I’ve been in and around the mortgage business for over 20 years. Along the way, I’ve collected many go-to mortgage marketing ideas. I often pass along these little tips and tricks to jumpstart my mortgage marketing plans for my clients: mortgage lenders and loan officers I talk to daily.

In this monster list of mortgage marketing ideas, you’ll discover how to generate a consistent and steady flow of high-quality mortgage leads without spending a fortune.

Here’s the basic formula before digging into any specific mortgage marketing ideas.

- Build awareness for your brand — corporate or personal — by engaging in local and digital activities that raise your profile

- Borrowers want to engage online first — remember this and make it easy for them to find you and start their mortgage process online

- Make it personal — enable each borrower on a personal level

- Scale yourself and your brand with technology

- Follow-up, using content, forever!

Now, let’s dig into our 11 pillars of mortgage marketing and 50+ individual mortgage marketing ideas.

Get Our 90-Day Mortgage Marketing Plan

Build a Personal Network

Referrals sustain all successful loan officers. Leads are essential and necessary to build your database, but a solid base of referrals should be your foundation.

If you’re a lender, advocate this ethos in your branches and call centers.

Here’s how to build that foundation.

1. Email friends and family

Friends and family are always your first and best source of mortgage leads.

Send emails and Facebook messages around to all your friends and family to let them know you’re in the mortgage and real estate business. Put this on your calendar to touch base at least a couple of times a year.

Don’t forget to ask for referrals, too.

2. Introduce yourself to real estate agents

This is a no-brainer, and most of you have been told this over and over. If you start generating a fair number of leads, you can make this networking more fruitful.

Also, notice above that I always start my networking conversations with, “I’m in the real estate and mortgage business.”

Keep in mind that everyone wants a home, not a mortgage. By introducing yourself in this way, people will come to you when they are selling their homes as well as buying.

Handing a real estate agent a new listing is better than hundreds of boxes of donuts.

3. Teach financial advisers about mortgages

Financial advisers are one of the best referral sources you can cultivate.

They are working with affluent clients, and they rarely think about those clients’ mortgages. Yet, those mortgages could be a huge source of additional wealth they could be managing in the future if they call it into their financial planning process.

Financial advisers typically only meet with their clients a few times a year to review their financial plans. These meetings are my favorite starting point.

Create a simple email template that goes something like this:

Subject Line: Things to review on your next client call…

Hi {first_name}!

As you prepare for your next client financial review meeting, you might want to ask these questions:

Would you benefit from refinancing? With today’s rates significantly higher than they were a year ago, the amount of people who would benefit from a refinance has taken a dive. However, some people may still benefit from refinancing to a lower rate or a shorter term length.

Have you considered tapping into your home equity? With rates on the rise, if they are thinking about any significant home improvements or paying down some higher-interest debt, they might want to get a HELOC, home equity loan, or cash-out refinance so they don’t have to draw down other assets.

Have you thought about your long-term care options? If they are over 62 and haven’t thought about long-term care, they might want to start educating themselves on reverse mortgages. This is a common strategy for paying for assisted living or memory care.

Let me know if you have any questions.

{signature_block}

Beyond this little trick, offering regular mortgage webinars for their book of business could be another interesting angle.

4. Teach personal finance classes

Teaching is one of the easiest ways to sell anything.

As a mortgage broker or lender, think of all of the things you know about personal finance. The average person struggles with the following topics:

- Credit scores

- Debt management

- Budgeting

- Saving

- Investing

My favorite way to get in front of lots of potential borrowers is by teaching at Financial Peace University. FPU is a well-respected personal finance curriculum and is often sought out by name.

Become a certified FPU coordinator, and Dave Ramsey’s brand and organization will fill your classes.

If you do a good job, you will invariably generate new leads and referrals from your students.

5. Teach people how to improve their credit score

Credit scores often crush homeownership dreams. Yet a little education, coaching, and effort can raise almost any credit score.

Customers that you are running through your credit improvement content become great sales pipeline builders.

Create a step-by-step guide to resolve common credit issues. Add to this guide some cheat sheets for some skills that often improve credit scores:

- Paying off debt faster, using the snowball method

- Budgeting basics

- Savings tips and tricks

6. Coach your clients and partners on how to give your referrals

Everyone always talks about referrals, but no one tells you how to get them.

The most important part of referral building is coaching your friends, family, and past clients to give you great referrals.

Here are a couple of my simple tricks:

After a successful loan approval or cleared to close, simply ask: “Do you know anyone else like you that is thinking about buying a house or refinancing right now?” So often, circles of friends are talking and doing similar life events at the same time.

When you introduce yourself to someone new, tell them you’re in the real estate and mortgage business. Then say, “Hey, what’s your number? I’ll send you a quick text message in case anyone asks you for your real estate and mortgage person.” When you text them, send them this message: “{your first and last name} your real estate and mortgage guy/gal.” When they search on their phone for real estate or mortgage, guess who is going to pop to the top of the search results? Yep, you!

7. Host a monthly webinar or seminar

Monthly webinars or seminars are a great way to serve the people in your community and earn quality leads.

Your potential leads have tons of questions about the mortgage process. Give them an opportunity to learn, ask questions, and even start the mortgage process by offering an informative meeting.

Your meetups might consist of frequently asked questions, information about specific loan products, how to qualify, or even letting the audience questions lead the direction.

Webinars are a simple and free way to connect with and earn the trust of your audience: You can just have everyone meet up on Facebook Live or YouTube Live. We’ll dig more into these channels later.

Create PDF Sales Collateral

People love getting things. They will give almost anything to get a gift, even if it is as simple as a downloadable PDF.

Create a library of PDFs (a great universal format that opens on any computer or device). Then find new and creative ways to distribute them to prospective clients.

Here are just a few ideas for helpful PDFs you can create and use in your sales process.

8. Create an “everything I sell” one-pager

One of the No. 1 brush-offs in sales is the “Send me something” request.

Don’t be offended, be ready. Have the one-page PDF designed to show all the options you can provide and the benefits of working with you.

Now, even customers trying to brush you off are getting one more positive brand impression from you.

9. People love simple flyers and checklists

Boil your loan programs down to a single one-page flyer.

Summarize your loan application, qualification, and document collection process into easy-to-follow checklists. Turn them into PDFs that you can email, and your customers can pull up on any device or even print them out.

These simple sales collateral pieces will make your customers more confident and get you what you need with less confusion.

10. Create simple cheat sheets for each of your loan programs

Make sure that you have a simple one-pager on each of your loan programs.

Not only is this a great way to fine-tune your sales presentation for each of these programs, but it’s also a handy document to give to your clients.

These cheat sheets are also great to hand out to your referral partners — financial advisors, CPAs, and real estate agents — to advise their clients and remind them to send them to you.

11. Create a list for borrowers to navigate the mortgage process

People love checklists, especially when they are navigating through unfamiliar territory.

The mortgage process can be long, tedious, and confusing. To make things worse, there are times during loan processing when everything seems to come to a standstill from the customer’s perspective.

Give your clients a roadmap that they can refer to, and you can reference when they grow impatient or anxious.

12. Create a list to help borrowers collect and submit documents

Collecting documents is the bane of a loan officer’s existence. We waste so much time telling and retelling borrowers what you need and how you need them delivered.

Make this more straightforward for you (and easier on the borrower) by giving them a simple how-to on gathering and preparing their documents for underwriting.

