Generating mortgage leads is perhaps the most crucial aspect of keeping your business afloat, besides closing sales.

As a loan officer or mortgage lender, getting enough high-quality leads to fuel your business is a continuous venture.

You’ve likely heard about the option of buying leads and may have purchased leads in the past. Or perhaps you’ve read online that the key to generating mortgage leads is through “SEO,” whatever that means.

With new proposed FCC lead generation guidelines and increased competition in 2023, you’ll need to understand the latest developments and regulations to stay ahead of the game and secure your place in the mortgage industry.

In this complete guide to generating mortgage leads, I’ll break down the full ecosystem and potential sources of online mortgage leads.

This includes top lead providers, tips on how to set up your own mortgage lead generation funnel, and advice on nurturing leads until they’re ready to close a mortgage loan.

Work with Kaleidico to help build your lead generation strategy.

Lead generation compliance in 2023: A look at the latest FCC and regulatory actions in lead generation

Are you like me and receive tons of robocalls each day?

Because of this growing problem, the FCC (Federal Communications Commission) is cracking down on third-party lead aggregators, and you’ll need to pay close attention to avoid possibly being penalized for purchasing third-party leads.

In late December 2022, the FCC and interest groups began taking action to restrict lead aggregators and data brokers to combat illegal texting and robocalling to consumers.

All lead generation agencies are at risk even if their services are all done legally and above board.

Purchasing leads from third-party aggregators is still legal, but for how long?

Mortgage companies that depend on buying third-party leads need to begin pivoting now to find other conventional (and still compliant) methods to generate their own mortgage leads.

While this news may seem disheartening or perhaps even scary, it gives companies a new opportunity to differentiate themselves from their competitors, such as:

- Generating leads from their own branded website

- Using social media to connect with potential clients

- Using email marketing to stay connected with potential buyers

- Writing helpful blogs and producing educational content to attract web traffic

- Purchasing pay-per-click (PPC) ads to drive new traffic to their website

For a more in-depth look at the FCC’s new guidelines, read our blog post: Third-Party Lead Generation at Risk of Shut Down: Protect Yourself by Building an Internal Lead Generation Strategy.

What is a mortgage lead?

A mortgage lead is the personal contact information of prospective home buyers and borrowers who have successfully completed a web form.

They’ll typically sign up to receive a rate quote, learn which loan programs they may qualify for, or inquire about mortgages in general.

These leads then work together to build your mortgage lead funnel.

First, it starts with a mortgage website that’s optimized for conversion. Generating a mortgage lead counts as a “conversion” in your advertising campaign.

Conversion means attracting prospective customers to your website, and the user completes your desired goal. The goal is often to collect contact information or another measurable outcome.

One way to attract users to your website is to create helpful blog content. The goal is that eventually, people in the researching phase will find your articles in their Google search, go to your website, and fill out a contact form.

This begins the mortgage sales process involving warm calling, lead nurturing, and following up.

Why are mortgage leads important to lenders and mortgage loan officers?

Yes, referrals are nice—but they’re simply not enough to sustain a business.

When you consider that the top mortgage salespeople call around 100 people a day, you can see that relying on referrals will only get you so far into the workday. And what if nobody in your network knows of family members or friends who need a mortgage?

Instead of waiting around hoping you’ll get referrals, you can actively start generating your own leads. These new clients can pave the way for future referrals to come later.

The problem with referrals is that they’re not scalable at all. It takes years to build trust and form relationships with your clients. And if you’re a new mortgage loan officer, you’ll depend on leads because you haven’t formed any customer relationships yet.

This is why every mortgage lender and loan officer needs to build a strong foundation for a continuously replenishing pipeline of mortgage leads so that you’re never left waiting around to hear back from people. Instead, you’re actively calling and emailing warm leads.

How do mortgage professionals get leads?

If you want more mortgage leads, and I think you do, then you really only have a few options:

- Buy them from a lead provider (see note below on FCC’s latest news)

- Generate leads yourself

- Use client referrals

First, let’s look at the different types of leads you can purchase online.

Buy leads from lead aggregators (before the FCC puts an end to it)

2023 Update: Purchasing leads online is certainly the fastest way to ramp up your mortgage operation, but again, because of the FCC’s recent decision to potentially ban third-party lead aggregators from selling leads, this option may end very soon. (It’s important to remember this decision is still in the process of being implemented, and the consequences of the ban are still largely unknown.)

Lead provider companies have done all the leg work to attract traffic to their website and collect contact info from people who have shown a high intent to take the next step in the sales funnel. These users are sometimes referred to as “hand-raisers.”

Lead providers like LendingTree have been around for more than 20 years, earning a positive reputation and receiving millions of monthly visitors to their websites.

Will your mortgage website be the next LendingTree? No, probably not, and it doesn’t need to be to generate enough exclusive leads for your company.

Learn more about Kaleidico’s mortgage Leads on Demand program.

Generating leads through a lead-generation marketing agency

The problem with purchasing leads is that as soon as you stop paying for leads, the leads stop coming in.

The other growing problem is third-party lead generation sites like LendingTree are facing a potential upheaval in collecting and selling consumer information to companies.

As the FCC lays down new regulations for ethical means of collecting and selling personal information, it may change the lead purchasing model forever.

That’s why now is the perfect time to differentiate yourself from your competitors and start generating your own leads using a customized lead generation website and content marketing (blog writing) to attract traffic to your website.

Instead of buying leads from LendingTree or another lead provider, try creating your own mortgage lead generation ecosystem. Your mortgage conversion-optimized website is a 24-hour referral system.

