If your prospective borrowers were to figure out their mortgage rate calculations on their own, they better know their algebra — M = P [ i(1 + i)n ] / [ (1 + i)n – 1].

However, don’t count on your borrowers doing the math with a pencil and paper at home — because they’re Googling “mortgage calculators” to find a website to do it for them!

High-intent mortgage customers are searching for mortgage calculators right now to find current mortgage rates and determine their mortgage payoff calculations.

Given the choice between two potential mortgage lenders — one that offers a mortgage calculator on its website and one that doesn’t, which website do you think will get more engagement and collect more leads?

In this article, I’ll talk about how mortgage calculators work, explain the most popular types of calculators and include tips on how you can promote your calculator online to generate the most amount of leads.

What is a mortgage calculator?

A mortgage calculator is an online tool that lets borrowers estimate their monthly mortgage payments.

Mortgage calculators contain several variable input fields such as:

- Interest rates

- Down payment amount

- Principal and interest

- Homeowner’s Insurance

- HOA fees (if applicable)

- Home price

- Loan term (30-year, 20-year, 10-year)

- Zip code

- Credit score

- Purchase or refinance options

Because interest rates change depending on the length of the loan term and credit score, mortgage calculators have various inputs to allow borrowers to play around with numbers to find out how much home they can afford comfortably.

After calculating, the results will show a nice breakdown of the interest and principal in the monthly payments.

To do all these calculations on your own, with the number of variables involved would be a tremendous math equation, which is why borrowers search for mortgage calculators in Google searches.

Naturally, almost all of the websites showing mortgage calculators are mortgage lending companies or lead generation companies, because this information is too valuable to give away for free.

Close more loans with a mortgage website built to fuel sales

How do mortgage calculators generate leads?

If you’re fearful of adding a mortgage calculator to your mortgage website thinking it will scare off people when they see high-interest rates, don’t be!

Here are some common concerns we hear all the time from mortgage company clients:

- “I might not be able to match the rates they see online”

- “Those rates might be too high and scare them away”

- “Calculators leave out too many factors”

- “Borrowers don’t put in realistic numbers or understand the assumptions”

Some mortgage companies expect they can just put a call-to-action on their website that says “Contact us to get your free quote!” without actually listing updated daily mortgage rates.

This strategy works sometimes, just like how used car dealerships will say “Inquire about price” instead of just displaying the price. They think this strategy weeds out unqualified customers and promotes more engagement and lead generation. But really — it just drives people away because of aggressive sales tactics.

However, by adding a mortgage calculator to your website, you’re gaining a heck of a lot of search traffic related to mortgage calculators!

As I said before, if you don’t have a mortgage calculator on your website, then your visitor will find a website that does and give their contact info to them instead of you.

Include mortgage calculators on your website to generate traffic

Adding a mortgage calculator to your website can act as a “lead magnet.”

The way most loan calculators work is by allowing your reader to enter all of their variables. It automatically displays the monthly principal and interest information that the user is seeking.