Believe it or not, this is an excellent marketing tool too. Many prospective borrowers are trying to get ready/prepared for getting a mortgage. This little checklist makes for a great download and email capture on your website.

Develop Templates, Lots of Templates

Mortgage sales and marketing are a lot of doing the same things over and over again. Templates will free your soul.

Create a template for anything you do more than twice and expect to do again. Templates not only make you more efficient, but they also make your sales and marketing process more repeatable and scalable.

13. Templates will free you. Start with an outline.

Templates are the key to making all of your sales and marketing processes more efficient and consistent in their effectiveness.

They will genuinely free you to focus on clients, not worrying whether you have all the details right. Templates will ensure perfection.

As you begin to build your template library, I suggest starting with an outline:

- Chart out all of your internal and external processes

- Map your marketing workflow

- Document your sales process and customer touchpoints

- Work with your processing team to outline their procedures

As you look at those workflows, identify critical points of communication and collaboration. These touchpoints are the best places to implement templates.

Let’s take a few examples of templates you can implement at these mortgage process touchpoints.

14. Create email templates

An email is an excellent place for templates. Stop crafting new emails for things that you do over and over again.

For example, here are a few emails that you should immediately turn into a template:

New lead initial outreach: Whenever you get a new lead, your primary goal is to immediately respond and schedule an appointment to get on the phone and discuss their needs. Your template should acknowledge that you received the inquiry, understand their request (i.e., loan type or situation), and provide a scheduling link to grab a time that works best for them.

Follow-up: Much of the mortgage sales process’s inefficiency (and frustration) is following up and trying to get prospective borrowers on the phone. Create a half-dozen or so follow-up email templates.

Getting documents: Collecting the proper documentation and delivering it in acceptable formats can be challenging for you and your customers. Create an email template that clearly explains what is needed and when. Then, include your document checklist PDF that you created.

15. Create process and borrower templates

Consider your routine processes and borrower communications and turn each of those activities into templates and checklists to help you quickly accomplish those tasks.

These templates will help you to avoid procrastination and ensure that all of the details are covered.

Another benefit to templates in this area is that they are carefully considered and can be reviewed for compliance — no problematic statements or characterizations as you try to speed the process for your clients.

16. Create FAQ templates

Customers ask the same questions about mortgages, qualifying, and the process of getting to the closing — document each of these into a master FAQ template.

As you get these common questions, just copy and paste the answer into your email reply, or better yet, have the email ready to fire off.

17. Create marketing templates

Templates aren’t just for email. You should also create templates to document your marketing plans, create social media posts and campaigns, and outline your email marketing tactics and workflows.

By creating templates around your marketing processes and activities, you can eventually teach, coach, and hand off these templates and strategies to an assistant, new marketing hire, or your agency — freeing you up and still getting it done right.

18. Create sales templates

Sales are probably one of the best places to implement templates.

Good sales processes have a lot of repeatable and frequent process points. Turning things like email outreach and follow-up, answering common questions, and walking prospective customers through loan options into templates makes your sales smoother for you and your customers.

Create a Mortgage Website

Everyone needs a home base. Whether you are a loan officer or a lender, your customers will start with your website. Make sure that it is professional and full of good guidance.

Questions left unanswered force your prospective borrower to return to Google and likely land them on a competitor’s website.

19. Start simple, but get a website up and running

Whether you are a single loan officer or a multi-branch, national mortgage lender, get your website up and running. More importantly, get your website designed and serve your prospective customers.

Here are the top things that mortgage customers expect from your website:

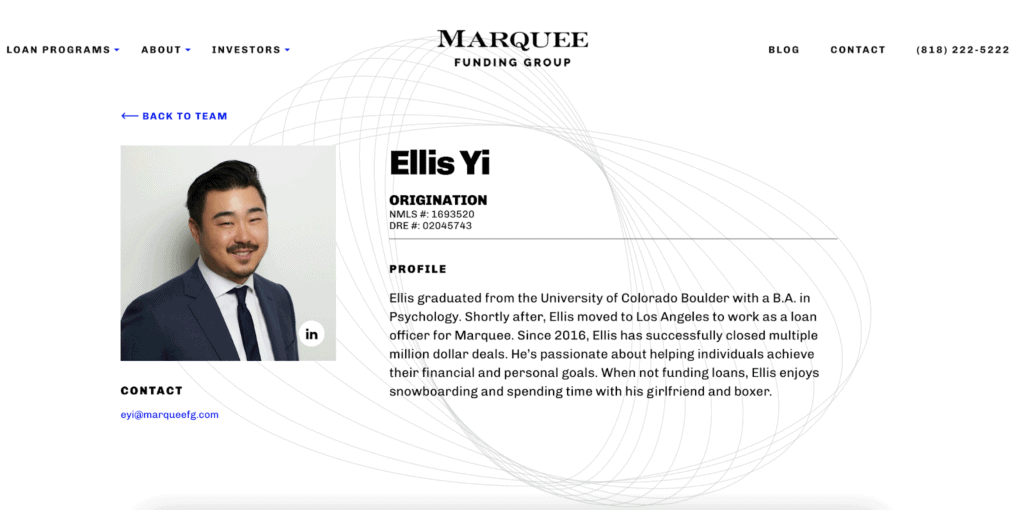

Your loan officer page: a simple but helpful loan officer profile page containing your NMLS number, contact information, and an online loan application.

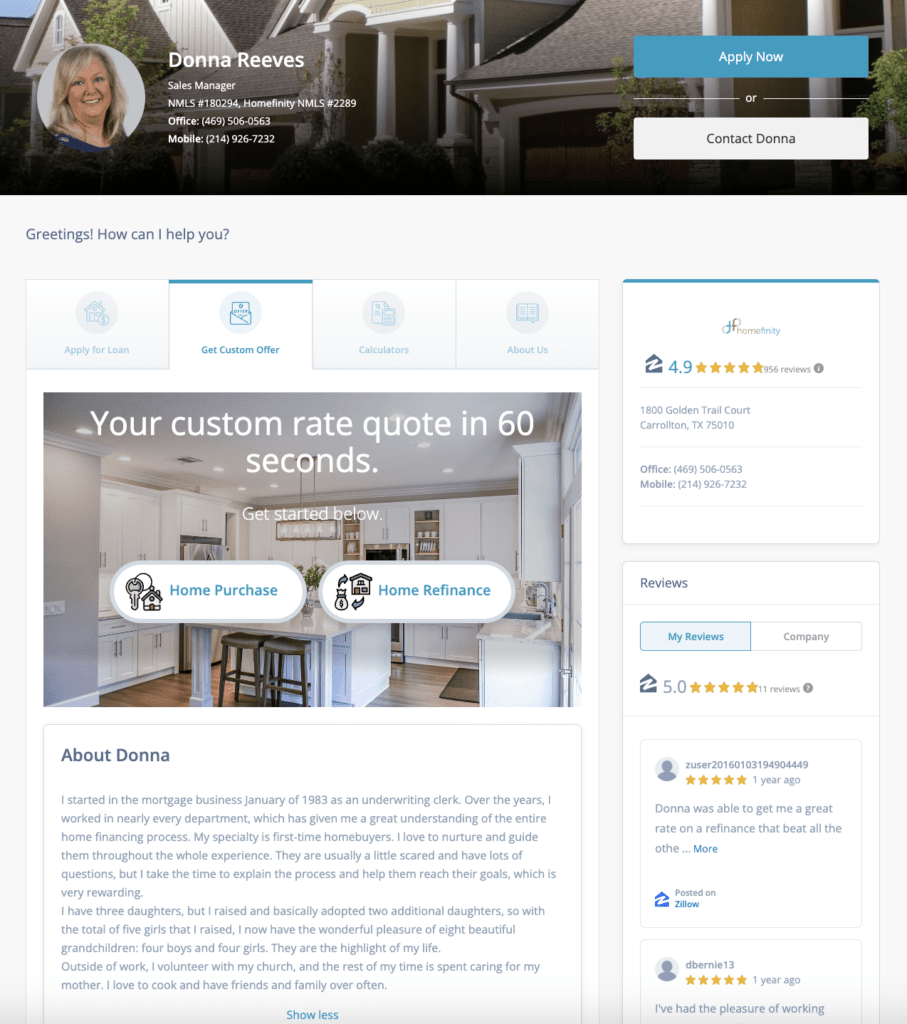

Look at the example below from Homefinity, which contains clear links to “Apply Now” or “Contact Donna,” plus an About section and reviews prominently displayed along the side.

