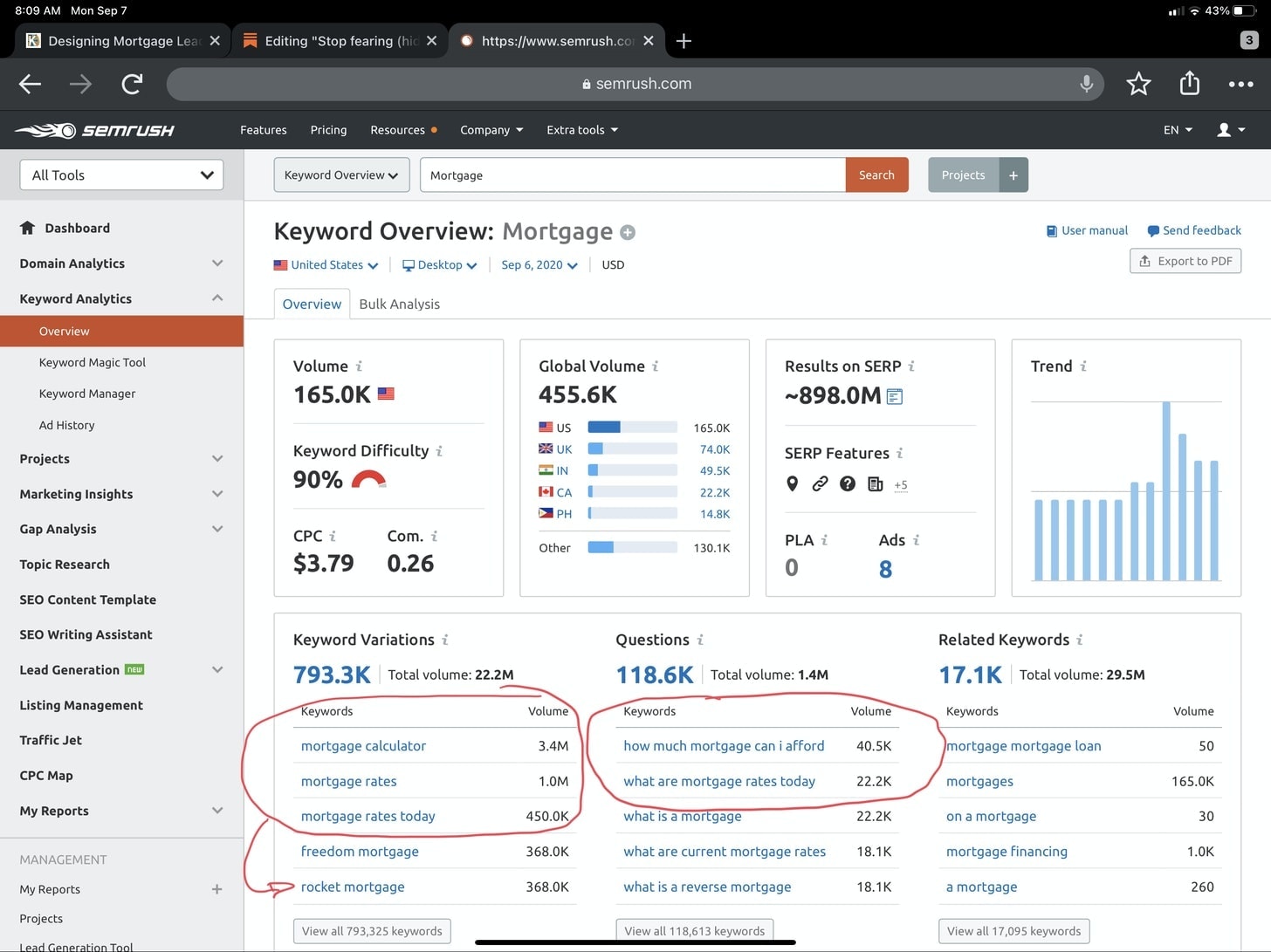

If you’re thinking about buying a home or refinancing a mortgage, what do you want to know?