Yes, generating your own mortgage leads will take a bit longer than simply purchasing them. But once your website is properly set up and running, you’ll generate mortgage leads passively, letting your website and its blog content do the work of targeting new borrowers.

And you’ll also be playing nice with the FCC, which means your site won’t be punished.

Learn how Kaleidico’s mortgage marketing agency works.

Getting referrals from clients

As I already mentioned, referrals are not comparable to leads—they’re targeted, show high intent, and are free to receive.

Again, the problem is often that referrals don’t work for new loan officers and aren’t enough to satisfy monthly sales quotas.

But let’s look at the top ways to generate client referrals:

- Always be available on your phone. If you can go above and beyond, you’ll get more referrals.

- Be knowledgeable about your customers. When they call you, you will know what they need and will not need to dig around your files for a few minutes.

- Offer your customers something your competitors can’t. For example, offer VA loans, down payment assistance, lower or waive origination fees, etc.

- Send email newsletters frequently. Use an automated drip campaign to contact past and new clients.

- Post to social media. Post consistently on whichever platform your audience is on (Facebook, LinkedIn, etc.).

- Partner with local real estate agents. Set up a referral network of referral partners.

Related reading: 60+ Mortgage Marketing Ideas

What are the different types of mortgage leads?

Broadly speaking, there are four main categories of mortgage leads you can buy:

- Exclusive

- Semi-exclusive

- Non-exclusive

- Aged leads

Keep in mind that when you generate your own leads, they’re automatically exclusive because your website has generated its own lead that you don’t intend on selling!

Let’s review the different types of paid leads, their benefits, and their weaknesses.

Exclusive leads

Exclusive leads are the most valuable because they are only sold to one buyer—you.

This means when you contact the lead, you’ll be the first person to ever call them about getting a mortgage after they fill out the contact form. And this is what you want because there is virtually no competition.

Exclusive leads have a drastically higher closing rate because the leads have shown a high intent to apply for a loan.

Pros: Low competition, high closing rate

Cons: High costs (2-3 times the price of non-exclusive leads)

Semi-exclusive leads

Semi-exclusive leads are exclusive leads sold to 2-3 different companies, resulting in more competition.

If you’re buying semi-exclusive leads, you need to be quick on the draw to contact your lead before other loan officers do.

Consider setting up your CRM to automatically send an email or SMS as soon as the lead arrives.

- Pros: More exclusive than non-exclusive leads, less competition than other leads

- Cons: Higher price than non-exclusive, not “totally” exclusive, there is competition

Non-exclusive leads (at risk in 2023 because of FCC’s regulations)

Non-exclusive leads are the most common and some of the cheapest mortgage leads you can buy online. They are, by name, non-exclusive and will be sold to numerous mortgage loan officers.

However, because the FCC is beginning to crack down on third-party lead aggregators selling consumers’ personal information, this option will probably be eliminated once the FCC decides. (Too many robocalls, unwanted calls, and spammy messages ruined it for everybody.)

This means you’ll really need to be on top of contacting leads as soon as they come in. You don’t want to be the last person to call a lead because your odds of success will drastically decrease.

However, non-exclusive leads still have many benefits, especially if you know your stuff and can read or even predict your borrower’s needs.

At this point, it’s a competition between who the best salesperson is, which is why these leads are cheaper—there’s too much competition.

- Pros: Cheaper leads

- Cons: Too much competition

Aged leads

When lead providers such as NerdWallet or LendingTree promise “3-5 free quotes” instantly to their web visitors, they mean it.

However, sometimes, they’re unable to sell these “exclusive, real-time leads” within 48 hours. If this happens, their fresh leads become “aged leads,” and they’re forced to sell them off at a steep discount.

Aged leads are typically sold by age, with the most recently aged leads being the most expensive and leads older than 30-60 days being sold at the cheapest prices.

Because many people are still in the research phase when filling out a contact form, you can still have success with aged leads.

Benefits: Lowest priced leads possible, still a viable option, a great way to fill the sales pipeline with a high quantity of leads

Weaknesses: Leads may have already been contacted by a loan officer, may have already gotten a mortgage, information may be outdated

Get the mortgage leads you need to hit your origination goals.

Is it better to buy or generate my own mortgage leads?

If the FCC’s new regulations prohibit the purchase of mortgage leads from third-party lead generators, mortgage companies will need to find alternative (and compliant) methods to generate their own leads quickly!

The main driving factor behind the FCC’s decision is unethical or uncompliant methods contributing to unwanted robocalls.

However, if the FCC establishes guidelines for new ethical and compliant methods, buying leads will still be a potentially viable option.

Ultimately, third-party lead aggregators must step up and comply if they want to continue staying in business or face the consequences.

Generally speaking though, it’s always preferred to generate your own leads over buying them.

As I mentioned earlier, once your lead generation ecosystem has been built, it will start to generate leads organically (free) on its own.

Generating your own leads is also a guaranteed way to get exclusive leads.

When a person goes to your website and fills out your form, they have entrusted you to contact them.

This is much different than going to a lead aggregator site and filling out a contact form—they have shown a specific interest in your company, not an aggregate site.

Of course, if you need speed, purchase leads so you can start making phone calls immediately.

It’s not uncommon for companies to work with a lead-generation marketing agency and purchase leads simultaneously.

Learn more about how to pick the best lead generation companies.

This can be a win-win situation: While waiting for your website to be built, you can get a list of names to start calling.

