Digital-first mortgage marketing strategies have given us the tools and data to reach our audiences at every stage of their journey.

However, marketing for mortgages in 2024 and beyond will be rich and complex, involving a dynamic mix of digital, traditional, and cutting-edge strategies.

It’s an exciting time to be in the mortgage industry!

Whether you’ve been a lender or loan officer for years or are just starting your career, our 50 innovative mortgage marketing strategies can help you brainstorm, transform, or refine your lead generation plan.

Take what you can use, and leave the rest!

AI transforms mortgage marketing

We couldn’t begin an article on “innovative” strategies without including AI front and center.

AI can help mortgage lenders, loan officers, and brokers understand their customers better and create more personalized strategies designed to engage and convert.

1. AI-powered chatbots to nurture leads

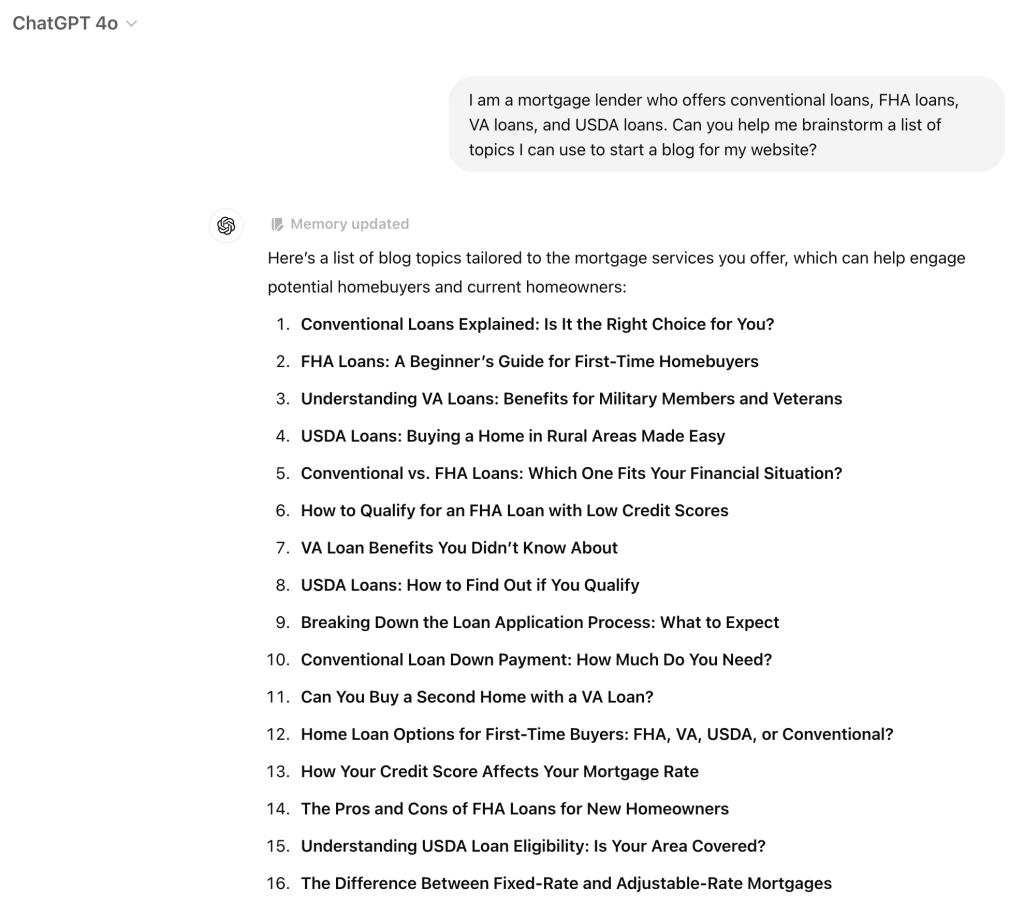

2. AI-driven content creation

Use AI tools to generate blog posts, social media updates, and even email templates based on specific topics or audience segments. Save time and resources while making sure that content remains relevant and engaging.