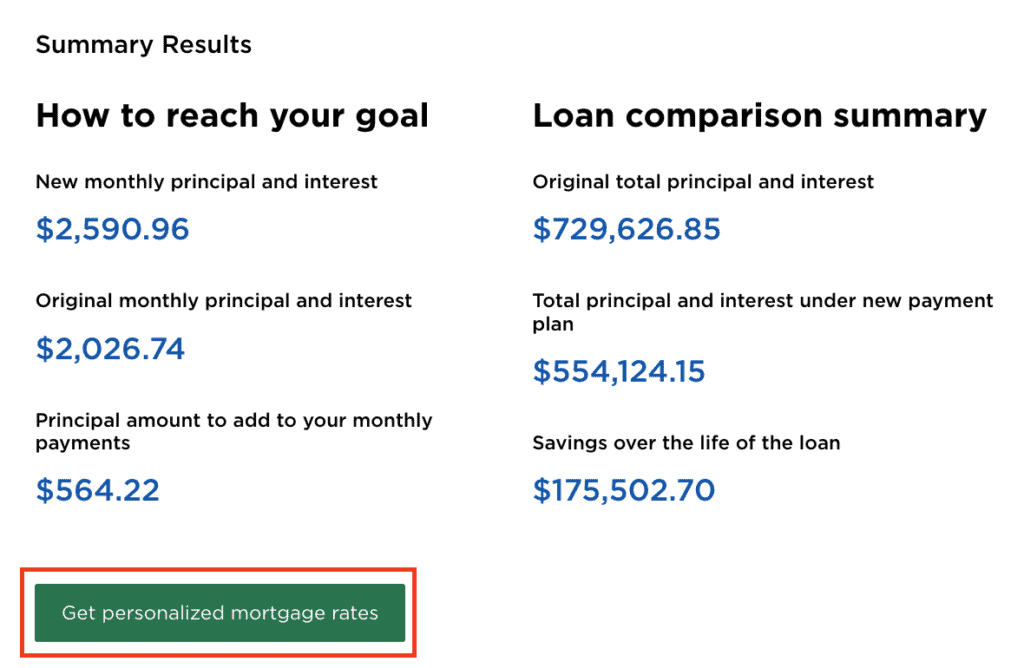

However, in order to collect a lead, many websites will then have a clickable button that says “Get personalized mortgage rates” or “Next” to prompt the reader to fill out a customized form to fill in more details.

By collecting your lead after allowing your borrower to run their loan situation through your calculators you’ll be able to qualify your leads and sort them by only high-intent borrowers.

Also, once you’ve collected an email address, you can add it to your existing email list and automatically kick off a drip email campaign to automate the long-term lead nurturing process.

How to set up your mortgage calculators for lead generation

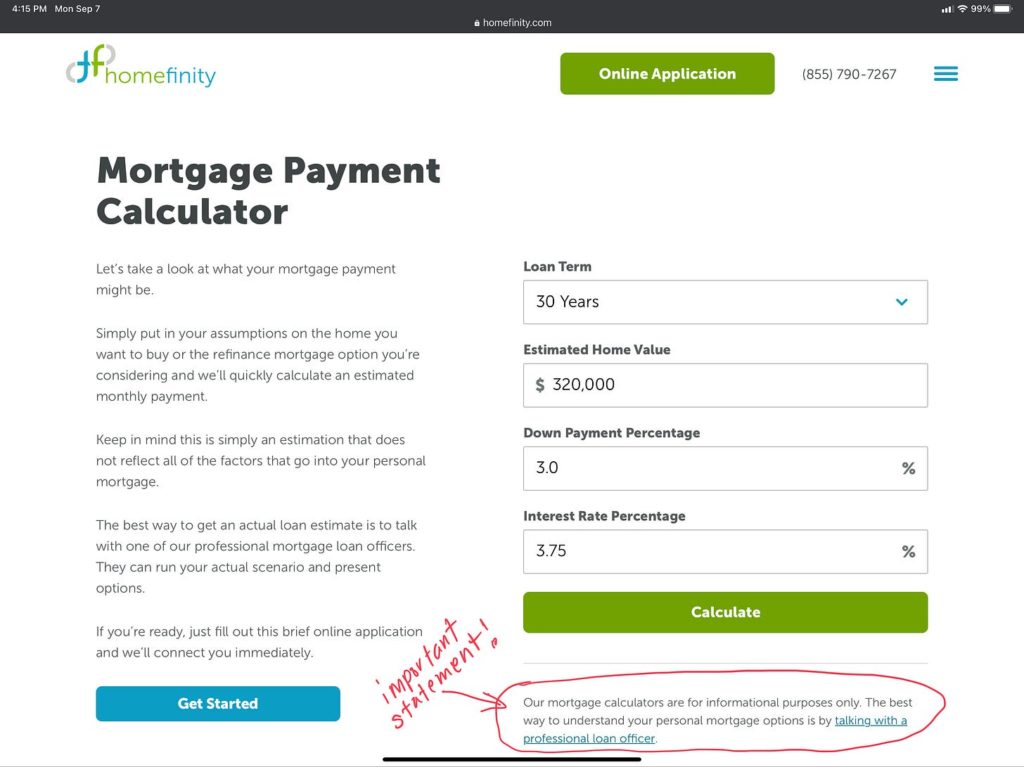

Mortgage calculators are educational tools to help your reader understand their monthly payoff amount — they are not loan applications!

Therefore, be careful when setting up your mortgage calculator not to ask for personal information that may give the impression you’re offering loan estimates.

