use these tools to streamline your workflow and improve your clients’ overall customer experience.

Customer relationship management (CRM) software

A customer relationship management (CRM) program is a digital marketing tool that can automate the overall sales cycle and can integrate with an email marketing platform to completely streamline the outreach process.

Essentially, a CRM is like a digital Rolodex that allows loan officers to maintain relationships with their clients.

CRMs can allow you to track your customers’ primary data, such as:

- Name

- Address

- Phone number

- Company website

- Loan date

- Add notes

- Lead scoring

- Status in the sales pipeline

- Much, much more

CRMs can enhance the overall client service experience, ensuring none of your leads get overlooked or missed.

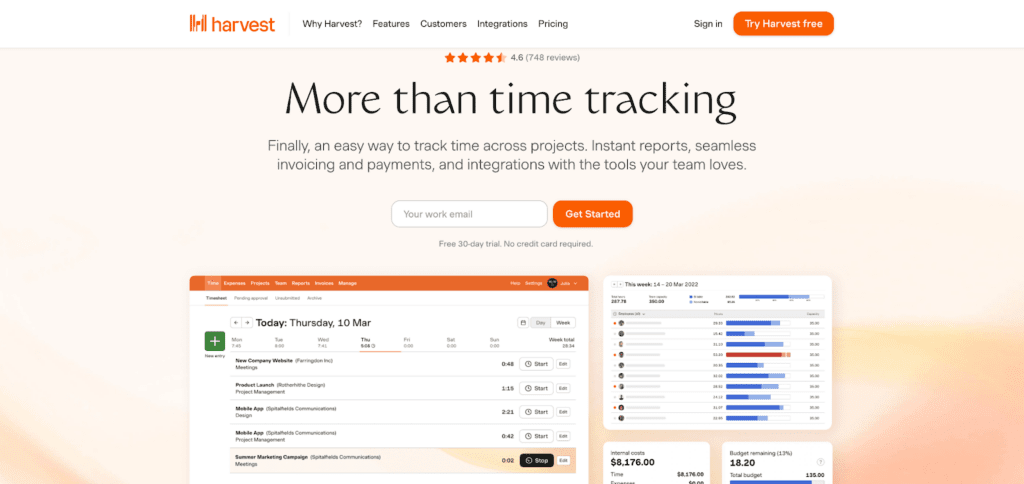

Harvest time tracker

Harvest integrates with multiple productivity apps, including Google Calendar, Basecamp, Asana, Outlook, and Slack, to keep track of your time and prevent “time loss.”

Users can track their time by selecting “start” and “stop” options in real time to better record their hours spent calling leads or working on various projects.

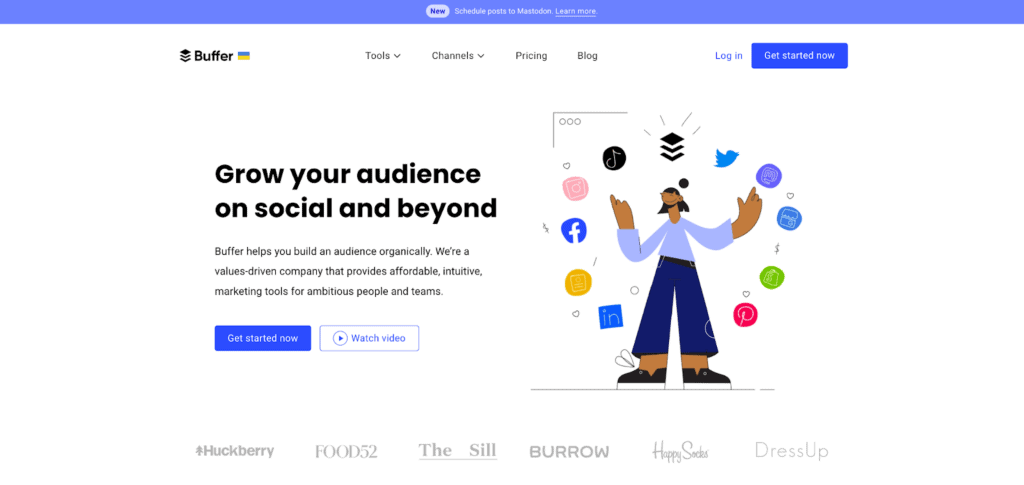

Buffer

This social media management tool lets users upload and schedule several upcoming social media posts all at once, saving them time from having to manually publish social media posts throughout the week.

The program works with Twitter, Facebook, Instagram, Pinterest, and LinkedIn so you don’t have to constantly log in to each account — you can post everything from the Buffer platform.

Pocket lets you save articles, videos, and other types of content you can find on the internet to refer back to later.

No more screenshotting or bookmarking random pages that you’ll never find again.

Instead, use Pocket to save those helpful ideas that you’ll refer back to again and again.

LastPass

LastPass is a password manager that saves all of your passwords, making it easier and more secure to log in to various websites.

With LastPass, users can save their passwords in the program and the program will then autofill their login information, so you don’t need to manually type in or remember tons of different passwords.

If privacy and security are a concern, and they should be, then you’ll like LastPass’ built-in password generator that creates long, randomized complex passwords for enhanced security.

Evernote

Evernote is a web-based notepad that lets users keep all of their notes, to-dos, project ideas, voice memos, and more all in one place.

Use Evernote to keep track of your mortgage marketing ideas or to collaborate with your team.

Evernote integrates with most email platforms such as Gmail, Google Suite, Outlook, Microsoft Teams, and Salesforce.

Lead management systems with sales automation and messaging capabilities

Lead management systems with built-in messaging capabilities help loan officers and mortgage lenders streamline their sales process and improve communication with potential customers.

Below are a few suggestions of the top lead management systems and messaging tools to check out and see if they’re right for your needs.

Bonzo

Bonzo is labeled as “conversation software” that’s used for streamlining emailing, calling, leaving voicemails, and texting leads.

And while it’s not technically a CRM, its platform has many of the same features you’d expect from a CRM platform.

Bonzo can set up email campaigns, and SMS campaigns, organize sales pipelines, and create ads with Google Ads and Facebook Ads integration.

It uses AI and machine learning to drive outreach, send follow-ups, and start conversations with your leads.

If you ever needed help following up and messaging your leads, try Bonzo today.

Total Expert

Total Expert is a software company that created a CRM and customer engagement platform for mortgage brokers, loan officers, and financial technology companies.

TotalExpert offers a range of products from its popular CRM, to its marketing automation, compliance, and customer intelligence platform.

According to its website, “Total Expert unifies data, marketing, sales, and compliance solutions to provide a cohesive experience across the customer lifecycle.”

It has a 4.5-star review on G2, with many of the top reviews claiming it to be one of the best CRMs for sales teams.

Your smartphone

Use your smartphone to record simple, short videos to upload to your social media profiles and website.

The camera and sound quality of modern smartphones are perfectly fine for professional filming needs.

You don’t need a professional 4K video camera to impress your web visitors — a short, friendly video will suffice.

Get your free 90 day plan

Kaleidico —your mortgage marketing agency

Kaleidico is a marketing and lead generation agency that has the experience necessary to specialize in mortgage marketing.

Our founder, Bill Rice, has over 15 years of experience in the mortgage industry. He combines his experience in the industry and as a digital marketer to help more loan officers generate leads online.

Kaleidico specializes in web design, web development, graphic design, SEO, PPC, email marketing, and content marketing.

Meet our team and learn how we can help our clients grow their marketing strategies and create more consumer-direct mortgage lead generation.

Photo by Tima Miroshnichenko from Pexels