3. AI-enhanced SEO

AI-driven search engine optimization (SEO) tools take keyword analysis to the next level by evaluating competitor strategies, identifying search trends, and optimizing content automatically.

4. Predictive analytics

AI is also being used to analyze large datasets and predict customer behavior.

Predictive analytics can identify the types of clients most likely to apply for a loan, allowing you to focus on the leads with the highest potential.

5. AI for personalized campaigns

AI tools can analyze customer data to tailor email campaigns, ad targeting, and messaging for each lead, such as sending personalized mortgage rate offers based on a borrower’s financial situation.

SEO and content marketing strategies

Your valuable, informative content needs SEO to drive traffic to your website and generate leads.

Keep these strategies in mind in the coming year.

6. Long-form blog content

Long-form content tends to rank higher on search engines and keeps visitors on your website longer, increasing engagement and conversion opportunities.

Create in-depth guides and articles to address customer pain points and establish your brand as a trusted resource. Include relevant keywords throughout.

7. Local SEO

Include location-based keywords—such as “mortgage lender in [City]” or “best mortgage rates in [State]”—to help your content rank highly in local searches.

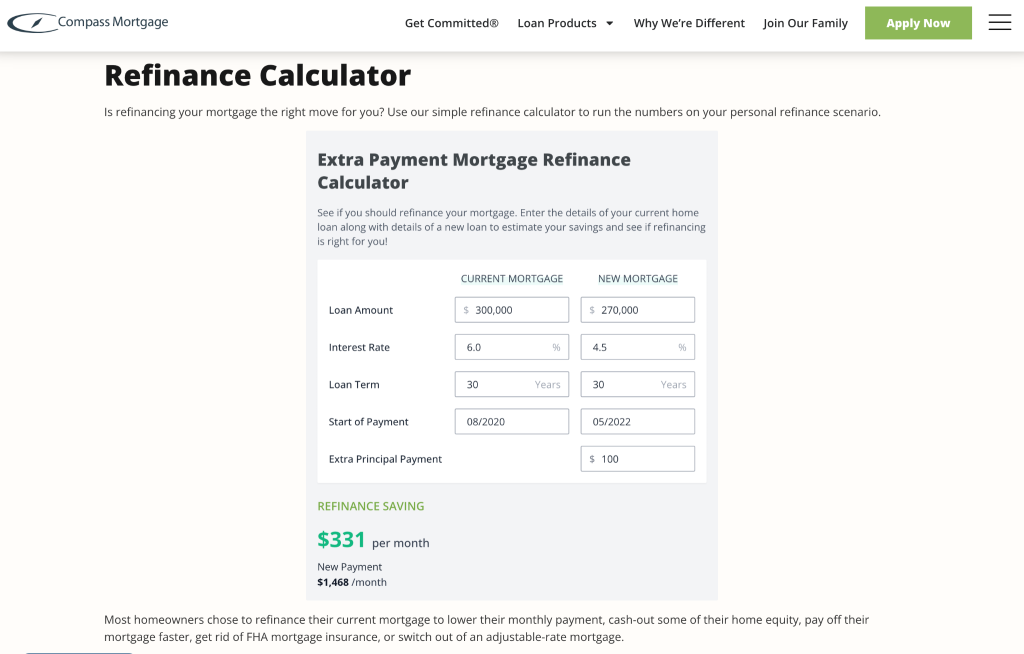

8. Interactive tools

Mortgage calculators and quizzes add significant value to your website (and collect data) by allowing users to input their financial information and receive personalized insights, such as how much they can afford or what their monthly payments might be.

9. Evergreen or “timeless” content

Evergreen content is designed to remain relevant over time, continually driving traffic to your site without frequent updates.