Make sure not to ask for this kind of information:

- Name

- Contact info

- Credit scores

- Employment

Instead, set it up as a calculator to give borrowers a variety of input fields and variables to allow them to play around with mortgage numbers. For example:

- Demonstrate how putting more or less money down or buying a bigger or smaller house changes your loan amount and how those monthly loan payments might compare

- Give first-time home buyers the ability to “what-if” several different home price scenarios to estimate monthly mortgage payments to test affordability

- Allow homeowners the ability to estimate how a lower mortgage rate might change their monthly mortgage payment

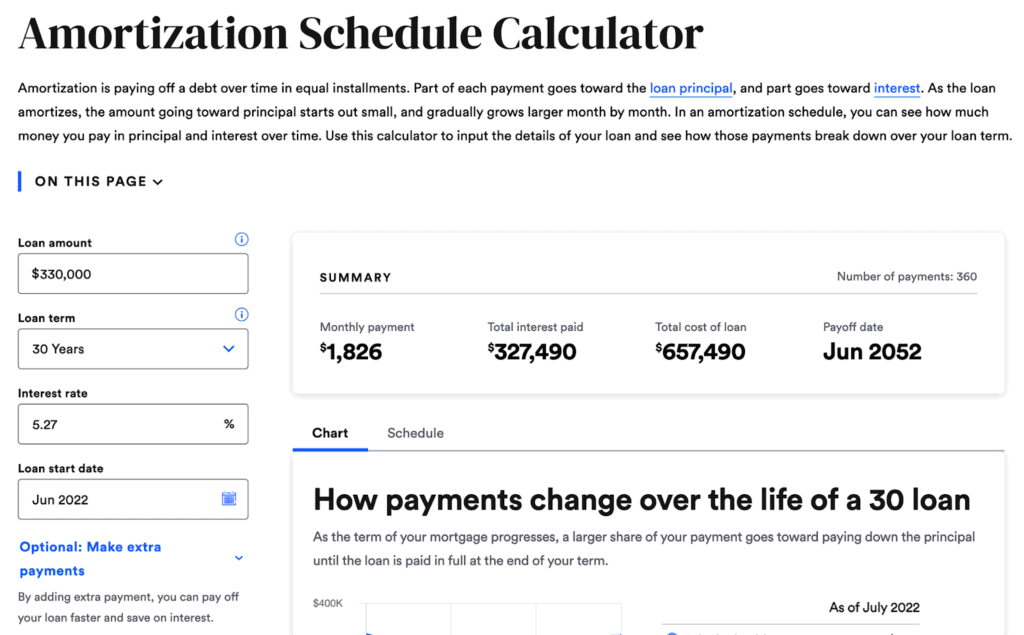

- Show how amortization works

Mortgage calculators can help borrowers understand how mortgages work and compare various loan options. They can observe how confusing concepts like amortization, down payments, mortgage insurance, homeowners insurance, and property taxes come together to make up a monthly payment.