Mortgage lead form and phone number: a progressive web form that quickly collects some initial qualifying information and contact information.

You can use Typeform or something custom, like Gravity Forms on WordPress.

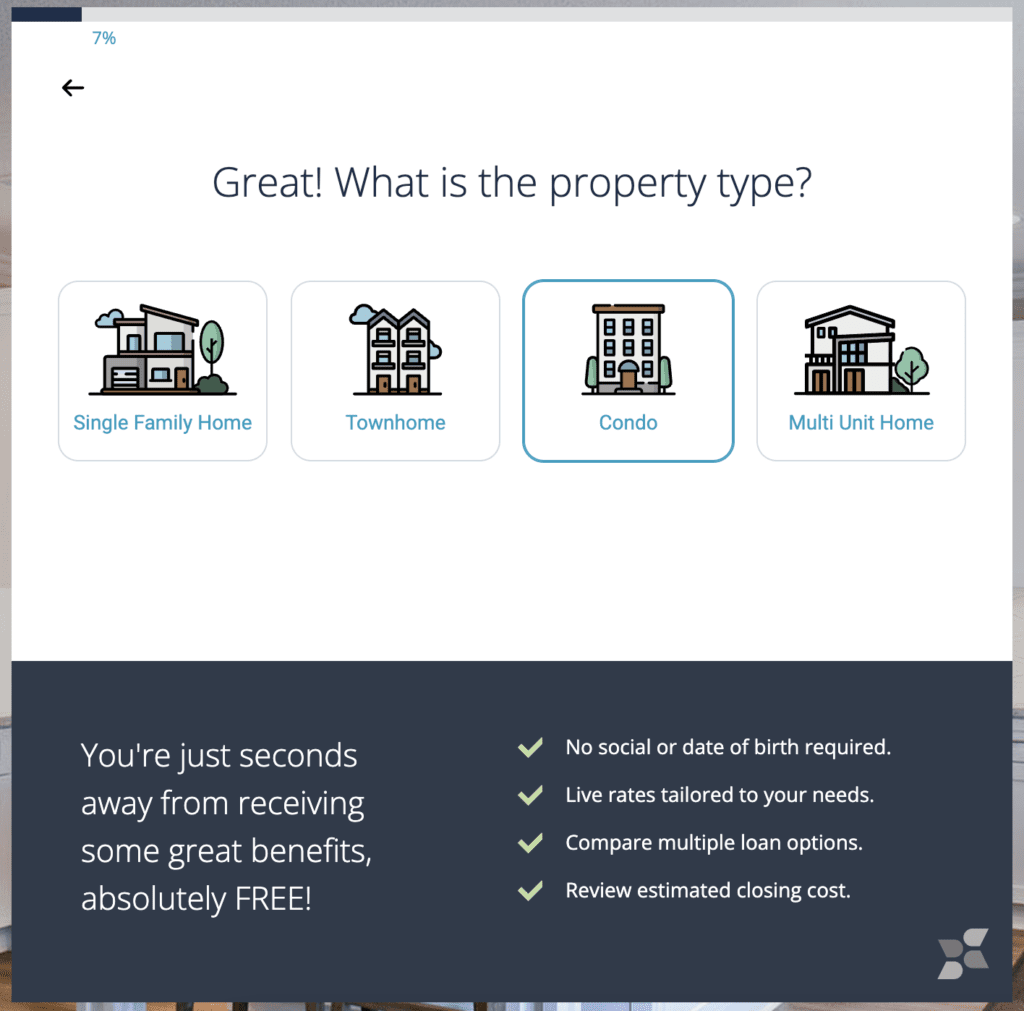

The next example is from the same Homefinity page for Donna Reeves. The following lead form appears if a customer clicks the “Home Purchase” CTA.

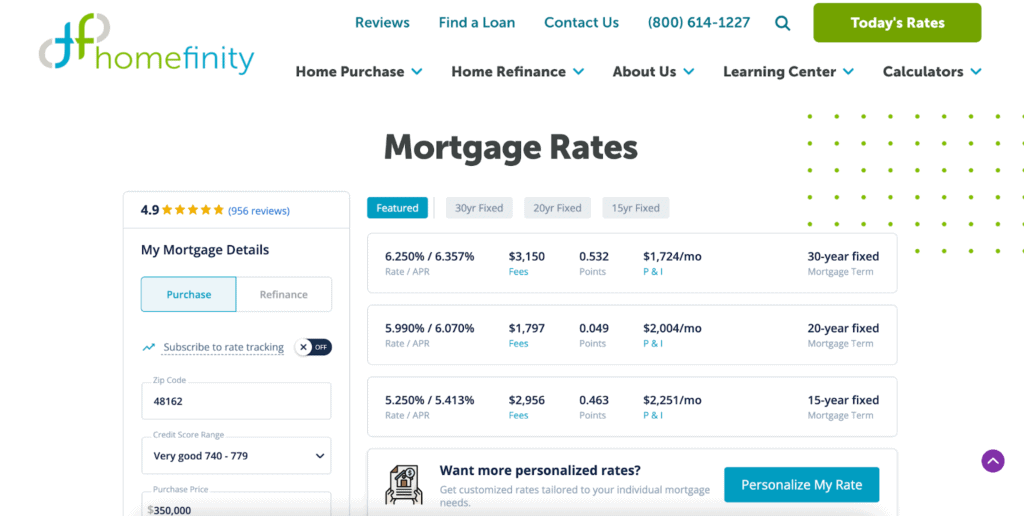

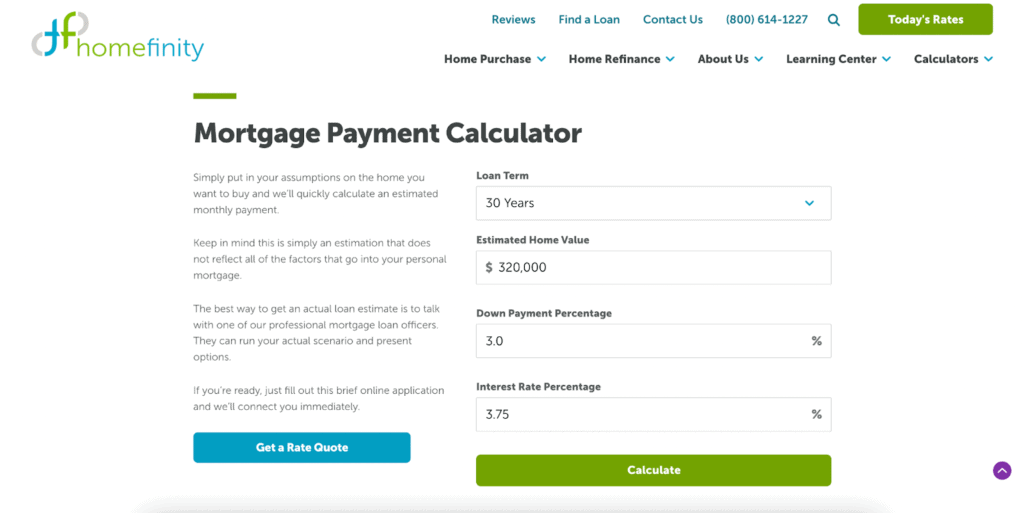

Mortgage rates: These don’t need to be loan rate quotes, just general rate trends — national trending 30-year and 15-year mortgage rates and 10-year treasury rates — something like this mortgage rates page.