Topics might include “How to Apply for a Mortgage” or “Steps to Buy Your First Home.”

10. Optimized video content

Create valuable video content, such as explainer videos or how-tos, and optimize for search by including relevant keywords in the title, description, and tags.

Video transcriptions also can be indexed by search engines, further boosting SEO.

Social media and digital advertising

Social media and digital advertising help you to reach prospective homebuyers where they spend the most time—online.

11. Geo-targeted Facebook ads

Geo-targeted ads allow you to display relevant mortgage offers, rate promotions, or homebuying webinars to users in your city or state.

12. TikTok marketing for younger audiences

TikTok’s popularity among Gen Z and Millennials makes it a great platform for engaging younger homebuyers with short, relatable videos that break down mortgage concepts, share quick tips, or explain the benefits of homeownership.

13. Instagram Stories for real-time engagement

Instagram Stories help maintain a connection with followers and push them closer to conversion. Use polls, Q&As, and interactive content to engage with users directly during their research phase.

14. Retargeting ads

Show tailored ads to people who have previously visited your website but didn’t take action to remind them of your offerings and encourage them to return.

15. Social proof

Share client testimonials, positive reviews, and success stories on social media platforms to establish credibility and showcase your ability to help homebuyers achieve their goals.

Email marketing and lead nurturing

With the help of automation and AI, mortgage companies can create personalized, timely, and impactful email campaigns that guide potential borrowers through the decision-making process.

16. Automated drip campaigns

Keep potential leads warm by sending pre-scheduled emails over time that provide educational content, loan options, and reminders about current mortgage rates.

17. Personalization through email

Use existing data to address specific needs, such as a lead’s homebuying stage, location, or mortgage preferences.

18. Lead scoring

Lead scoring is an automation technique that ranks leads based on their interactions with your content.

Leads who frequently open emails, click links, or visit your website may be more likely to convert and can be prioritized for more direct follow-up.

19. Email newsletters with market updates

To keep your audience informed and engaged, send regular email newsletters that provide timely market updates, such as mortgage rate changes, new loan products, or housing market trends.