Buying leads is the easiest route, but it’s generally more expensive. And as I mentioned before, when you stop paying for leads, they stop coming in.

But set up a mortgage website optimized for conversion and write several blog posts on relevant mortgage topics. You can get referral traffic to your website for years, organically and passively generating new exclusive leads.

Controlling the amount of generated leads is simple — spend more to get more leads, spend less to decrease the volume.

Work with Kaleidico to help you generate your own exclusive leads.

The top mortgage lead providers online

2023 Caveat: Currently, the FCC has only begun discussing implementing changes to lead generation collection and sales from third-party lead generators (the list of companies below are all third-party aggregators).

As of right now, purchasing leads from these aggregators has not changed.

However, if the FCC does lay down new guidelines (and it seems they will), these third-party aggregators will be heavily affected and may drastically change their entire lead purchasing model. Be advised.

Purchasing leads online can be a great way to jumpstart your mortgage business and referral pipeline. Though expensive, let’s look at some top lead providers.

LendingTree

LendingTree is the biggest mortgage industry name for professionals and consumers.

Their website promises to connect potential borrowers and home refinancers with multiple loan operators to apply for mortgages, credit cards, deposit accounts, and more.

Because LendingTree has been around for 20+ years, they’ve earned a lot of trust and a top spot on Google’s search engine results page (SERP). This equates to more highly qualified leads.

Success strategies and tactics for LendingTree leads

However, LendingTree makes its money by selling its generated leads to at least 3-4 different mortgage companies, which makes their leads highly competitive to sell.

Sales automation (auto-dialers, SMS, email) and marketing automation (lead nurturing and email campaigns) are your keys to consistently converting and winning against your competitors.

Cost: $$$

Zillow

Zillow is the leading website for real estate and home buying. At this point, everybody has become familiar with Zillow and has likely visited their site to check home prices in their area at one point.

Most homebuyers don’t come to Zillow to get rate quotes — they look at houses and see an option to receive a rate quote.

This means that Zillow leads show a lower intent because most people are “just looking” or trying to assess their home’s value for a cash-out refinance.

However, Zillow’s leads are exclusive and are given to you based on Zillow’s recommendation of the areas you serve.

Success strategies and tactics for Zillow leads

Once a lead is generated, Zillow controls the sales process and holds onto it for three days. You’ll get the lead after three days only if Zillow’s sales team transfers a call live, sets up an appointment for you, or the lead is unresponsive.

If you’re going to work with Zillow mortgage leads, you will need to be available at indeterminate times throughout the day to accept their live transfer phone calls. You’ll also need to carefully watch your appointments in Zillow to stay on top of automatic appointments set by Zillow.

Poor performance in handling leads will hurt your standing in Zillow, which will result in receiving fewer mortgage leads.

To win this complex channel, invest in sales automation (auto-dialers, SMS, email) and marketing automation.

Cost: $$$

Loanbright, Consumer Track, Bills.com, iLeads

Sites like Loanbright, Consumer Track, Bills.com, and iLeads are traditional, mid-tier lead providers and media companies. They generate mortgage leads using several digital marketing strategies and tactics, such as:

- Content marketing and micro-websites that use PPC and SEO campaigns to get serious traffic

- Social media advertising and special offers

- Lead list email marketing

Because these companies’ leads will be generated from many different sources (Facebook, blogs, websites, etc.), they will be inconsistent.

For example, you may hear from one lead they filled out a form on Facebook, while another used a website’s mortgage calculator, or another responded to an email newsletter.

However, the benefits of using such providers include:

- The leads are very affordable and can be purchased in high volumes to fill a loan officer’s sales pipeline immediately

- Fewer sales competition on each lead

- Many of these lead providers have liberal return policies because they know the leads may be inconsistent in quality

Success strategies and tactics

These sites are a great resource for high-quantity, affordable leads.

However, the consistency of the leads will be all over the place, meaning some leads will show high intent while others are just curious about mortgages.

As always, using a strong combination of an automated sales process and lead nurturing progress to maximize success.

Cost: $$

Really Great Rate Marketing

Unlike the other lead aggregators on this list, Really Great Rate Marketing uses email marketing as their core lead generation strategy — and they’ve been doing it a really long time.

In addition to email, they also depend on content marketing (blogs) to generate traffic to their website to generate more leads.

Success strategies and tactics for Real Great Rate Marketing leads

Because most of their leads are generated through emails rather than just a website form, they show different levels of intent. Usually, the leads respond to a specific incentive or co-registration type offer.

There are positives and negatives to this potential quality of an email channel. Positively, you get a highly engaged and responsive sales lead. However, many of these leads are “tire-kickers” who aren’t serious about getting a loan yet.

Cost: $$

Doublepositive

Doublepositive is a live-transfer lead provider, making it different from many other lead aggregates.

First of all, Doublepositive’s leads are generated by a diverse set of lead partners using a variety of marketing tactics, so the quality will be a bit more inconsistent.

What sets Doublepositive apart is their leads are first called by their team and warmed up for a conversation about mortgages. The qualified leads are transferred to loan officers and mortgage lenders via a live call connect as a “warm transfer.”

What’s great about this process is leads have already been qualified for you, weeding out the leads who have not shown a high intent or requirements to get a mortgage.

This process is similar to LendingTree’s live call transfer, so you must be ready to take the calls when they come in.

Cost: $$$

Bankrate

Back in the day, before rate tables were online, Bankrate sold their rate tables to traditional newspapers.