- Current mortgage rates

- And, what will my monthly payment be

Logically, it follows that the shortest path to a conversation with a high-intent mortgage customer is to show the current mortgage rates and provide them mortgage calculators to run a few what-if scenarios around monthly mortgage payments.

Mortgage Marketing Experts

Kaleidico has been designing websites and marketing programs that generate mortgage leads since 2005. If you’re launching a consumer direct mortgage strategy you should talk to us.

The Case for Mortgage Rates and Calculators on Mortgage Websites

So, why are mortgage lenders avoiding or hiding these features?

Why are lenders afraid to give web visitors an easy way to research rates? Why are lenders denying customers the opportunity to calculate and compare monthly mortgage payments?

Here’s the logic I hear around these decisions, day after day:

- “I might not be able to match the rates they see online”

- “Those rates might be too high and scare them away”

- “Calculators leave out too many factors”

- “Borrowers don’t put in realistic numbers or understand the assumptions”

Each of those arguments is largely fueled by a confirmation bias that is inherent in the mortgage process. Our most prevalent objections are: “I can get a better rate or why is my payment so high?” The fact of the matter is that those objections don’t stem from looking at rate trends or using the mortgage calculators on your website.

Quite the opposite, these objections are often born out of ignorance and a lack of these educational tools, or worse they arise out of advice from no-it-all, Crazy Uncle Larry.

So, that’s my case. Stop avoiding these features. You’re just missing out on the majority of the market opportunity that is created by these common consumer entry points.

Now, let’s talk about the best way to use them on your website and start generating high-quality leads from them.

How to Use Mortgage Rates and Mortgage Calculators to Generate Leads

Let’s start with a baseline of assumptions.

- Don’t set these tools up to feel like applications or give the impression that you are making an offer.

- When presenting mortgage rates, don’t use your own mortgage rate data. Instead, use market surveys.

- Mortgage rates should be presented as trends, ranges, and changes.

- Mortgage calculators should be obviously simplistic and clearly state that they are calculations based on the data the user provides. Just do the math for them.

Mortgage Rates

Make sure to set up your mortgage rates as a factual demonstration of market mortgage rates over time, not your rates.