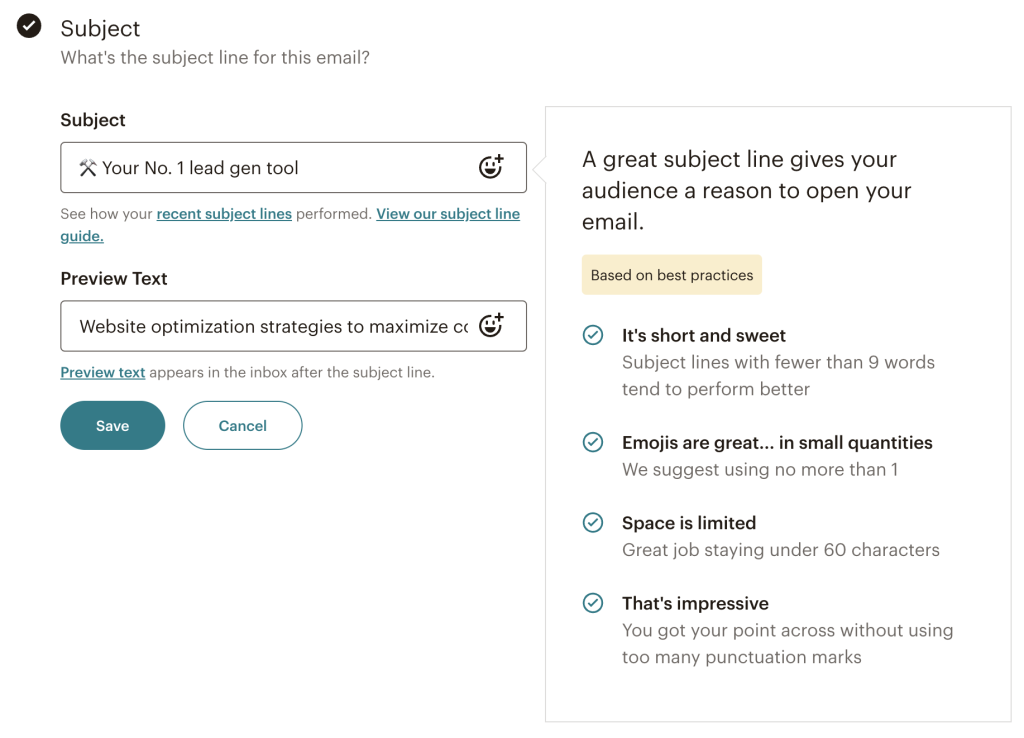

20. AI-powered subject line optimization

AI tools can analyze past campaigns and audience behavior to generate subject lines more likely to grab attention and boost open rates.

Partnerships and referral strategies

Building strong partnerships and referral networks will help you expand your reach and attract high-quality leads.

21. Collaboration with real estate agents

Regular communication, co-hosted events, and shared marketing materials can strengthen these relationships and drive consistent referrals.

22. Joint webinars with industry experts

Partnering with industry experts—such as financial advisors, home appraisers, or real estate attorneys—for joint webinars can provide immense value to prospective borrowers while showcasing your expertise.

23. Partnerships with local businesses

Cross-promotion with local businesses, such as movers, interior designers, or contractors, can help you reach clients at different stages of the homebuying process.

24. Real estate investment groups

Real estate investment groups are a steady source of leads, particularly for mortgage lenders offering services like fix-and-flip loans or rental property financing.

Consider sponsoring events, educational seminars, or special financing options tailored to investors.

25. Referral incentives for existing clients

Offer referral incentives, such as discounts on closing costs, gift cards, or other perks, to encourage your current clients to refer friends and family to your mortgage services.

Innovative ad formats and platforms

Tap into the right digital advertising channels and use advanced targeting techniques to reach potential borrowers with precision (and boost engagement)!

26. Google Ads for competitive markets

Google’s advanced targeting options, such as location-based targeting and audience segmentation, increase the likelihood of your ads reaching the right prospects at the right time.

27. Native advertising on finance blogs

Native advertising blends seamlessly into the surrounding content, making it less intrusive and more engaging for users.

Placing ads on finance blogs or websites that offer homebuying advice can attract highly relevant traffic to your mortgage services.

28. Sponsored content with influencers

Partner with financial influencers who have established trust with their audiences to provide a powerful endorsement for your mortgage products.

29. YouTube pre-roll ads

Use these short video ads before home-buying tutorials, financial advice videos, or other relevant content to present your mortgage offerings to a highly targeted audience.

30. Dynamic retargeting with Google Ads

Show personalized ads to visitors who have previously interacted with your website but haven’t converted.

Get Our 90-Day Mortgage Marketing Plan

Data-driven decision making

Data is key to making informed marketing decisions that drive results in the mortgage industry.

31. A/B testing campaigns

Test different versions of your marketing messages—such as subject lines, ad copy, landing page layouts, or call-to-action (CTA) buttons—to determine which variation performs better regarding click-through rates, conversions, and engagement.

32. CRM data analysis for lead insights

Customer Relationship Management (CRM) systems are treasure troves of valuable data.

Analyze CRM data to understand which marketing channels and strategies generate the highest quality leads.

33. Heat maps for website optimization

Heat mapping tools visually represent how users interact with your website, showing where they click, scroll, and spend the most time.

Use this data to identify areas of the website that may need optimization.

34. Advanced analytics for predicting market trends

Use historical data and current economic indicators to adjust your marketing strategies in response to future changes.

For example, if rates are expected to drop, you can create targeted campaigns to encourage borrowers to refinance or apply for new loans before the market shifts again.

Customer experience and personal branding

A strong personal brand and exceptional customer experience are key differentiators in today’s competitive market.