Mortgage rates tables

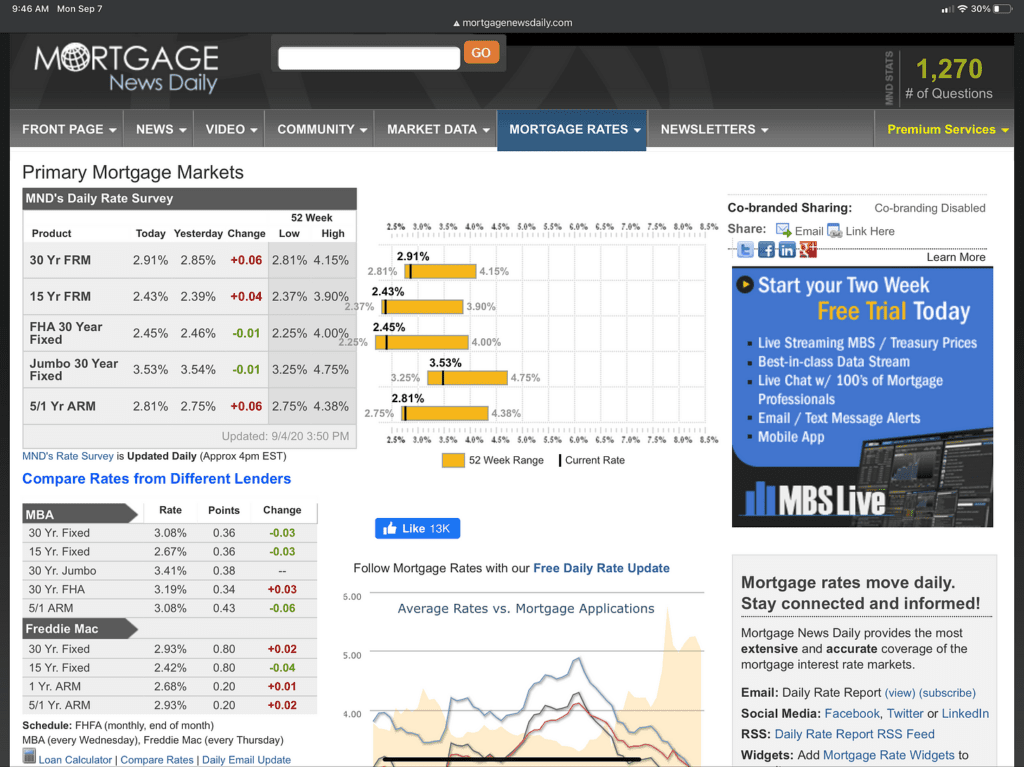

While we’re at it, let’s cover mortgage rates tables too because in addition to mortgage calculators, they also receive a high monthly search volume.

Make sure to set up your mortgage rates as a factual demonstration of market mortgage rates over time, not your rates.

There are all kinds of great ways to do this. Some of the most popular is to show market rate surveys, like Freddie Mac’s Primary Mortgage Market Surveys from Freddie Mac (FNMA), Fannie Mae (FHFA), Mortgage Banker’s Association (MBA), or Mortgage News Daily (MND).

Your goal is to educate your borrowers on how mortgage rates change, that there are periods of volatility, and whether we are currently trending high or low.

By the way, both trends spark urgency in borrowers to apply. And, this is essential to remember, consumers are consuming so many disparate data points that they are looking for someone to sort the truth for them – the loan officer.

The screenshot above is a perfect case in point. There are three different primary mortgage market surveys (the same market) and the range is 9 basis points.

If your reader is unfamiliar with the concept of “points” then you can write a blog post about it to start a conversation!

Because most aspects of mortgages are confusing to borrowers, you can write blog posts about each aspect to draw in more readers and attract them to your mortgage rates and mortgage calculators.

What are the different types of mortgage calculators?

Because there is more than one type of mortgage loan, there are multiple types of mortgage calculators.

Below are the most commonly searched mortgage calculators that you should consider adding to your mortgage website.