These days, Bankrate is the most popular mortgage rate table website, and they sell leads generated by their website.

Leads generated from these sites show high intent because they’re specifically looking for mortgage rates.

Cost: $$$

Leasing email lists using TrueMail

Like Really Great Rate Marketing, TrueMail uses email marketing as its top lead-generation method.

However, services like TrueMail let you “lease” their established lists of targeted customers to gain access to thousands of consumer inboxes.

These leads are of moderate quality, but you can use the list to generate numerous inquiries and grow your own in-house list.

Cost: $

How to generate mortgage leads yourself—creating a custom lead sales funnel

Okay, we’ve covered the basics of buying leads. Now, let’s talk about generating your own leads, which, if you haven’t already guessed, is probably the safest route moving forward because of the FCC’s recent potential crackdown on third-party lead generators.

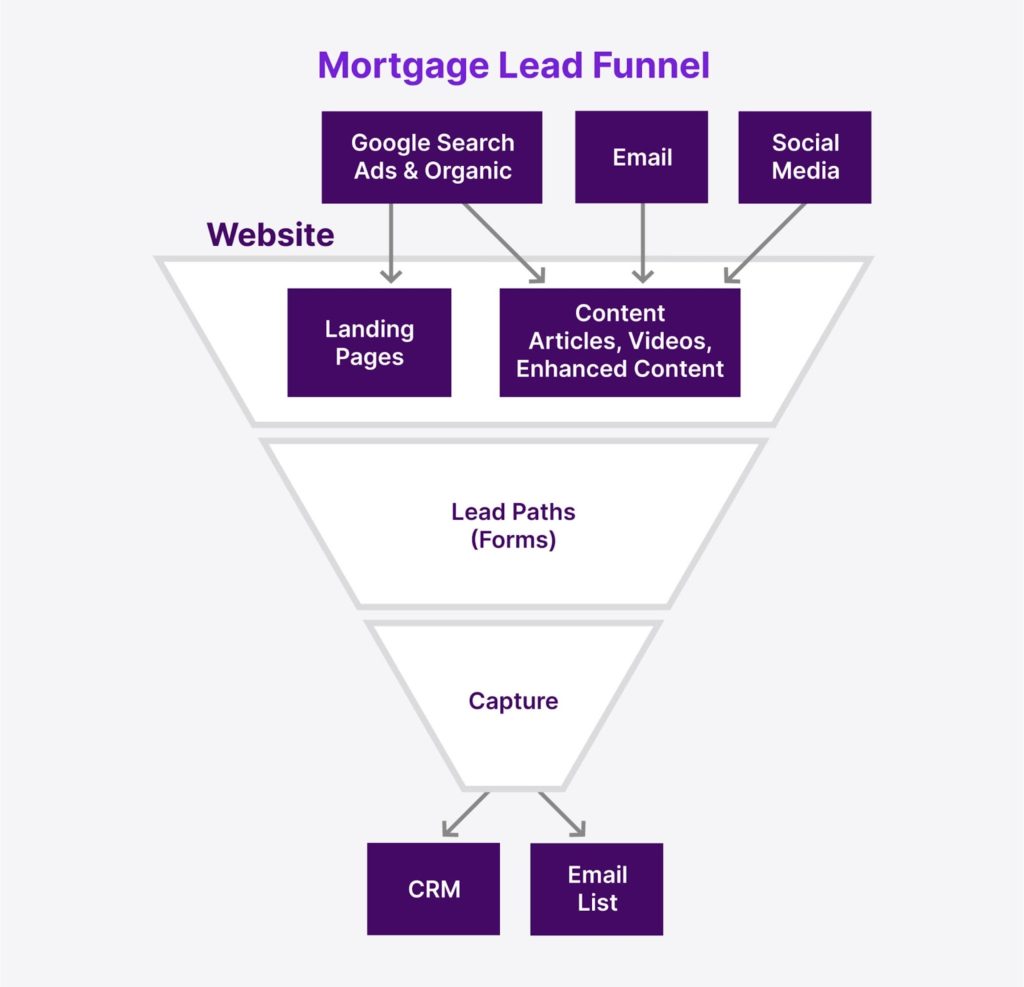

A mortgage lead funnel is an overall marketing strategy that:

- Represents all the steps of the entire customer’s journey (from the initial outreach to getting a closed loan)

- Targets a wide audience of people interested in mortgage loans

- Gradually narrows down and weeds out unqualified borrowers

- Stays in contact (lead nurturing) with the leads until they’re ready to close

- Remains in contact with leads to get referrals for new business

At the top of the funnel, at its widest point, marketers want to cast a wide net to find people searching online for mortgages. To do this, a mortgage website must be created, and then landing pages and blog posts must be published.

When people search online for mortgage calculators, how-to articles, and general advice, they’ll stumble upon a mortgage website’s content in a Google search (or click on an ad).

From there, the reader will be redirected to the mortgage website, where they will read a helpful blog post or landing page that answers their questions.

Satisfied with their answer, the reader will then “convert” into becoming a lead by filling out a contact form.

Lastly, the lead’s information gets automatically sent to a CRM and email list for the sales team to contact as soon as possible.

From here, the sales and lead nurturing processes continue, making sure to regularly reach out to the contact through phone, text, or email until they are ready to get a loan.

Optimizing your website for mortgage lead generation is key if you’re going to generate your own mortgage leads.

2023 update: Googles SEO ranking favors branded websites as the top search results

To get your mortgage website to the top of Google’s search engine results page, your website needs to be branded. But what exactly is a branded website over an unbanded website?

