Staying ahead of your competitors in 2025 means being proactive, and mortgage email marketing offers the perfect channel to quickly notify customers of new opportunities and slowly nurture those who aren’t ready to convert.

In this article, we’re diving into the true power of mortgage email marketing and how this channel (when done right!) can result in higher conversion rates, repeat business, and referrals.

The power of email marketing in the mortgage industry

Mortgage rates have been declining since the spring of 2024, a welcome relief for homeowners who purchased a home during last year’s 8% rates (and everything in between).

As a mortgage broker, lender, or loan officer, you know a rate change of as little as 0.5% can mean big savings for borrowers over the life of their mortgage.

However, your audience may not, and email allows you to communicate this directly and personally with prospective and current clients.

Importance of targeted communication for mortgage clients

With targeted, carefully crafted, and automated email campaigns, you can cater your messages to the specific needs and financial situations of each group, such as:

- Those looking to refinance

- First-time homebuyers

- Real estate investors

The result? You become a trusted advisor, automatically delivering information such as rate changes, refinancing, or purchasing tips straight to their inbox.

This enhances the message’s relevance and significantly boosts engagement and the likelihood of conversion.

The mortgage email marketing funnel

Email marketing is most effective in the mortgage industry when it aligns with the customer journey stages.

Let’s take a quick look at these four key stages and the types of communication they require:

- Awareness stage: You introduce your brand and build trust, so content should be educational and informative without being too salesy.

- Consideration stage: Your emails should be more personalized for specific audience segments and focus on helping prospects understand why your mortgage services differ.

- Decision stage: Your leads will become customers at this stage, so your emails should be action-oriented and contain clear calls to action (CTAs).

- Retention stage: The relationship doesn’t end after the loan is secured. Now, you shift into nurturing mode and send content to keep your services top-of-mind for future refinances, purchases, or referrals to family and friends.

Crafting messages that resonate with personalization

Personalization in email marketing campaigns allows you to connect with your audience and establish credibility.

But you can’t execute personalized campaigns without segmentation.

Segmentation: The foundation of effective personalization

Segmentation involves dividing your email list into smaller, more targeted groups based on various factors like demographics, behaviors, or stages in the mortgage process.

Use your CRM and email platform to group your clients based on where they are in the funnel. Then, you can create different messaging based on your segments.

Strategies for personalizing your emails

- Tailored subject lines: Include specific details relevant to the recipient, such as their name or interest in a certain product or service

- Behavioral triggers: Send out emails based on actions (or inactions) the recipient has taken, such as filling out a form or using an online mortgage calculator

- Geo-targeting: Customize email content to reflect local market conditions, rate changes, and housing trends in specific regions

- Client anniversaries: Send personalized emails to acknowledge important client milestones, such as the anniversary of their mortgage closing

- Personalized loan offers: Provide targeted solutions based on the recipient’s financial situation or previous loan history

Personalized mortgage email campaigns show recipients that you understand their specific needs and are ready to help them at every step.

Using automated campaigns to nurture leads

To make your campaigns as simple and hands-off as possible, you need to automate them.

Email drip campaigns make sure potential clients receive the information they need at each stage of their journey without a ton of manual effort on your part.

Common automated or drip campaigns for mortgage professionals include:

- Pre-approval campaigns that walk prospects through the benefits and help them gather documentation

- Refinancing campaigns that highlight the benefits provide rate updates and encourage action before rates change again

- Purchase campaigns that provide homebuying tips, rate updates, and loan options

Example workflow

Let’s take a look at an example of a new lead nurture sequence:

- Email 1 (immediate): “Thank you for signing up! Here’s what to expect next.”

- Email 2 (three days later): “Top 5 tips for securing the best mortgage rates.”

- Email 3 (one week later): “Ready to move forward? Get pre-approved with us.”

Creating high-value content to build trust

Now that you know how to segment and automate your campaigns, let’s get to the meat of the email: the content.