20. Have a loan officer profile page

I already touched on this as an essential element of your website presence, but I want you to leverage and focus some attention on this landing page.

Here are some critical features you want to get perfect.

Take a high-quality, professional, and friendly photo of yourself. Ideally, take it outside (early morning or late afternoon will give you the best natural lighting) with a relatively solid background.

Using portrait mode on your smartphone against a backdrop of green trees can create an excellent photo.

Write up a bio that is informative, customer-focused and reflects your personality.

Here is a template that I often use with clients:

“I’ve been a mortgage loan officer for [XX] years. During this time, I’ve prided myself on delivering exceptional service to each client. I enjoy advising and guiding folks through an often confusing mix of numbers, rates, and terms to help them select the best loan options for their situation.

Your advantage is my knowledge and experience in helping hundreds of home buyers and homeowners through home purchases and mortgage refinancing. Whether you are a first-time homebuyer or a seasoned homeowner, I look forward to delivering your best mortgage loan option and experience.

Here are just a few of the mortgage situations and loans that I specialize in:

- Conventional purchase and refinance

- FHA Streamline and purchase loans

- VA IRRRL refinance and purchase loans

- Special physicians’ mortgage loans

- Jumbo loans

- Second-home and investment properties

- Self-employed borrowers

When I’m not helping my clients finance their homes, you can find me …

If you have any questions, please contact me anytime.”

Make sure that you have complete contact information. I recommend adding your direct cell phone number. Don’t be afraid. My cell phone number has been published online since 2005 with no issues and lots of business.

Finally, ensure you have a link to your online loan application link. Folks are so conditioned to fill out web forms that they’ll happily complete the 1003 application for you.

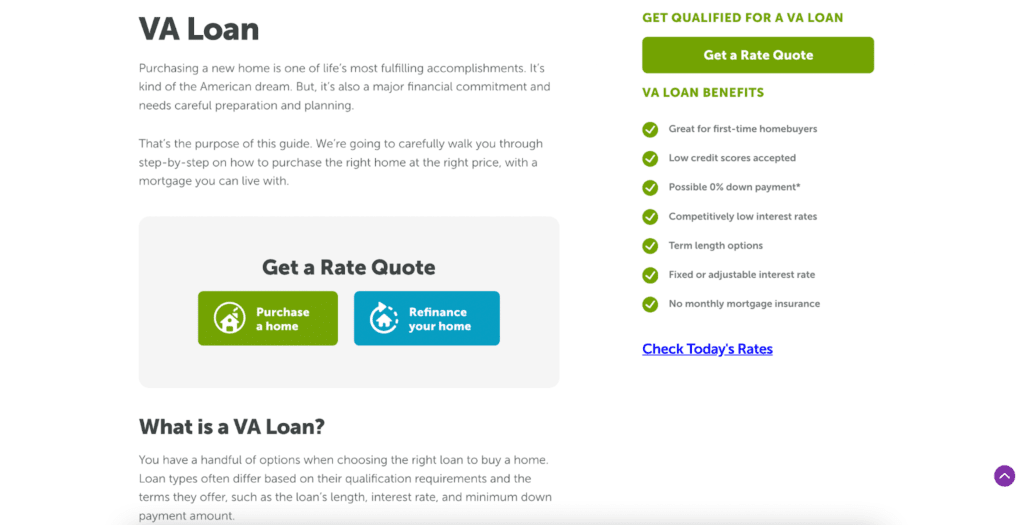

21. Set up pages for each of your loan products

Loan product pages allow you to dig into the specifics and requirements of each loan type.

The most important use of these pages is that you’ll be able to link to them in your content and use them for specific calls-to-action (CTAs).

Check out Homefinity’s VA loan page above. It contains a quick list of the VA loan benefits and defines what it is and how to get one.

The page also includes three CTA buttons for purchasing a home, refinancing a home, and getting a rate quote.

Set up a page for each of your products or financing options and use those links wherever appropriate, including your online ads, emails, and in your blog content.

22. Create a blog page

Your website also should include a blog page, which you might include under a resources tab, learning center, or another creative title of your choosing.

Blog content drives organic traffic to your website and is an essential component of any successful mortgage marketing strategy.

We’ll dig more into blogging in the next pillar.

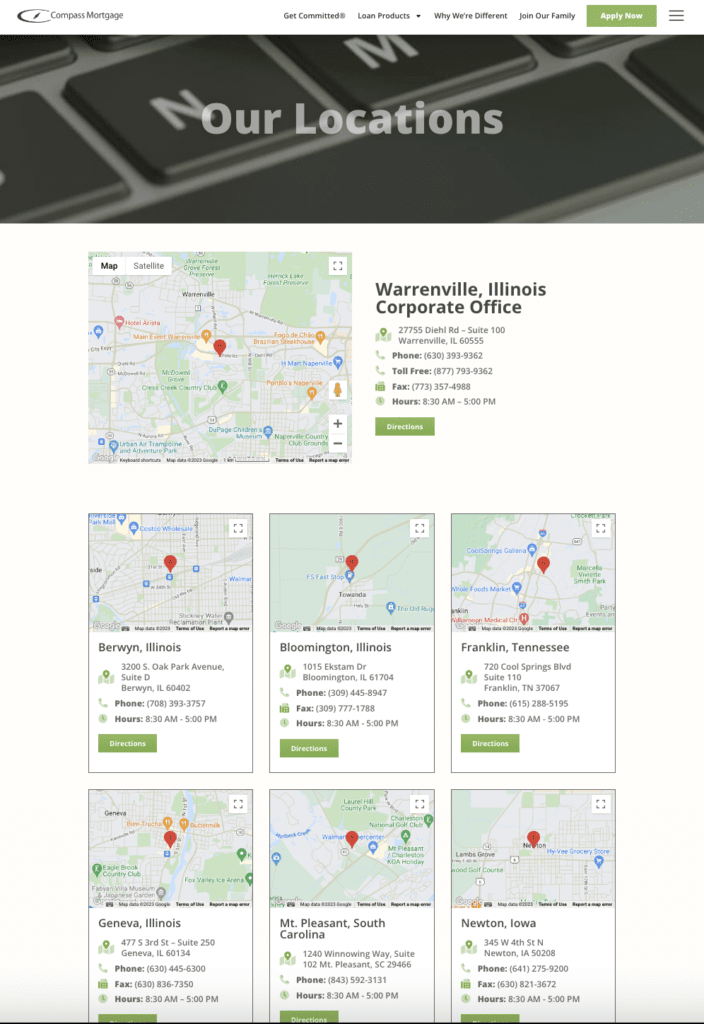

23. Have a local branch page

Don’t forget to leverage your location: Customers like working with local businesses and professionals.

