Mortgage marketing trends have the unique challenge of constantly adapting to fluctuating market conditions, changing consumer behaviors, and new technologies.

To remain competitive, brokers, lenders, and loan officers must stay informed about emerging mortgage marketing trends and anticipate new developments.

In this article, we’ll explore eight trends in mortgage marketing for 2025, from enhanced personalization to the evolution of mobile marketing.

1. Increasing personalization in communication

Personalization has been a top mortgage marketing trend for the past several years, but it’s only continuing to grow in necessity.

According to one survey, 62% of consumers said a brand would lose their loyalty if they didn’t deliver a personalized experience.

It’s not just a customer desire—it’s an expectation.

What does personalization mean in mortgage marketing?

Personalization includes tailored marketing messages based on specific data about a prospect’s interests, behaviors, and needs.

Instead of a one-size-fits-all approach, personalized marketing involves segmenting audiences and delivering content that resonates with each segment or individual.

This can range from personalized emails addressing the recipient by name to customized loan recommendations based on an individual’s financial history and purchases.

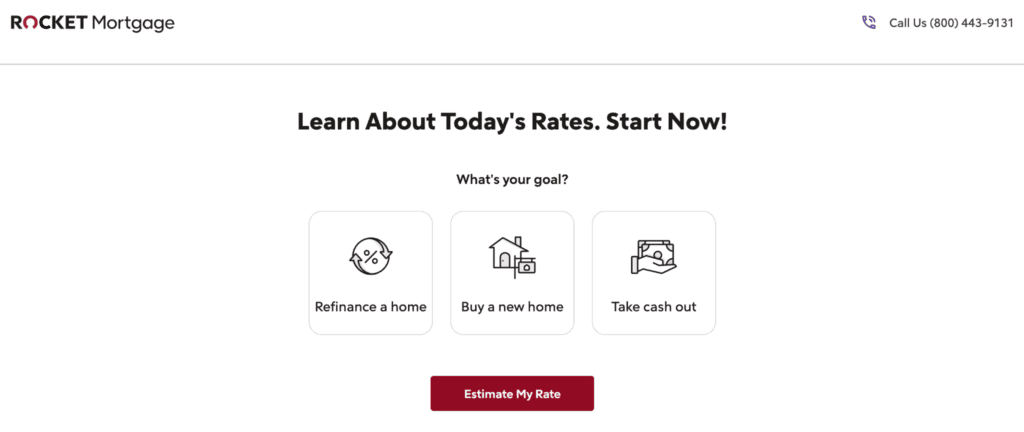

Rocket Mortgage provides prospects with customized rates and loan information once they provide more information about their needs.

Users can use the contact information they collect for further communication and marketing purposes with the user’s permission.

Technology’s role in advanced personalization

Fortunately, new technologies make personalization easier than ever for mortgage marketers.

Customer relationship management (CRM) software, AI, and data analytics tools have significantly improved the ability to personalize communication in the mortgage sector.

These technologies can:

- Analyze large datasets to identify patterns and preferences among potential customers.

- Predict which mortgage products a customer will likely be interested in based on their past interactions, credit history, and even social media activities.

- Trigger personalized communications at critical moments in the customer journey.

Tailored messages make potential clients feel understood and valued, which increases trust and loyalty toward the lender.

Additionally, satisfied customers with a personalized experience are more likely to recommend the lender to others.

2. Rise of video content

According to Wyzowl, 90% of marketers say video marketing has given them a good ROI—with 60% quantifying ROI through engagement such as likes, shares, and reposts.

In mortgage marketing, videos offer a dynamic way to convey complex information succinctly and engagingly.

Mortgage marketing ideas: The most effective types of video content

- Customer testimonials

- Explainer videos

- Day-in-the-life videos

- Q&A sessions

- Market update videos

Consistency in posting videos helps in building a loyal audience.

Establish a schedule for releasing new videos, whether weekly, bi-weekly, or monthly, and stick to it to keep your audience engaged and looking forward to more content.

3. Enhanced use of data analytics and AI

AI can uncover insights from vast amounts of data that would be too complex or time-consuming to perform manually.

These insights help mortgage professionals understand real-time market trends, customer preferences, and behavior patterns.

Examples of AI applications in mortgage lending

- Analyze existing customer data to identify distinct segments

- Target individuals with personalized marketing messages at optimal times

- Predict the likelihood of future defaults

- Estimate the lifetime value of clients

- Forecast how different segments will respond to specific marketing campaigns.

AI-powered chatbots are also used to engage potential customers visiting a mortgage website, providing immediate responses and guiding them through the loan inquiry process.