What Google considers “branded” websites

Earlier, I mentioned that you need to differentiate your mortgage website and brand from your competitors to win more traffic and convert more leads. I’ll be more specific.

To improve your mortgage website’s SEO for Google:

- Have a web presence across multiple domains and platforms (such as social media)

- Featuring your company name in the domain name

- Have a website that’s been established for a while (the longer, the better)

- Use the same logos and trademarks consistently across the web and your website

- Building a large number of high-quality backlinks (websites that link to your website)

- Consistently publish high-quality blog posts (which add important keywords to your website to improve searchability in Google searches)

What Google considers to be “unbranded” websites

As you saw above, Google likes to send its users to well-established websites because it would lose business if it directed people to bad “unbranded” websites.

The following is what Google considers an unbranded website:

- No established or strong brand presence online

- Unrecognized domain name

- Inconsistent branding elements (missing logos, inconsistent naming, etc.)

- A lack of back-links

- Newly established websites (sites that are generally less than a year old)

If your website falls under any of those categories, Google will likely bury it in the results.

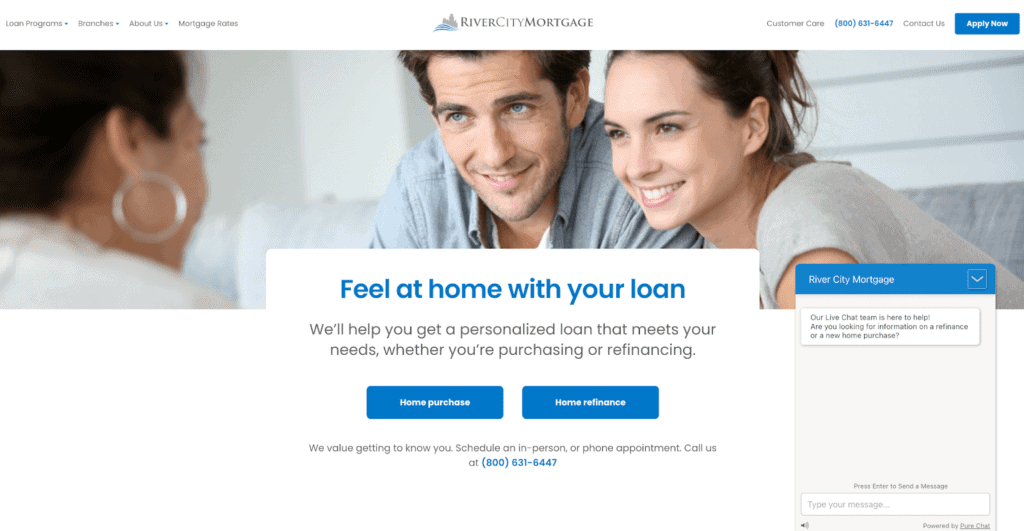

Generate leads with a well-designed mortgage website

Don’t think that a fancy website with fun animations and videos will generate leads.

Instead, keep your website as simple as possible to maximize conversions. You don’t want to distract readers from filling out a contact form.

Look at the essential pages and features you should have on your mortgage website.

Homepage — clear positioning statement

At the top of your website should be a strong positioning statement, such as “Helping homebuyers for 20 years. ”

It may be obvious to you, but if a reader clicks on a website and has no idea what the business is or does, they’ll bounce immediately. Leave no ambiguity to your readers.

Homepage — clickable buttons or “lead paths” to quickly capture leads

Below your mission statement, include lead “paths” or clickable buttons for users who want to buy or refinance a home.

These clickable buttons are sneaky contact forms. Once a reader clicks on a button, a pop-up questionnaire will appear. These questionnaires are called “progressive forms,” and they’re smarter than your average contact form.

One of the biggest reasons people don’t fill out contact forms is annoying, redundant questions. However, progressive forms are smart, only asking relevant questions and remembering not to ask the same repeated questions.

In short, progressive forms work better than generic contact forms. And if you want people to fill them out, disguise them as simple, clickable buttons instead of ugly, generic forms on the side of the page.

Loan officer bio pages

Want to become more trustworthy than a lead aggregator? Show your face on your website.

Create landing pages for yourself and each of your loan officers. Include a headshot, a brief bio, and an NMLS number.

When people search their names (or yours) on Google, their bio page should be one of the top results and lead them to your website.

Loan product pages

Create landing pages for each of your loan products, as well. For example, include pages for:

- VA loans

- FHA loans

- Conventional loans

- Cash-out refinance

You likely offer more loan products than this, so include all of them.

When your audience Googles “VA loans,” the goal is for your website to be listed in the top results because Google recognizes that your website has a whole page dedicated to VA loans.

This is part of search engine optimization (SEO), where a website uses specific keywords that match what the audience is searching for online.

The more your reader’s query aligns with your website’s content, the more relevant your website will be and the higher it will sit in the search results.