Google gets this, too, and rewards local companies with preference in search results. So, make sure that you have a branch landing page for each location or area with a nexus of loan officers.

Something like this:

24. Create a reviews page

One of the top searches for any mortgage lender is “[mortgage lender name] reviews.” Make sure you have a page by that name, and you’re sure to rank on page one for that search instead of some random Yelp, BBB.org, or other random reviews website.

Curate your best reviews and post them on your website or loan officer profile page.

25. Set up a free Google Business Profile

Google Business Profile is the centerpiece of how Google returns the “best option” in searches for local service providers.

Set up your Google Business Profile listing and fill it out completely. Then, regularly add new pictures and posts to keep it fresh and accurate. Google loves this.

Take a look at the Google Business Profile that pops up for Compass Mortgage. The name, address, hours, phone number, and website are on display, as well as 782 reviews and a statement from the company if you scroll to the bottom of the display.

This is how your business will be displayed if you fully set up your profile — as well as in local search.

Blog About Mortgage and Related Stuff

We’re almost halfway through our list. Now, we’ll dive into some of the advanced (don’t assume that means complicated) mortgage marketing techniques.

Blogging and SEO are essential for building long-term, ROI-crushing mortgage lead generation.

That’s why working closely with a marketing agency that knows how to get you results can be beneficial.

26. Write. The web is still all about words.

Whenever a borrower asks you a question or gets confused during the mortgage process, write about it and post it to your blog.

These frequently asked questions and common misunderstandings during the mortgage process are precisely the types of things that borrowers turn to search engines to figure out.

When you write up the best and most complete answers to these common questions, you start popping up in these weird searches.

Ultimately, these blog posts will start bringing you mortgage leads that are already trusting and grateful for the information you’ve provided them.

27. Blog and vlog together

Do you know what’s better than a blog post? A blog post with a video in it.

Let’s add a minor enhancement to idea No. 26: Every time you get asked the same question over and over or notice borrowers getting confused during the mortgage process, pull out your smartphone, hit record, and start teaching.

Start publishing these on YouTube. Then, write a blog post about the video you just made, embedding the video when you post it.

Not only will that give your web visitors more options on how they enjoy your content — written or video — Google will love you for it and probably rank your article higher.

28. Document your process

I’ve kind of hinted at this in previous ideas but simply documenting your process can be a great way to blog and draw more visitors to your website.

The added benefit of documenting your process on your website is that when borrowers invariably ask the same questions or make the same mistakes, you can send a link to your recommendations.

Stop writing out essentially the same response over and over. Just send customers the link, or better yet, use an email template and send them a friendly (personal-looking) email with the link already in there.

29. Answer common questions

There is a reason FAQs (Frequently Asked Questions) are so popular on the web. The same questions are invariably asked repeatedly.

By answering common questions and blogging about them, you always have detailed answers at your fingertips — a simple link away.

This tactic is only getting more powerful as Google is starting to feature simple lists and FAQs in the search engine results, and smart speakers are using them to answer voice questions.

30. Send out links instead of typing out long emails

Long emails are often overwhelming to customers. When they open a long email, they automatically assume terrible news or lots of work ahead.

You can keep your emails brief by linking to a blog post and link to more detailed instructions if the borrower needs more help.

31. Repurpose your content

One of the biggest mortgage marketing pro tips is repurposing your content.

This means you create a certain amount of pieces of content per month, whether blog posts, videos, or other, and you recycle this content into several other pieces.

If you put your energy into creating a few high-quality pieces that you can repurpose rather than focusing on a high output of average-quality pieces, you can potentially reach new audiences and give your content a chance to perform better.

Plus, it just saves time on your part. Rather than brainstorming tons of content ideas, you can focus on taking a few ideas as far as possible.

Examples of repurposed or recycled content includes:

- Turning blog content into videos or PDFs

- Sharing blog content on social media

- Turning videos or blogs into infographics

- Compiling several blog posts on the same topic and creating an ebook

- Transforming internal data into a case study

Repurposing isn’t just about new content, either. You can repurpose old content that performed well on your website or social media by updating it or turning it into new forms of content.

Schedule a strategy session with the Kaleidico mortgage marketing team to fill your pipeline.

Use Facebook

Everybody uses Facebook. You likely have an extensive list of extended friends and family networks already captured and tuned into your posts.

In a lot of ways, Facebook can be a social CRM.

Here’s how to get Facebook working for you.

32. Create a Facebook Page

The quickest way to let everyone in your community know that you are the go-to real estate and mortgage professional is through Facebook.

You already have all of your extended friends and family network following you. A simple post about the real estate market or mortgage rates will tune everyone into you and yield a few referrals each month.

Now, let’s take it to the next level.

Set up a Facebook Page. A Facebook Page differs significantly from a personal Facebook profile. Whether you are a mortgage lender or an individual mortgage loan officer, you want to have a page to advertise and boost posts for your business.

33. Go live on Facebook

The secret to success on Facebook is lots of content. One of the easiest ways to pack your Facebook Page with content is to turn on your camera, go live, and start talking about personal finance, real estate, and mortgages.

A few consistent winning Facebook Live topics include:

- Open house walk-throughs followed by briefing the audience on typical mortgage loan scenarios and payments for a “home like this.”

- Tips to improve your credit score

- Real estate and mortgage rates market updates

34. Run Awareness Facebook Ads

Keep letting everyone know that you’re THE best mortgage lender.

People are impressionable. Our minds record these little impressions and stack them up inside our brains. Then, an image pops up when we need something, like a mortgage. We want this image to be your brand.

Set up Facebook awareness campaigns.

35. Run Lead Generation Ads

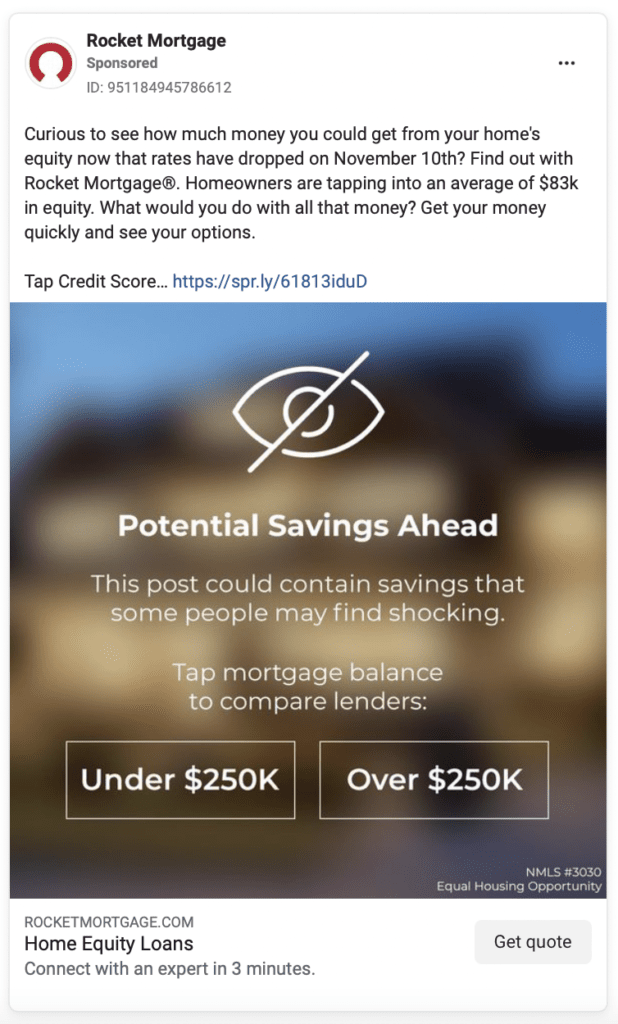

Using Facebook Ads again, run some lead generation ads. Unlike awareness campaigns, these ads should have more vigorous calls to action, such as this Rocket Mortgage ad.