35. Personal branding for loan officers

To build credibility and attract leads directly, position yourself as an expert in the industry through content creation, social media presence, and community involvement.

36. Customer journey mapping

Mapping out the customer journey will help you tailor your marketing efforts to clients’ specific needs and concerns at each stage.

37. Personalized video messages

Send quick, personalized video updates to create a more engaging and memorable experience for your prospects, such as mortgage rate updates, loan application status, or next steps.

38. Post-purchase follow-ups

The customer relationship doesn’t end at closing. After the mortgage process, check in with clients through follow-up emails, calls, or personalized messages to maintain long-term relationships and generate future referral opportunities.

39. Reputation management

Monitor and respond to online reviews—both positive and negative—to demonstrate that you value customer feedback and are committed to addressing any concerns.

Events and offline, traditional strategies

Events and community involvement can create valuable in-person interactions that digital platforms can’t replicate.

40. First-time homebuyer seminars

In-person or virtual first-time homebuyer seminars educate potential buyers about the mortgage process and establish your brand as a trusted resource.

41. Community involvement and sponsorships

Sponsor a charity run, support local schools, or partner with neighborhood organizations to connect with potential clients more personally.

42. Open houses with mortgage consultations

Partner with real estate agents to provide on-site mortgage consultations during open houses. This will help to increase the likelihood that buyers will choose your services when they’re ready to move forward.

43. Direct mail with QR codes

Combine digital with traditional by including QR codes linking to mortgage calculators, landing pages, or virtual consultations on well-designed mailers.

44. Trade shows and conferences

Attend relevant trade shows and conferences to network with industry professionals, build partnerships, and showcase your mortgage services.

Cutting-edge digital strategies

AI, blockchain, and virtual reality are becoming increasingly essential for enhancing the customer experience and future-proofing your mortgage marketing efforts.

45. Voice search optimization

Homebuyers often search for information using voice commands. Adapt your website’s content for conversational queries and focus on local SEO to help your mortgage services appear in voice search results.

46. Green mortgages

As environmental concerns grow and sustainability becomes a top priority for many homebuyers, green mortgages are emerging as an attractive option for eco-conscious borrowers.

47. Blockchain technology

Blockchain offers more secure and transparent transactions that streamline loan approvals, reduce fraud, and increase trust between borrowers and lenders.

48. Virtual reality tours

Partner with real estate agents to provide a more immersive experience for potential buyers, allowing them to explore properties in detail from the comfort of their homes.

49. AI-powered loan prequalification

AI-powered loan prequalification tools use algorithms to analyze borrower data in real-time and provide instant feedback on loan eligibility.

50. Predictive customer service

Predictive customer service uses AI to anticipate customer needs before they even arise by analyzing past interactions, transaction data, and behavioral patterns.

Mortgage marketing strategies FAQs

Mortgage marketing involves promoting mortgage services to potential borrowers through various strategies, such as digital advertising, SEO, content creation, and partnerships.

The goal is to attract, engage, and convert leads into clients by offering relevant information and solutions that meet their home financing needs.

Mortgage customers want clear, personalized information about loan options, interest rates, and the mortgage process. They value transparency, fast service, and expert guidance, especially when navigating complex financial decisions.

Additionally, many borrowers seek tailored solutions that fit their unique financial situation, whether first-time buyers or refinancing.

To generate mortgage leads, combine digital marketing strategies such as SEO, social media advertising, and email campaigns.

Building partnerships with real estate agents, offering valuable content like mortgage calculators, and leveraging AI tools for personalized lead nurturing can attract potential borrowers and convert them into clients.

Partner with Kaleidico to close more loans in 2025

We have endless innovative mortgage marketing strategies and ideas to share with you.

For the cost of hiring one Marketing Director, Kaleidico offers an experienced turn-key marketing team that provides all of the services and expertise you need to generate exclusive leads.