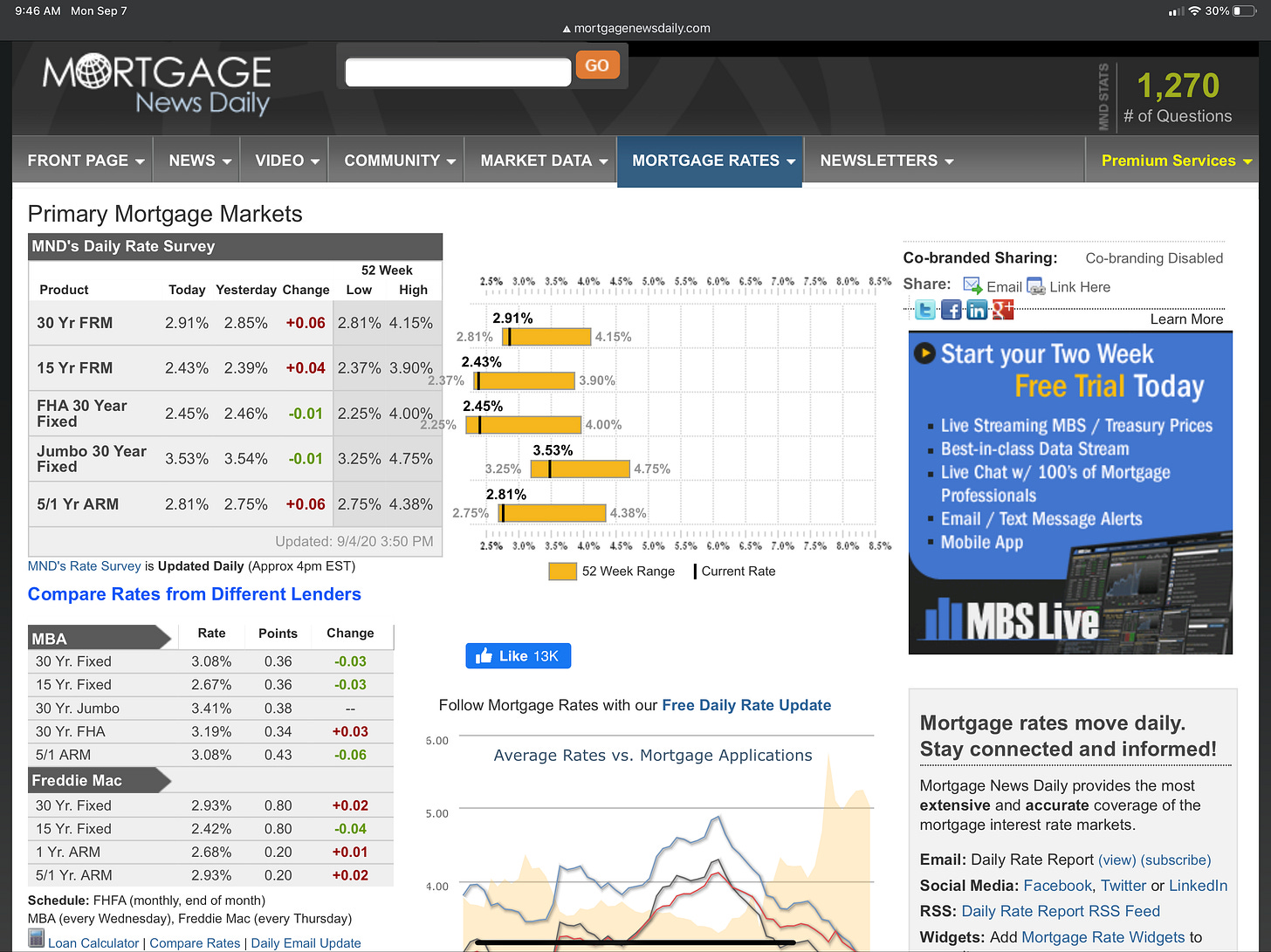

There are all kinds of great ways to do this. Some of the most popular is to show market rate surveys, like Freddie Mac’s Primary Mortgage Market Surveys from Freddie Mac (FNMA), Fannie Mae (FHFA), Mortgage Banker’s Association (MBA), or Mortgage News Daily (MND).

Your goal is to educate your borrowers on how mortgage rates change, that there are periods of volatility, and whether we are currently trending high or low.

By the way, both trends spark urgency in borrowers to apply. And, this is essential to remember, consumers are consuming so many disparate data points that they are looking for someone to sort the truth for them – the loan officer.

The screenshot above is a perfect case in point. There are three different primary mortgage market surveys (the same market) and the range is 9 basis point and then you throw in the concept of “points.” What a great opportunity for an expert conversation! One your borrow will appreciate, value, and thank you for.