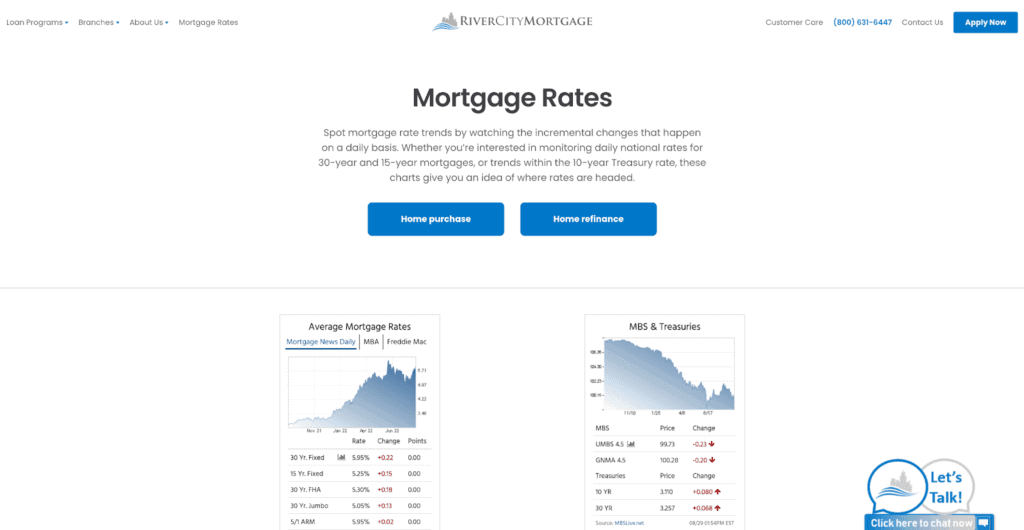

Mortgage rates page

Mortgage rates are one of the highest volume search terms, often used by those in the market for a mortgage who are trying to find the best rate. Featuring a mortgage rates page on your website will capitalize on this traffic.

Mortgage calculator

The same goes for mortgage calculators. People search for calculators online and just want a simple tool to plug some numbers into.

Put a mortgage calculator on your website because if you don’t, your prospective buyer will go to a competitor’s website with one.

Calls to action (CTAs)

Visitors who land on your website won’t automatically submit their contact info, even if they trust your website and the free information you’ve provided.

Why? Because you didn’t ask for them to contact you. Sounds simple, but these prompts, or calls to action, work.

If your goal is to get people to fill out your form, give them ample opportunities to do so and with clear intentions. Place CTAs throughout your website to “Call today” or “Get a free quote!”

Add CTAs throughout your blog posts, as well, so your readers have a convenient way to contact you while reading your content.

Use traffic providers to send qualified users to your website

Now that you know how to optimize your website to capture leads, let’s get you some visitors. Getting web traffic is the first and most crucial step in the mortgage lead funnel.

Web traffic is the flow of customers who are attracted to or distracted by ads, websites, and blog posts that direct them to your website, where they will submit a contact form to get more information.

When using paid platforms, such as Google Ads or Microsoft (Bing) Ads, this traffic is sold on a cost-per-click (CPC) basis.

When this traffic is generated passively and freely from your website’s web pages and blogs, it’s called “organic” search traffic.

Google Ads is the most widely used paid ad platform online, allowing you to reach about 90% of all online users!

Ads are purchased by picking the desired keyword, such as “mortgage rates,” and showing your ad every time a person searches for that keyword.

As you can imagine, mortgage-related keywords can be expensive, as all mortgage companies compete for the same keywords.

Whichever company bids the most on the desired keywords will display their ads in Google’s SERP.

You will be charged the amount you bid on the word when an ad is clicked on. You don’t get charged if your ad is shown but not clicked.

Microsoft (Bing) Ads

Microsoft Ads are similar to Google’s, except they’re cheaper, as there are fewer Bing users and, as a result, less competition.

But don’t count out Bing Ads. You may be able to reach people who don’t use Google.

Facebook and Instagram Ads

Facebook’s Ad Manager lets you create ads on Facebook, Instagram, and WhatsApp, either as sponsored posts or stories or as display ads.

Unlike Google and Bing Ads, which are “active advertising” because they only show ads to people searching for specific keywords, Facebook is “passive advertising.”

Instead of bidding on keywords, you enter your demographics and interests to target people who fit your target audience.

In this sense, leads from Facebook Ads may show lower intent.

However, Facebook has a specific type of ad called a “Lead ad, “which allows a person to fill out a lead ad’s contact form with just one click of a button. Facebook then auto-populates that form using their Facebook personal information.