36. Post Your Content on Facebook

People browse and scroll through Facebook every free moment they get. They’re always looking for what’s new and something clever to share. As a result, Facebook craves content.

So, constantly think of ways to fill your Facebook Page with content.

Here are some examples:

- Take pictures as you’re working with your team

- When you close a loan, visit an open house

- Take screenshots when you read something interesting or inspirational

- Write up small, quick tips about credit scores, qualifying for a mortgage, and clever home maintenance and improvement projects

- Post your latest blog posts and helpful guides

- Run polls

- Share other exciting posts you find on Facebook

The more you post, the more significant your audience will grow and the more active they will become.

37. Have a little fun on Facebook

Don’t be all business on Facebook.

Facebook is a great place to show your personality and have a little fun. Create and share mortgage memes, post silly pictures and commentary, and ask stupid questions.

For the most part, keep Facebook lighthearted.

Use YouTube

You’ve heard this before — YouTube is the second-largest search engine.

You probably also find yourself going to YouTube to figure stuff out all the time, especially home DIY projects. Guess what? So are your mortgage customers.

Get a channel started and start teaching what you know about mortgage, real estate, credit, and personal finance.

38. Create a YouTube Channel

Set up your YouTube Channel. Then, get out your smartphone, stand before a window with some natural light, and hit record.

When you’re getting started, don’t overthink or over-produce things.

Start answering common mortgage questions and teaching borrowers to be better customers — preparing their credit, savings, debt, and documents for a smooth transaction.

39. Go live on YouTube

One of the easiest ways to get started is to Go Live on YouTube.

Hit the red record button and act like you’re counseling a typical borrower on a new home purchase or thinking through a cash-out refinance.

If you’re lucky, you might even draw in a few live viewers. Encourage them to ask questions; their engagement and comments will help grow your channel.

40. Set up Playlists

Good organization on your YouTube channel can help your audience binge-watch you.

Playlists help viewers to dig into a topic and go deep, video after video. This kind of watch behavior increases watch times on your channel and will soar your rankings in YouTube searches.

Playlists are also a great way to organize your content calendar. By creating a series, you can make coming up with new video ideas easier.

41. Teach personal finance

Schools don’t teach personal finance. Most parents don’t either.

Meanwhile, it’s the No. 1 source of deals gone bad.

People come into the mortgage process unprepared — too much debt, not enough down payment, or dinged-up credit scores.

Or, they do something silly during the process to send the deal sideways — buy a car, run up their credit cards, or do something screwy in getting that gift.

Take to YouTube and create tutorials to guide borrowers through a successful mortgage process.

42. Teach credit improvement

Credit is still the most common challenge in qualifying for a mortgage. Yet, many circumstances that generate a poor credit score are preventable and recoverable.

Credit scores are mysterious to most borrowers. Even the most basic credit management best practices are unknown to many.

Savvy credit tips like maintaining low utilization rates and keeping old credit cards open and active go unheeded. Even paying debts on time can be lost for some.

Managing and improving your credit is an excellent opportunity for a YouTube series — a series that will help your borrowers and stock your sales funnel.

I recommend recording an “Intro to Credit” video that you can put in your email signature file or send in one of your early outreach emails.

43. Explain the mortgage process and popular loan programs

People are getting busier and busier. Trying to get them on the phone can be tricky.

Video can be a great way to cut through the noise and allow them to meet you whenever they get a free moment.

Use a YouTube video to introduce yourself in a nearly personal way. They will get to hear from you and see you. This unique marketing approach will begin to build an emotional connection and, believe it or not, gain trust and rapport.

These videos explain the mortgage process and any mortgage loan programs you think would fit their situation.

These videos can be a great way to break down borrowers’ anxiety about engaging with a stereotypical slick-willy salesperson.

Use the Channels Your Audience Use

Facebook and YouTube are the big ones, but your audience is likely spread out across all channels, including LinkedIn, Instagram, and TikTok (yes, TikTok — Gen Z made up 9% of first-time home purchase applications in 2022).

Determine which channels your target audience uses the most, get on them, and start posting content and/or running ads.

Remember, you are also free to recycle content on these channels. Just look at your competitors and see what content they are creating and how you can put your own spin on it.

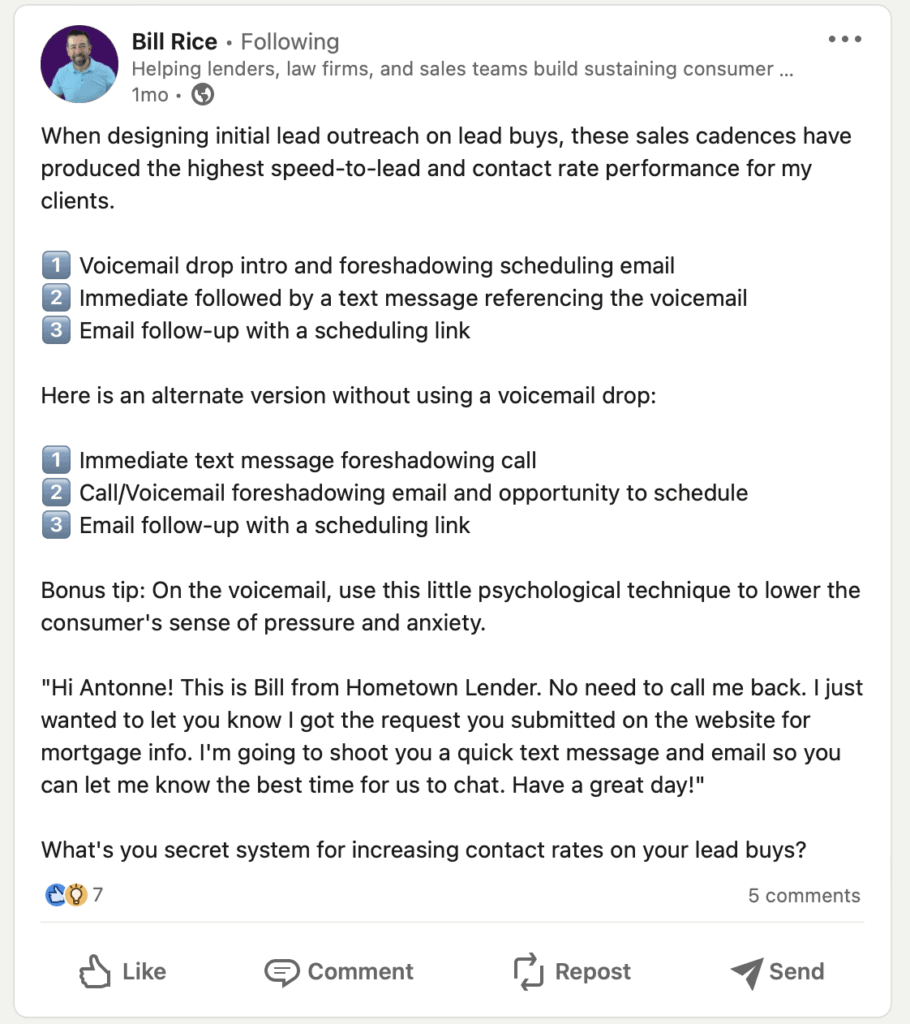

44. Create posts for LinkedIn

LinkedIn is great for networking with other professionals and displaying your credentials so potential clients and partners can find you.