4. Focus on customer education

There’s far too much competition today for consumers to be comfortable with snap buying decisions—especially with a commitment as significant as a mortgage.

The modern customer is more likely to perform extensive research prior to making financial decisions and is sensitive to being “sold to.”

Instead, your prospects must be nurtured slowly over time and across channels to build connection, engagement, and trust.

YouTube videos are a helpful strategy for sharing tips and information on the homebuying process that will give your prospects the confidence to reach out.

Types of educational content that attracts and retain clients

- Blogs and articles

- Webinars and workshops

- Infographics and visual guides

- E-books and guides

- FAQ videos

An educational approach empowers your prospects by making the mortgage process more accessible and less intimidating—especially for first-time buyers.

5. Integration of social media and influencer marketing

Social media platforms like Facebook, Instagram, LinkedIn, and even TikTok offer unique opportunities for brands to connect with diverse audiences.

Mortgage companies can share information and listen to and respond to potential clients, creating a two-way communication channel that enhances customer service and brand loyalty.

Additionally, social media analytics provide invaluable insights into consumer behavior, preferences, and trends, enabling marketers to fine-tune their strategies in real time.

How partnerships with influencers can expand reach and credibility

Influencer marketing involves partnering with social media personalities or industry experts who already have a substantial following and the trust of their audience.

For mortgage marketing, influencers can introduce a mortgage brand to a broader or more targeted audience while enhancing its credibility.

6. Sustainability and ethical mortgage marketing

Consumers are becoming more conscious of their purchases and investments’ environmental and social impacts.

As a result, they are increasingly choosing to engage with brands that demonstrate a commitment to sustainability and ethical practices.

In the mortgage industry, this can translate into a preference for companies that promote sustainable housing, offer green loans, or engage in fair and transparent business practices.

7. Regulatory technology and compliance

Recent advancements in regulatory technology, or RegTech, have led to automated compliance processes and more robust risk management frameworks.

For example, technologies can instantly scan marketing materials to ensure they meet specific regulatory requirements, such as those mandated by the Consumer Financial Protection Bureau (CFPB) or local advertising laws.

Clear and compliant communication helps protect consumers from fraud and misleading information, thereby supporting a fairer market environment.

8. The evolving role of mobile mortgage marketing

The widespread and increasing use of mobile devices means that your potential clients are more likely to encounter mortgage products and services on these devices than on a desktop.

As a result, mortgage companies must prioritize mobile-friendly marketing strategies to engage this growing audience effectively.

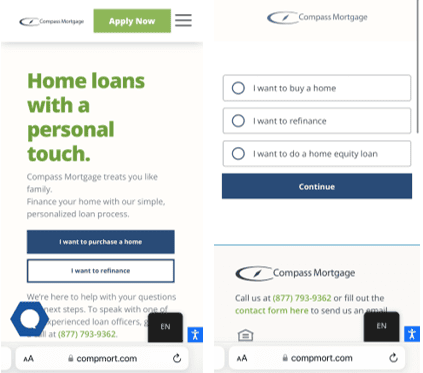

Compass Mortgage’s website has a user-friendly mobile version that allows visitors to easily click to “Apply Now,” call for more information or access any other site resources.

Mobile-first strategies in website design and app development

- Implement a mobile-first approach with larger fonts, easily clickable buttons, and faster load times.

- Develop a dedicated mobile app with features like document uploads, appointment scheduling, and real-time notifications.

- Streamline the application process, reduce the number of steps to complete actions, and provide clear calls to action to simplify the user journey.

A mobile-first approach can be your edge against lenders who are slower to adapt.

Unlock more mortgage marketing ideas with Kaleidico

Kaleidico is your competitive advantage.

We can help you leverage the latest mortgage marketing trends to meet your lead generation goals.

Mortgage marketing trends FAQ

To market a mortgage effectively, leverage digital marketing strategies such as SEO, email campaigns, and social media alongside traditional methods like direct mail and networking.

Personalize communication, provide valuable educational content, and leverage technology to enhance customer engagement and satisfaction.

Loan officers find clients through various channels, including networking events, referrals from past clients, and partnerships with real estate agents.

They also employ digital marketing techniques such as targeted online ads, social media, and content marketing that educate potential buyers about mortgage options.

Building a successful mortgage business involves maintaining a strong reputation for reliability and ethical practices and continually updating your knowledge of industry trends and regulations.

It also demands leveraging technology to streamline processes and focusing on client relationships and exceptional service to foster referrals and repeat business.