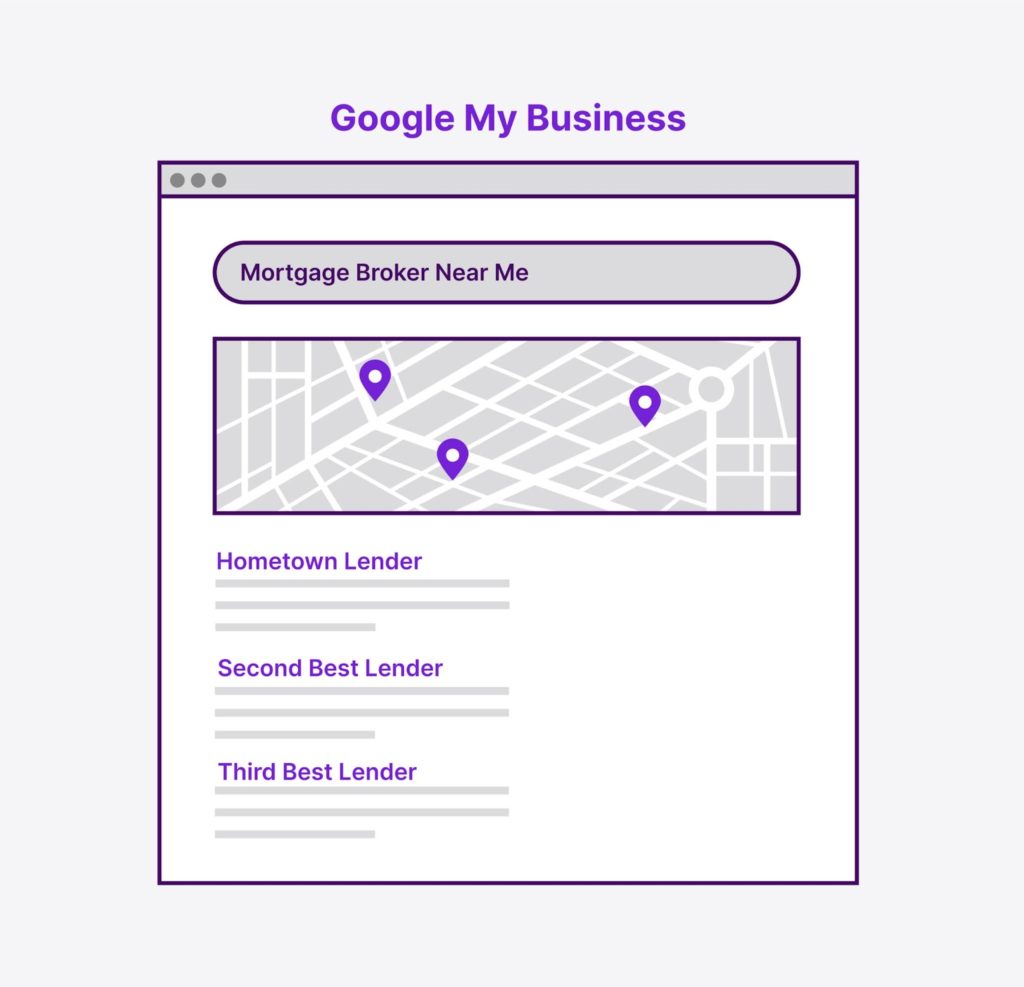

Local directories and SEO

If you want your company to have a local presence and target your local population, set up profiles on local directories such as:

- Google Business

- Yelp

- Yellowpages

- Angi (Angi’s List)

Online reviews

You’ll need many positive reviews to appear at the top of the results for local directories.

To get positive reviews, start by creating a list of all your previous happy customers and asking them for a review.

You don’t need to ask for a positive review because you’ve contacted only happy customers.

Google Business

You must create a Google Business account if your company’s office isn’t already on Google Maps.

This allows you to create a Google profile for your company, update your address, phone number, and photos, and add social media profiles to your Google listing.

Remarketing ads

Platforms like Google Ads, LinkedIn Ads, and Facebook Ads all have “remarketing ads” which use tracking snippets of code to show your advertisements only to people who have previously visited your website.

Remarketing ads are the best way to reconnect with people who visited your website but left before filling out a contact form.

In short, they work but are pretty sneaky!

Use SEO to dominate search traffic and rankings

SEO is a lead-generation tactic that uses Google searches to direct traffic to your website.

The highest-ranking websites in Google search results get the most traffic and generate the most leads.

SEO aims to improve a website’s ranking on Google. That’s done mostly through keyword matching.

SEO is the practice of determining which keywords get the most search traffic and using those terms on your mortgage website.

This tactic takes a lot of marketing skills, as well as content creation.

Not only do you need to learn which keywords are being searched for, but you also need to create tons of content using those words to capitalize on that search traffic.

Investing in SEO is a long-term investment. It will take time for your website to rank higher in Google searches. But once it does, you’ll generate nearly free leads over the long term.

Get Our Free 90-Day Mortgage Marketing Plan

Content marketing: write blogs to capture Google search traffic

Along with SEO comes content marketing.

As I mentioned, SEO is done by matching keywords in a Google search with text on billions of websites. The more matches there are, the higher your website will be in search results.

Blogging is the best way to add these important keywords to your website.

Trying to capture traffic for FHA loans? Then, write a ton of blogs about FHA loans, such as:

- How to Quality for an FHA Loan

- Complete Guide to FHA Loans

- 10 Tips to Getting Approved for an FHA Loan

Do this for every one of your loan products to increase your odds of success of getting discovered in a Google search.

One last tip: Write a blog post that’s at least 1,000 words and include CTAs to encourage readers to message you after they’ve finished reading your article.