Monthly mortgage payment calculator

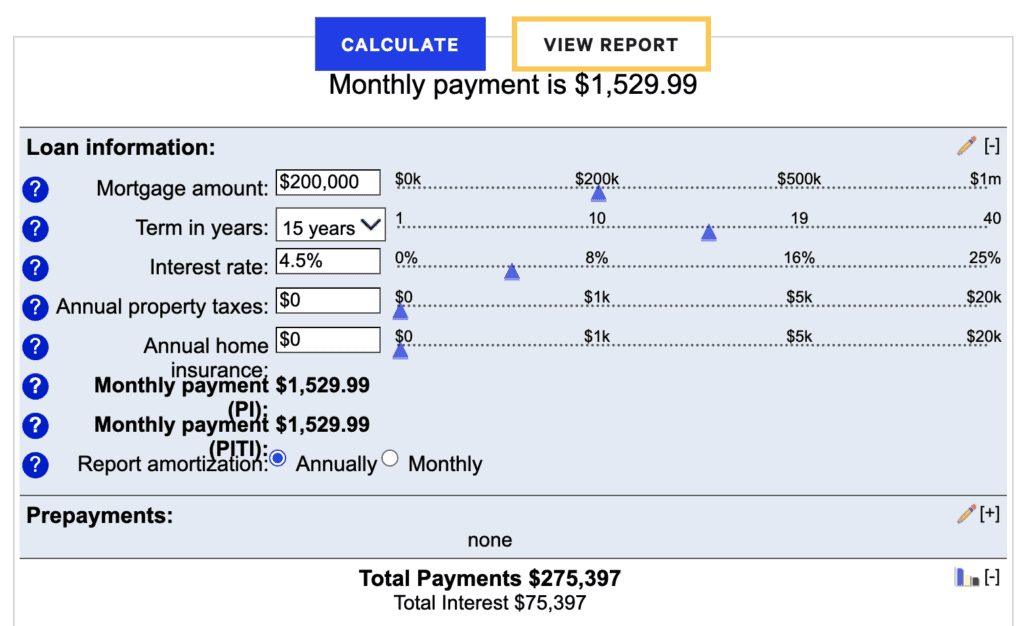

The mortgage payment calculator is the most common tool out there that helps prospective buyers estimate their monthly mortgage payments.

Add one of these mortgage repayment calculators to your mortgage website to let visitors play around with the numbers to see how much house they can afford.

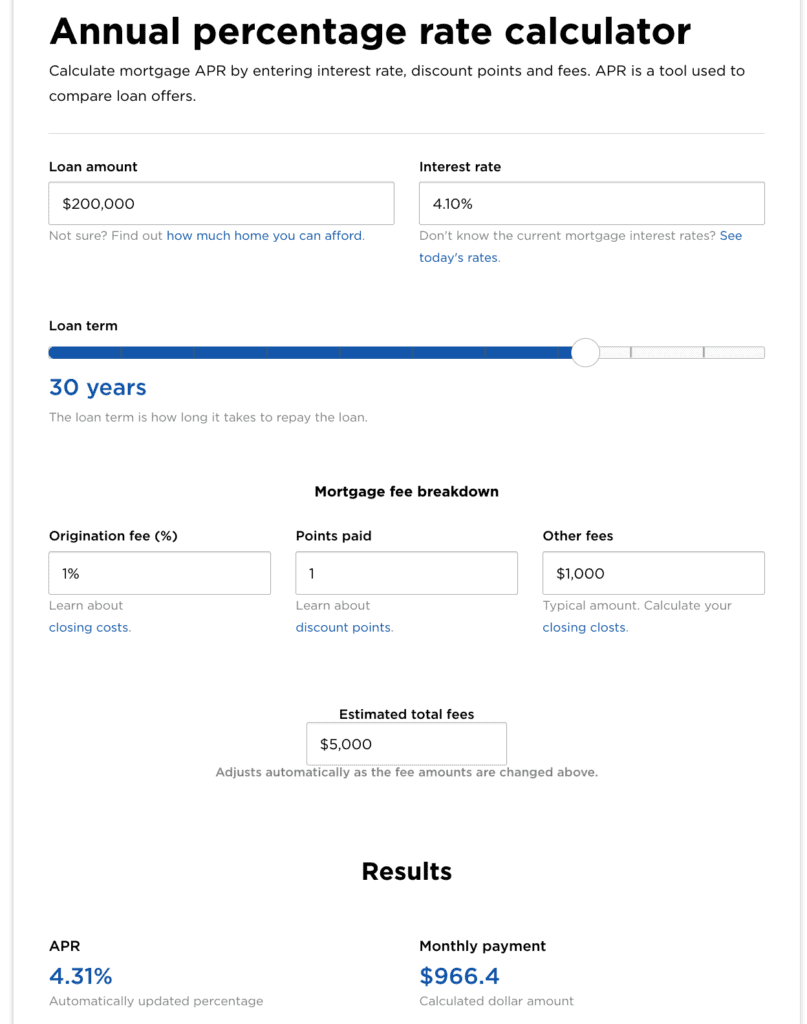

Mortgage annual percentage rate (APR) calculator

One important variable in the mortgage process is determining the annual percentage rate (APR) of the loan.

Use an APR mortgage web calculator to type in different interest rates to determine the monthly mortgage repayment schedule.