It’s also the perfect place to connect by interacting with others’ posts.

Consider summarizing an intriguing blog post topic on LinkedIn (and linking to the blog), sharing your unique view on a hot topic, or posting some interesting internal findings within your business.

Infographics, photos, and links all perform well on LinkedIn. To push your content further, consider running a few LinkedIn ad campaigns.

45. Run ads on TikTok

Rumor has it that the mortgage market remains fairly untapped on TikTok Ads, so you may be able to gain excellent exposure on the platform — and quality leads.

The bonus to running ads on TikTok is that you don’t have to constantly compete with the regular feed, which contains thousands and thousands of videos.

If you find that a portion of your target audience loves TikTok but doesn’t want to put the time and effort into constantly competing with the millions of other users on the app, consider running a few ads and measuring how they perform.

46. Post regularly on Instagram

Instagram is most effective when you are able to target the right niche. This way, you can create the exact types of content they are seeking and can guarantee it will perform better.

To help you reach the right audience, make sure you tag your location on posts and make it clear the location you serve.

The ultimate key to success on Instagram is creating a consistent posting schedule, and making a point of interacting regularly with your followers and other industry professionals.

Instagram is also a great platform to partner with influencers.

Do Email Marketing

Email marketing will eventually require technical skills and knowledge, but simply sending better emails is the best place to start.

47. Start with email templates

Start by focusing more closely on the emails you send to clients and optimizing them for better results.

When you send follow-ups, start taking more time to craft exciting and engaging emails. Work harder on the subject line and the body of your emails.

Then, take these better emails and turn them into templates. You can pull out and use emails over and over with standard outreach, follow-ups, and questions.

These templates can turn into campaigns when you set up your marketing and sales automation technology.

48. Add sequences to your CRM

Take those email templates and start building them into your CRM as sequences.

Use lead status changes to trigger these email sequences and assist your outreach and follow-up processes.

49. Use Mailchimp or another email service provider

Play the long game!

Get all of your leads flowing into a master in-house email list. You can start with something as simple as MailChimp.

The idea is to stay at the top of their mind — not just hammer new leads and toss them away.

There are various reasons that consumers become unresponsive—changing priorities, anxiety, and even losing to a competitor. But that doesn’t mean they won’t need you later.

Use the content and helpful emails around personal finance, credit, insurance, and other financial topics to build brand awareness and loyalty. Doing this will yield a consistent flow of new or re-engaged leads from email.

50. Build a long-term lead nurturing campaign

Leads are never dead. We just stop engaging them.

Borrowers come into our sales funnels under a variety of different perspectives and circumstances. As a result, their level of interest, intent, and time to close could be all over the place.

This variety can be challenging for your sales team. However, if you introduce marketing automation to keep in contact — in a good/valuable way — you will get the call when they are ready for that mortgage.

Long-term lead nurturing requires a slightly different approach, considering you’re looking to build an infinite campaign. Use a much broader spectrum of content to keep things fresh.

Leverage content from your blog and explore a variety of personal finance topics.

These are some popular content categories:

- Credit scores

- Debt management

- Savings

- Investing

- Credit cards

- Home improvement projects

- Interior design and decorating

- Anything else adjacent to qualifying for a mortgage or owning a home

51. Use lead magnets and guides to grow your list

People are impatient and distracted. Trying to get them to focus on reading a web page for more than a minute or two is tough. But, most are willing to grab an ebook, guide, or checklist (we call these lead magnets) in exchange for an email address.

Of course, they have the best intentions of reading this material. They probably won’t, but that’s okay. We want to take that same content, break it into several emails, and then drip it out to them over the next several weeks.

With this tactic, we grow our list and nurture that email subscriber into a future mortgage lead.

Advertise Using Google and Facebook Ads

Now that we’ve exhausted our network, it’s time to venture into the larger marketplace.

Using Google Ads and Facebook Ads, you can grab the attention of people considering buying a home or refinancing. People who don’t necessarily have a friend in the mortgage business.

52. Create one or more landing pages

Before you even begin wading into paid advertising, you need to make sure that you have a way to turn that paid traffic (clicks) into leads.

Your first step is to have a compelling landing page. The most straightforward possible conversion rate optimization pattern I can give you is this:

- Loan program name

- Who this loan type is for

- The top 3 benefits of the loan type

- A web (lead) form and phone number <– Don’t forget this!

You need to create a unique landing page for every loan type or program you will advertise. Page relevance is critical to profitably running paid ads and getting conversions to leads.

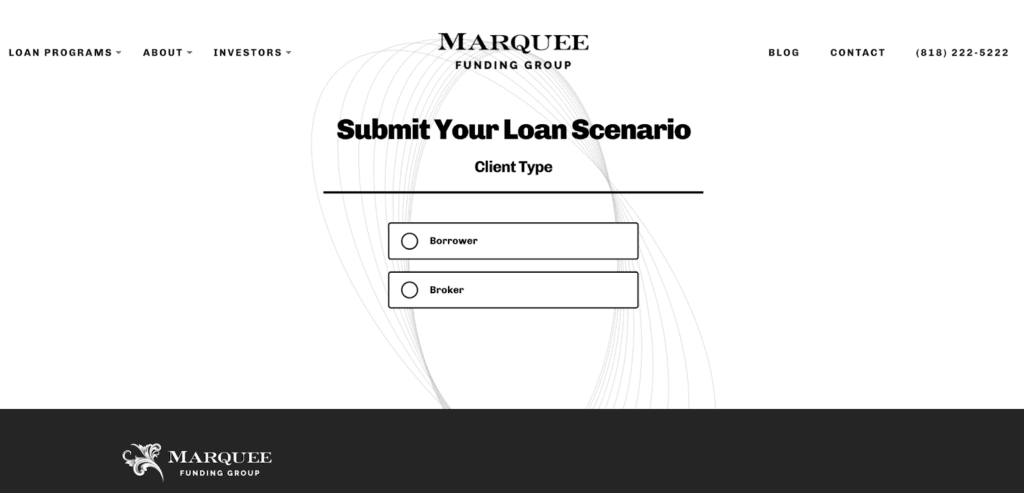

53. Use progressive lead forms

Web (lead) forms have come far from the basic contact form.

Instead, use progressive to multi-step forms to quickly ask detailed questions about their mortgage needs. These forms are more like a game or answering a fun quiz on Facebook. Your borrower will rocket through the form, and you’ll get a very detailed mortgage lead.

Here is an example of one of these progressive forms.

54. Google Ads is not that expensive and highly effective

One of the biggest misnomers of Google Ads is that you need tens of thousands of dollars to get started and effectively generate leads.

