Content marketing has proven to be one of the most effective mortgage marketing tools, but success in today’s market requires more than blogs and basic SEO.

Today’s borrowers expect personalized, dynamic content that speaks directly to their needs, concerns, and financial situations.

And as the lead-buying landscape continues to shift, generating your own leads is more important than ever—which is where content can truly set up and shine.

In this article, we’ll take a look at the top tools and trends for content marketing for mortgage lenders in the remainder of 2024 and beyond.

The importance of first-party data and building your own lead base

In late 2023, the FCC adopted rules to close the “lead generation loophole” in the Telephone Consumer Protection Act (TCPA).

This rule, which will go into effect in January 2025, requires “one-to-one consent” from a consumer to receive robocalls and robotexts from a seller.

How the rules will impact mortgage companies

The decision will impact those who purchase leads, including mortgage leads, and highlights the importance of building your own lead generation strategy so you have one-to-one consent—and a full pipeline of high-quality leads to rely on at all times.

The following content strategies will help you effectively generate, convert, and nurture your own mortgage leads.

Content that converts: Meeting borrowers where they are

Creating content without a clear vision of the customer’s goals and mindset will only lead to a dead-end.

The key to content that converts is understanding where the borrower is in their journey—and what they are experiencing in the current market.

The result is personalized content that reaches the right borrowers at the right time.

Read more: The Homebuyer’s Journey: Tailoring Mortgage Marketing at Every Stage

SEO-optimized blog posts with the latest trends

News about search engine optimization (SEO) was all over the map in 2024.

From articles claiming SEO is dead to those insisting it’s still a worthwhile endeavor, many marketers are confused about where to focus their efforts.

As always, the truth is somewhere in the middle. You need to know two major things about SEO in the coming year to remain competitive.

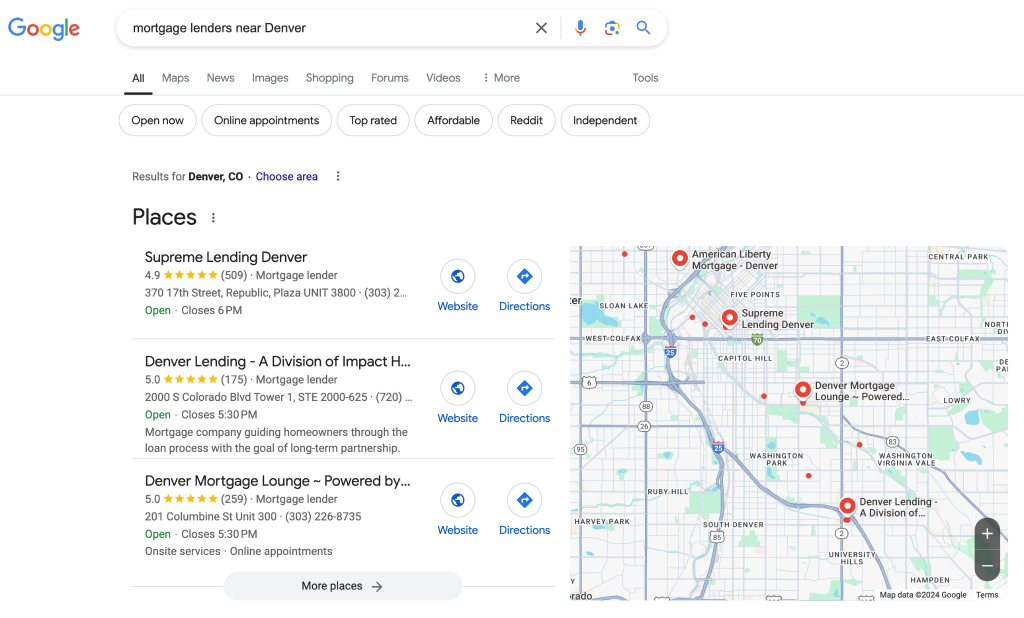

1. The power of local SEO

Borrowers often search for mortgage options and lenders within their own geographic areas, so targeting local markets with your content will help you capture more qualified leads.

Incorporate region-specific data in your content, use geo-specific keywords, and keep your Google Business Profile completed and updated.

2. Conversational content

As more people rely on voice and AI assistants for quick answers to their questions, this trend reshapes how users interact with search engines.

To capture this audience, consider incorporating more conversational and long-tail keywords that reflect how people speak or search.

Additionally, aim to keep answers to these questions quick and concise.

Leveraging interactive content to capture leads

Interactive content requires user engagement and provides personalized results.

Top interactive tools for mortgage lenders include:

- Mortgage calculators: Provide up-to-date information to borrowers that reflects the current market and can give them an estimate of monthly payments or interest savings, depending on the loan type.

- Quizzes: Provide personalized recommendations to borrowers based on their answers to a few simple questions, such as whether they should refinance or lock in a rate.

- Dynamic forms: Adapt based on a user’s responses, leading to higher conversion rates and more effective lead nurturing

Video content: The key to engagement

As mortgage rates and products fluctuate, borrowers seek clear and concise explanations to help them navigate the market.