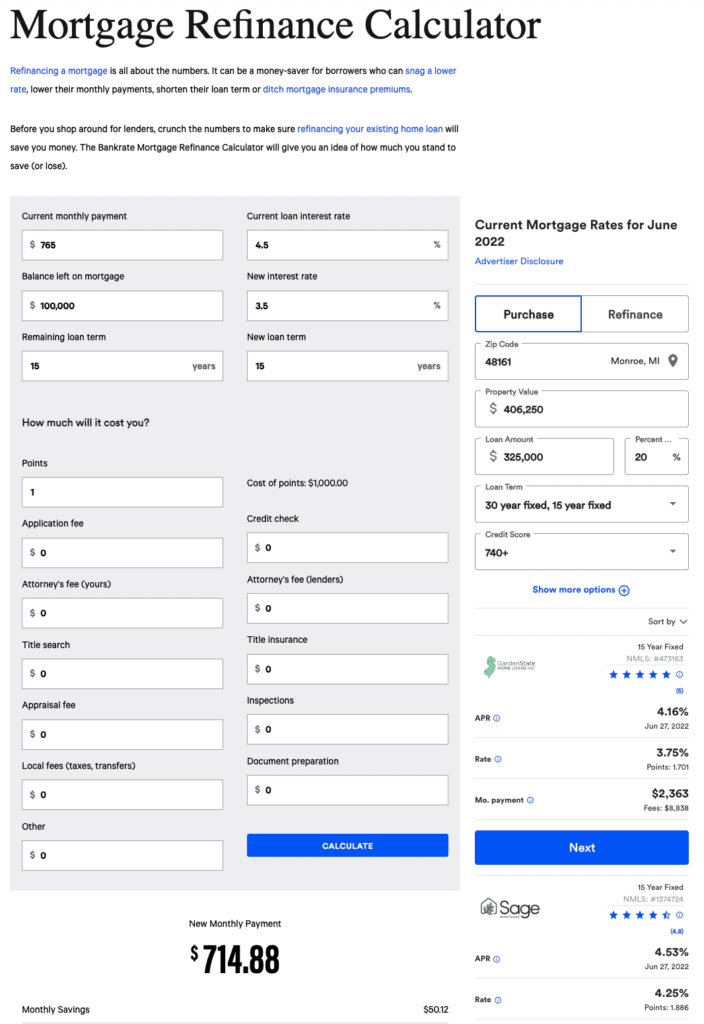

Mortgage refinance calculator

For borrowers looking to refinance their home, offer a mortgage refinance calculator to help them find a lower rate and save them money.

Amortization schedule calculator

Adding an amortization schedule calculator can let your prospective leads estimate the amount they will pay in principal and interest over time in equal installments.

How to create a mortgage calculator for your website

These days there are many plugins and mortgage calculator widgets that can easily be “dragged and dropped” into most CMS-style websites, including WordPress and Squarespace.

Simply find the specific mortgage calculator widget and add it to your mortgage calculator landing page.

If you’re offering different loan types, then consider adding a different mortgage calculator to each loan’s individual landing page, in order to collect more leads from each page.

A digital marketing agency such as Kaleidic can employ developers to create custom Excel formulas and transform them into beautiful calculators that will impress your audience.

Let Kaleidico build your custom mortgage calculator.

How to get the word out about your mortgage calculator

Adding a mortgage calculator is a good first step, but you’ll need to optimize your website to get the most traffic.

Follow these mortgage marketing strategies to promote your mortgage calculator tool across various channels online.

Optimized landing pages for SEO

Create individual web pages for each specific type of mortgage calculator that you want to add to your website.

For example, create a page that’s optimized around the keywords Mortgage Payoff Calculator, Mortgage APR calculator, VA Home Loan Mortgage Calculator, and so on to add the specific calculator to each page.

This will improve your website’s search engine optimization (SEO) so that when people search for a mortgage payoff calculator, your website will be a relevant search result because of your mortgage calculator page.

Content marketing (blogging)

The next best thing after optimizing landing pages is blogging about your mortgage calculator.

Write a 1,000-word blog post about each type of mortgage calculator you offer, and why they’re important. These blog posts will show up in Google searches when people are searching for mortgage calculators.

PPC ads

The last step you can take is to create PPC ads based on the word mortgage calculators so that when people search online, they’ll see a paid ad that can direct them back to your website, where you can generate a new lead.

Get Our 90-Day Mortgage Marketing Plan

Kaleidico — a marketing agency for mortgage lenders

Kaleidico is a full-service marketing and lead generation agency for mortgage lenders, law firms, and fintech companies.

We help loan officers generate more leads through custom websites and lead generation strategies that include blogging, PPC ads, email marketing, lead magnets, mortgage calculators, and more.

Contact us to help increase your monthly mortgage leads.

Photo by Eva Bronzini