Many smaller lenders spend our minimum of $2,500/month and get anywhere from 50 to 100 high-intended mortgage leads a month.

Try to beat those economics on any exclusive mortgage lead — even a shared lead.

55. Use Facebook Ads to build your brand

Facebook Ads can generate mortgage leads, but I like to use them primarily as a brand-building tool.

Facebook, by definition, is an interruption marketing tool. We’re dropping advertising units into targeted consumers’ Facebook streams. Sometimes that’ll get us a click, but almost as importantly, it will bring us an impression. So make your ads stand out.

I also like to use Facebook remarketing to keep popping up in front of consumers who have visited your website — more impressions.

56. Remarket, Remarket, Remarket

Once you get visitors to your website, you never want them to forget you, especially visits you pay for with Google or Facebook Ads.

Remarketing is the best way to do this. You don’t need to understand the technology; you just need to set it up in your Google and Facebook Ads accounts and get the pixels set up in your Google Tag Manager.

Check out this great introductory guide to remarketing.

Buy Mortgage Leads

By design, I left the mortgage marketing shortcut for last.

Buying mortgage leads is a great way to grow your mortgage business, but I’m a big believer in understanding how the sausage is made and how these leads are generated.

I also think that your lead buying will be more effective if you have considered and implemented many of the previous 56 mortgage marketing ideas.

57. PPC Agency

A great place to start buying leads is by generating your exclusive mortgage leads with PPC, specifically Google and Facebook Ads.

Many mortgage lenders avoid PPC because it can be complex and expensive if you aren’t an expert. But, staying out of these paid marketing channels can be an ample missed opportunity.

Instead, hire a PPC agency that specializes in mortgage lead generation.

An expert mortgage lead generation PPC agency can generate leads at a comparable cost to lead generators and lead aggregators.

58. Content marketing agency

One of the best ways to build your long-term lead flow is through SEO and content marketing. By producing high-quality content that serves your prospective borrowers, you can grow your audience and brand.

The challenge is finding time (and the expertise) to write and produce content that is of sufficient quality and promoted to get it on the first page of popular searches.

Positioning yourself on page one of relevant Google searches is where a content marketing agency specializing in mortgage lead generation can give you an edge and generate exclusive leads daily.

59. Rate tables

I love rate tables for mortgage lead generation. Rates are the number one thing that prospective borrowers are looking for — whether they should be or not 🙂

There are many ways to buy impressions on rate tables. In my mind, impression share is the key to rate tables. Leads off these mortgage rate tables are great, but prospective borrowers do a lot of scanning and what-ifs without ever filling out a lead form.

Therefore, your primary objective should be to show up in each rate table — regardless of the borrower’s scenario.

In addition to buying positioning on rate tables, I encourage you to create mortgage rate landing pages on your website. Many of you will recoil at that notion.

Still, there are lots of ways to satisfy your prospective borrower’s curiosity about current mortgage rates and trends without having to give specific loan program rates.

60. Lead generators and aggregators

Most mortgage lenders are sales-driven organizations. They’re exceptional sales organizations, but at the same time, can struggle to build out a marketing organization.

In a lot of ways, these are two very different cultures. Sales teams are emotional, reactive, and impatient — they are driving to a revenue goal every month.

Meanwhile, marketing must be analytical, proactive, and patient to generate consistent lead production month-over-month.

This culture clash is why buying leads makes a lot of sense as your sales team grows beyond what individual loan officer referrals can sustain.

Even if you are a small mortgage operation, it’s worth dipping into lead-buying marketing. Learning how to effectively buy and work leads before you need them for scale is wise.

61. Aged leads

Aged leads are my final mortgage marketing idea — buy aged leads!

Every advertising market — billboards, display ads, even print advertisements — has a remnant marketplace. A remnant market is advertising space or legs of a lead that has not sold. As a result, it becomes excess inventory and, therefore, considered less valuable. Remnant ad inventory creates an affordability opportunity — leads at bargain prices.

Aged leads are the same real-time internet leads generated by lead providers and aggregators. However, more leads are often generated than can be sold within their network of lead buyers. As a result, these real-time leads begin to age — 30-90 days — and must be sold in the secondary market.

Aged leads, which sell for around $1 per lead, are a great lead source for call center operations and stocking your loan officers’ CRMs with unlimited opportunities.

Best marketing books to help you plan and execute your strategy

There are thousands of marketing books to choose from in 2023, but we rounded up the top five you should grab to help you focus on a plan and thoughtfully execute it.

1. The 1-Page Marketing Plan by Allan Dib

Allan Dib’s one-page marketing plan consists of a single page divided into nine squares.

Based on these nine squares, Dib details a step-by-step process for creating a personalized marketing plan. He helps readers scale their marketing style to fit a medium or small-sized business rather than using a “big business” style that could hurt smaller businesses.

Finally, Dib explains how you can close deals without being “pushy” or “obnoxious” and how it will help you both to get new customers and make sales from existing ones.

Amazon reviewers praise the book for its “rock-solid,” comprehensive advice considering the modern world.

2. Building a StoryBrand: Clarify Your Message So Customers Will Listen by Donald Miller

“Building a Storybrand” explains the seven universal story points all humans respond to and how to use this storytelling to create simpler, more effective messages to reach your target audience.

The book highlights the importance of using the correct wording for your brand, or your customers won’t understand what you can do for them.

Donald Miller details how to create effective messaging for websites, social media, and brochures.

One GoodReads reviewer called the book one of the best branding and messaging books they’ve read, and it ranks as the No. 1 bestseller in the Web Marketing category on Amazon.

3. Digital Marketing Strategy: An Integrated Approach to Online Marketing, 3rd Edition, by Simon Kingsnorth

The third edition of “Digital Marketing Strategy” was updated in 2022 to include the integration of AI in marketing, e-commerce, marketing automation, and how to use digital analytical tools.

In the book, Simon Kingsnorth shares how to select, align, and manage your digital channels and operations and measure your results.

The book is recommended by the Chartered Institute of Marketing and includes case studies from Coca-Cola, Spotify, and more.

Reviewers praise it for its depth and up-to-date advice.

4. The 22 Immutable Laws of Marketing: Violate Them at Your Own Risk by Al Ries and Jack Trout

How can a marketing book published in 1994 possibly be useful in 2023?

Ask the thousands of reviewers who still consider this book a “must-read” today.

The book covers the principles of successful marketing with “timeless laws” for any business owner.

It covers 22 rules for understanding and succeeding in marketing, including the “Law of Leadership” and the “Law of the Mind.”

5. Upstream Marketing: Unlock Growth Using the Combined Principles of Insight, Identity, and Innovation by Tim Koelzer and Kristin Kurth

“Upstream Marketing” analyzes seven high-profile companies to break down what makes them great and how businesses can apply these strategies in their own workspaces.

Authors Tim Koelzer and Kristin Kurth include research, case studies, and best practices they’ve uncovered in their 20+ years at management consultant agency EquiBrand Consulting.

The book explores identifying and fulfilling customer needs with a proactive mindset.

One Amazon reviewer considered it a concise “cliff-notes” version of multiple business book best-sellers, giving readers the most bang for their buck.

Get our 90-day mortgage marketing plan for free

Need more mortgage marketing ideas? Next steps

If you need help, learn more about Kaleidico, my mortgage marketing agency, and schedule a discovery session.

Our team executes strategy and marketing for some of the biggest names in the mortgage market.