Here are the most effective types of content for mortgage customers and prospects:

Educational content

The mortgage process can be intimidating. Educational content helps empower your prospects and prepare them for success, including:

- Newsletters

- Blog posts

- Guides

- FAQs

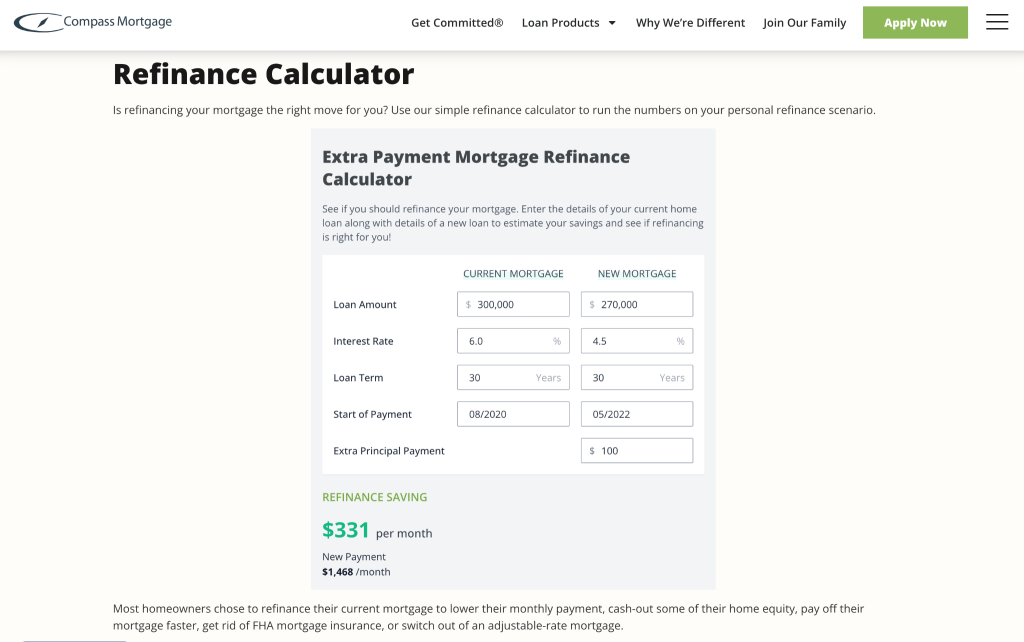

Mortgage calculators

Interactive tools like mortgage calculators are popular because they give prospects a quick idea of what they can afford, how much they’ll have to pay, or how much they could save by refinancing.

Rate alerts and updates

Timely updates on rate changes can be extremely valuable for borrowers who are making a decision about a home purchase or refinance.

Comprehensive guides

Long-form content, such as e-books or guides, allows you to dive deeper into specific topics and provide clients with a resource they can refer to throughout the mortgage process.

This type of content can also be used as lead magnets to build your email list.

Customer testimonials

Sharing client success stories or testimonials is one of the most effective ways to build trust.

Potential clients are more likely to trust your services when they see real-world examples of people in similar situations achieving their goals.

How data can help you improve email performance

To gauge the effectiveness of your campaigns, focus on tracking the following metrics on your email platform:

- Open rates (how many recipients open your email)

- Click-through rates (how many click on links)

- Conversion rates (how many take desired actions, like applying for a loan)

Compliance considerations for mortgage email marketing

The most important things to know regarding compliance for mortgage email marketing is:

- Always include an easy way to unsubscribe

- Make sure you write accurate subject lines and content

- Get clear consent from recipients

These key practices will help to keep your emails both compliant and effective.

Leveraging AI for smarter email campaigns

AI can help mortgage professionals analyze their campaigns to maximize their effectiveness.

Tools like HubSpot, Mailchimp, and ActiveCampaign use machine learning to predict client preferences, optimize send times, and personalize content—helping you nurture leads more effectively.

Email marketing in an ever-changing market

Mortgage email marketing can involve a lot of moving pieces.

Getting started doesn’t take much, but you may need some help for long-term effectiveness.

That’s where we come in. Kaleidico offers proven tactics for sales outreach and email marketing to help you engage leads on an ongoing basis.

Mortgage email marketing FAQ

Yes, email marketing remains one of the most effective ways to engage clients, especially in the mortgage industry.

With targeted, personalized content, it offers a high return on investment by building client relationships, increasing conversions, and driving repeat business.

While email marketing requires planning and strategy, automation tools make creating and managing campaigns easier.

Using segmentation and personalization, mortgage professionals can efficiently reach their audience without much manual effort.

The success rate of email marketing varies by industry, but it typically offers high engagement and conversion rates.

Open rates for financial services emails can reach around 20%, and well-targeted campaigns often lead to significant returns on investment.