Mortgage Calculators

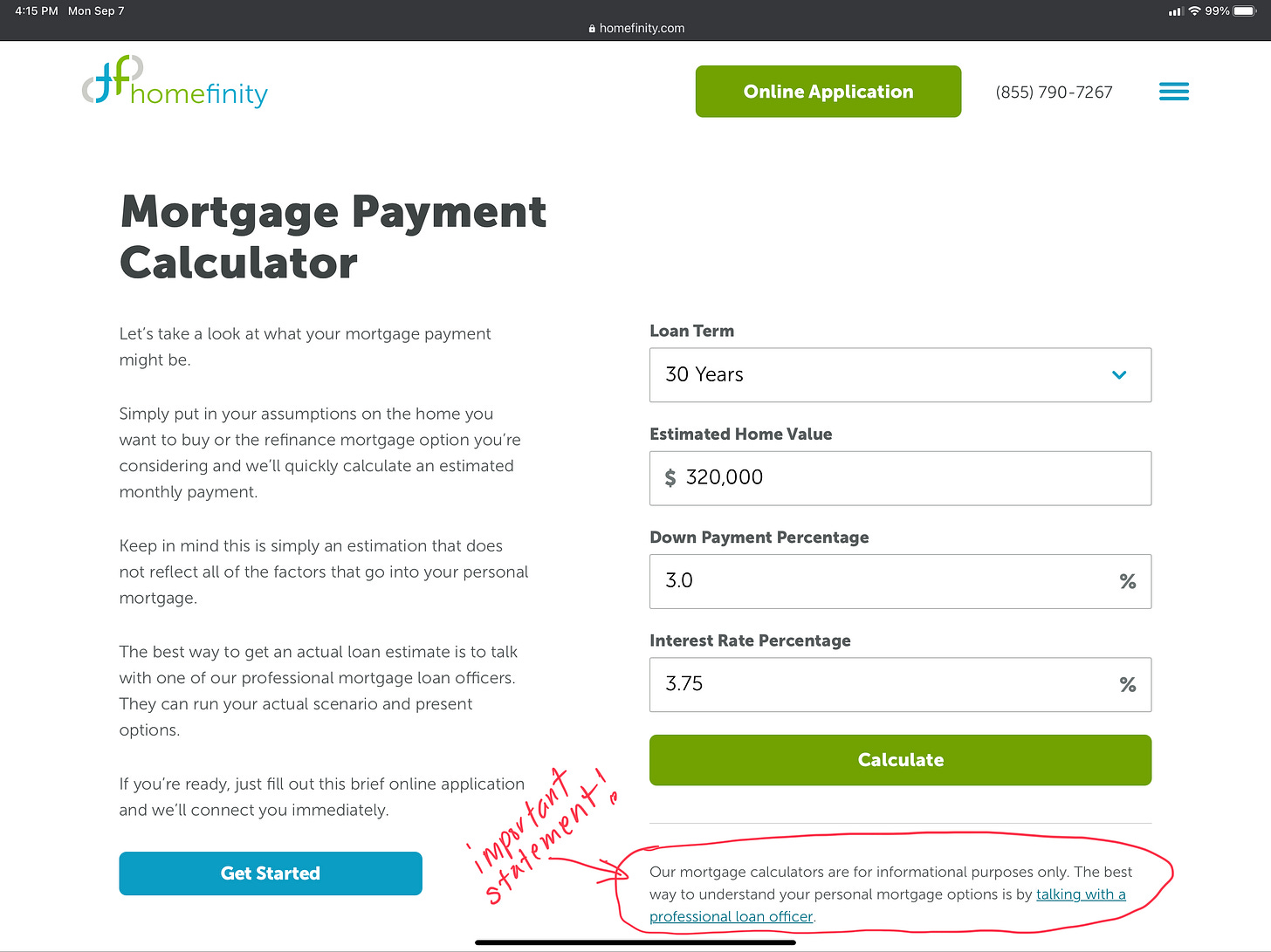

Like mortgage rates, mortgage calculators should never appear to be loan applications.

- Don’t collect personal information, like name and contact information

- Don’t ask credit qualifying information, like credit scores and employment

- Don’t present anything that looks like a loan estimate

Instead, they should be set up, as the name implies, like a calculator. Giving users the ability to punch in a variety of numbers (assumptions) and then simply do the math, using those numbers. For example:

- Demonstrate how putting more or less money down or buying a bigger or smaller house changes your loan amount and how those monthly loan payments might compare

- Give first time home buyers the ability to “what-if” several different home price scenarios to estimate monthly mortgage payments to test affordability

- Allow homeowners the ability to estimate how a lower mortgage rate might change their monthly mortgage payment

- Show how amortization works

Mortgage calculators are great educational tools.

Mortgage calculators can help borrowers understand how mortgages work and compare various loan options. They can observe how confusing concepts like amortization, down payments, mortgage insurance, homeowners insurance, and property taxes come together to make up a monthly payment.

How did I do convincing you?

What do you think?

Will you try adding mortgage rates and mortgage calculators to your website?

Do you have any questions? Are you working on your consumer direct mortgage strategy?

Please, feel free to reach out to us.