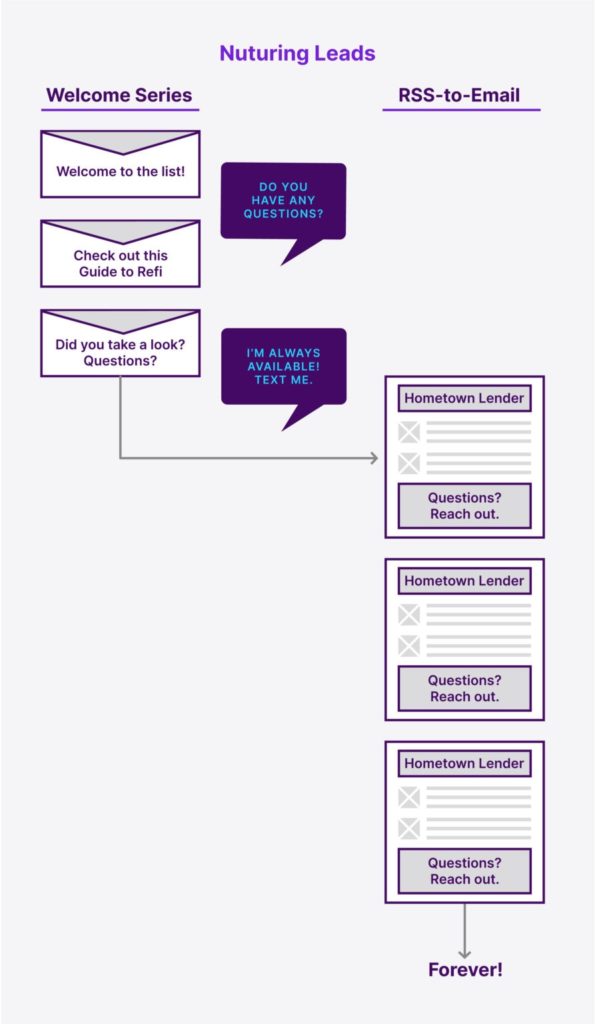

Lead nurturing — sales automation and marketing automation for 2023

Some leads generated from your channel will be quickly intimidated, overwhelmed, or unprepared for a mortgage. This is where our sales operations guide to working mortgage leads helps you stay in contact with your leads until they’re ready.

Lead nurturing is a combination of sales and content marketing. It involves finding valuable or “non-annoying” ways to stay in touch with your leads while they’re “out of the market” until they are finally ready to consider a mortgage.

Most lead nurturing campaigns send readers educational emails, such as helpful blog posts, to educate them about the various aspects of mortgages.

This is where copywriting and content creation will be useful. Send your highest-performing blog posts to your email list.

The article might get opened, or it might not, but eventually, you’ll send an email that speaks to your reader’s needs, and they’ll open it and start the process all over again.

2023 update — phone calls are out and text messages are in!

Ok, are phone calls out? No, but remember that people like me (millennials) hate talking on the phone. I almost take it as a personal affront to receive a phone call without a text message first.

Consumers (your mortgage leads) like to control their conversation and their time. They don’t want to be interrupted or cornered on a surprise call.

This isn’t just anecdotal evidence; 64% of potential buyers prefer texting over phone calls, and SMS messages have an open rate of 98%! Take that email!

Personally speaking, text messages also have more social pressure to respond to them over phone calls or emails. It’s easy to ignore an email but harder to ignore a text.

Obviously, choose your preferred method, and if possible, keep your lead’s age in mind (if you have that information) to weigh whether or not to send a text or a phone call once those leads come in.

Use a calendar scheduling app on your mortgage website

Typically, you get web visitors to fill out their contact information (and become a lead) so you can schedule an appointment with them to discuss their mortgage.

Instead, why not just let your web visitors schedule their own appointments on your website?

Adding an online booking system for your business can help convert more visitors into leads, especially if they visit your website after their usual business hours, when 35% of customers schedule their appointments.

In addition to contact forms and lead paths, you should also embed a calendar scheduling app, such as Calendly, Booksy, Schedule.cc, Setmore, or Square Appointments to let your visitors view and select an open appointment slot according to your schedule.

Sales automation

Don’t let new leads slip through the cracks. Set up mortgage sales automation so your lead receives a message instantly after completing a contact form.

Here are some tried and true methods for initial outreach:

- Automated SMS messages, such as “I just received your request. When is a good time to talk?”

- Automated welcome email message. Include your office phone, mobile phone, FAX, and website.

- Automated voicemail. Most people won’t pick up the first call, so leave an automated voicemail so they can get back to you.

- Use an Autodialer to dial numbers quicker with more accuracy.

Drip email campaigns

Drip email campaigns are automated emails, from the initial welcome email message to several follow-up messages.

Each step should match your lead’s sales status and correspond with the sales process.

Drip email campaigns will continue re-engaging and re-feeding these leads into your warm sales queue.

Marketing automation

Email marketing and CRM platforms help you track each customer’s lifecycle. They notify you of the best times to message the lead, which emails get opened, and the ability to trigger a variety of communication types, such as email, SMS, voicemail, or phone calls.

TLDR (too long; didn’t read) summary

This article is a long one, so I’ll do my best to summarize the most important aspects:

- Beware of relying on third-party aggregators, as the FCC might outright ban those sales to reduce the robocalling problem.

- Start investing in your own lead generation program yesterday.

- Build your own website for exclusive (and compliant) lead generation that keeps the FCC happy.

- Establish a strong brand for your website (using consistent logos, creating social media sites, and publishing blogs regularly), so Google will show it closer to the top of the search results page.

- Use free social media pages to drive traffic to your website.

- Use paid ads (Google Ads, Facebook Ads, Microsoft Ads) to direct traffic to your website.

- Invest in content marketing (writing blogs about mortgages) to capture free traffic in Google searches.

- Invest in sales and marketing automation tools (like CRMs, drip campaigns, email marketing platforms) to contact every new lead coming in automatically.

- Try to use more texts for sales outreach in 2023 (millennials hate phone calls).

- Use calendar booking apps like Calendly to let web visitors schedule their own appointments.

- Consider hiring Kaleidico to handle lead generation for your company in an ethical and compliant way that makes the FCC happy. 🙂

Hire Kaleidico-a mortgage lead generation company

At Kaleidico, many digital marketing tactics are built into one overall lead generation plan for your mortgage business.

We’ve been in the mortgage business for over twenty years, and have crafted a proven framework. We combine web design/development, content marketing, SEO, PPC ads, email marketing, and other digital marketing strategies to produce consistent and sustainable leads.

Looking to close more loans? Reach out today and we’ll find the best solution to your mortgage leads problem.

Schedule a Discovery call with the Kaleidico Lead Generation Team

Photo by fauxels