Video content can be used in a multitude of ways, including:

- Explainer videos: Help break down complex financial concepts into clear, understandable content that borrowers can easily grasp, such as the impact of Federal Reserve rate cuts, simplifying industry jargon, etc.

- Short-form updates: Ideal for breaking down market trends, mortgage tips, rate changes, and more in a timely, easily digestible format (think TikTok, Instagram Reels, and YouTube Shorts).

- Customer success stories: Allow potential clients to see the tangible benefits of working with your mortgage company through real stories that can be shared across your digital channels.

AI and automation in content marketing

AI-powered tools can quickly analyze large amounts of data and automate repetitive tasks, helping mortgage professionals create more relevant, targeted content that addresses the audience’s most urgent needs and challenges.

The most popular ways to leverage AI content in the mortgage industry include:

- Content tools: Can brainstorm topics, draft blog and social media content, and analyze customer data, trends, and behavior to personalize content (example tool: Jasper).

- Chatbots: Provide instant responses, guide users through their mortgage journey, and can be available 24 hours a day (example tool: Drift).

- Automated email sequences: Make sure your messages meet the right borrowers at the right time through personalized, timely emails that are segmented and loaded up for long-term nurturing (example tool: ActiveCampaign).

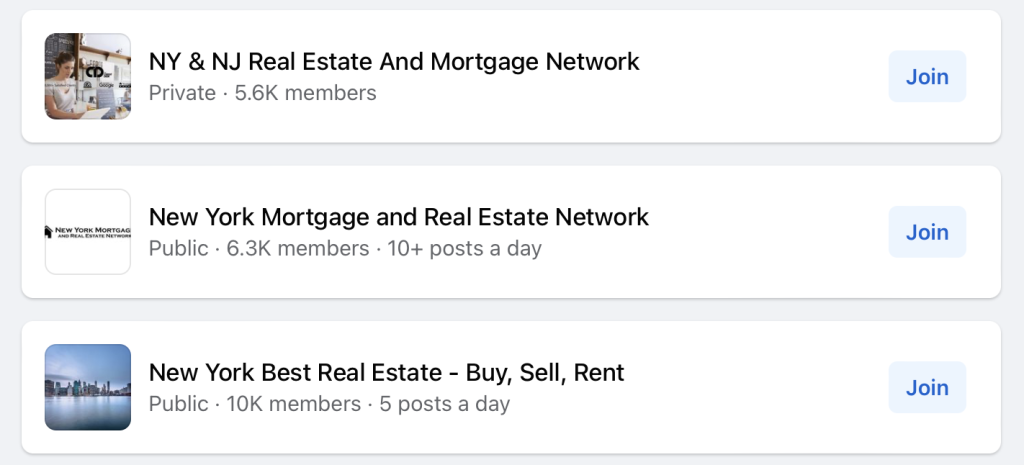

Social media campaigns: Building community and trust

Social media helps create communities, share important market updates, and engage with your audience.

Best strategies for connection on social media include:

- Creating dedicated mortgage-focused groups where borrowers can ask questions and share their experiences

- Providing the latest information on refinancing options, rate changes, and housing market trends

- Creating polls or quizzes that you can use for engagement and data-building purposes

- Hosting live stream sessions to discuss relevant insights or Q&As

There’s no general right or wrong platform—the trick is to understand where your specific audience prefers to hang out, engage, and meet them where they are.

Measuring success: Data-driven content strategies

You won’t know if content marketing for mortgage lenders is working unless you’re keeping an eye on the data, including:

- Engagement metrics: Track your blog performance, video views, social media reach, and engagement rates.

- A/B testing: Test different versions of headlines, email subject lines, and calls-to-action (CTAs) to see which your audience prefers.

- Optimizing for conversions: Use real-time performance data to tweak your CTAs, landing pages, and email sequences.

This data can help you understand what your audience is most drawn to, allowing you to create more of what they want.

Content marketing for mortgage lenders FAQs

Mortgage marketing involves strategies and tactics that mortgage lenders use to attract, engage, and convert potential borrowers.

It includes creating content, advertising, leveraging digital platforms like social media, and using tools like email campaigns to promote mortgage products and build relationships with customers.

Mortgage customers want timely information on mortgage rates, loan options, and the application process.

They value personalized guidance, competitive rates, and a seamless experience that makes navigating the mortgage or refinancing process easier, with transparent communication at every step.

Mortgage lenders use social media to share real-time updates on mortgage rates, provide educational content, build trust through customer testimonials, and engage with potential borrowers.

Platforms like LinkedIn, Facebook, and Reddit are also used to create communities, answer questions, and share market trends more personally and interactively.

Stay ahead in competitive markets with Kaleidico

Borrowers in today’s market are looking for more from mortgage lenders.

Fortunately, you don’t have to figure out what works alone.

Kaleidico can help you construct a smooth and compelling path to your loan products that works as a powerful lead generation system.