If you’re like most loan officers, you’re always looking for new effective ways to generate mortgage leads.

Email drip campaigns are an effective mortgage marketing strategy allowing you to generate more traffic and close more mortgages by connecting you with potential homebuyers—without all the legwork.

Successful mortgage email campaigns are so effective that 89% of professional marketers turn to email to generate leads.

Lenders who use drip campaign marketing to keep in touch with potential homebuyers improve their chances that the homebuyer will reach out to them—rather than reaching out to an unknown lender—when they need a home loan.

Tell us about your email marketing needs.

Why mortgage email marketing is important

In today’s competitive real estate marketplace, you can’t rely on realtor referrals alone—because they’re going to dry up eventually.

More and more mortgage professionals are using email to nurture potential homebuyers and nudge them toward new calls-to-action (CTAs).

For most, the strongest leads are the ones that come to you—not the ones you reach out to. But how do you get people you don’t know to come to you?

According to experts, email marketing remains one the most effective marketing tools for attracting new mortgage leads.

In fact, a recent survey found that email was almost 40 times more effective than Twitter and Facebook combined.

With so many demands already leaning on your time, the thought of sending out countless emails might seem impossible. That’s where automation can help.

Automation streamlines your mortgage email campaign by allowing you to write emails, set up the campaign once, and then let the program take care of the rest. It can actually save you from a time consuming task and free up your calendar. Then you can focus on tasks that yield a better return from your direct efforts.

So rather than spending valuable hours chasing a potential lead, you can work on in-process loans, thereby increasing your closings while your email drip campaign is smoothly running in the background.

Drip emails are an excellent way for mortgage lenders to nurture leads, introduce their products, onboard new clients, and engage existing ones.

Remember, most people won’t be ready to apply for a mortgage when you first contact them. You need to engage them in an ongoing conversation.

Lead visitors from awareness to conversion with drip emails

Drip emails are great for introducing your loan products to new customers or informing existing homeowners about new offers.

They’re also great educational tools that can captivate your audience’s attention while encouraging them to explore your business in greater depth.

Email marketing offers a practical and effective way to keep previous clients engaged with your brand. Providing a continuous stream of friendly, engaging emails containing usable information, updates, or professional recommendations makes it easier for clients to re-engage or recommend you to others.

What is an email drip campaign?

Drip emails can be a great tool to keep in touch with past clients and attract new mortgage leads.

Drip campaign definition

A drip campaign is simply a scheduled set of automated emails, usually activated by specific customer actions. Email drips allow you to engage your clients in a compelling manner.

Email drips have a 119% click-through rate compared to regular campaigns.

Think of “drip” as communicating the right message at the right time, drop by drop—in other words, no more or no less than what is needed at that exact moment.

An email drip campaign allows you to provide potential clients with applicable, relevant information when needed without “spamming” them. And that builds trust.

Let’s look at a scenario:

A visitor to your site signs up to receive an estimate of how much they might be eligible to borrow. Using a marketing drip campaign, they could receive a welcome email outlining several loan types you offer within minutes of signing up, regardless of the time of day or night.

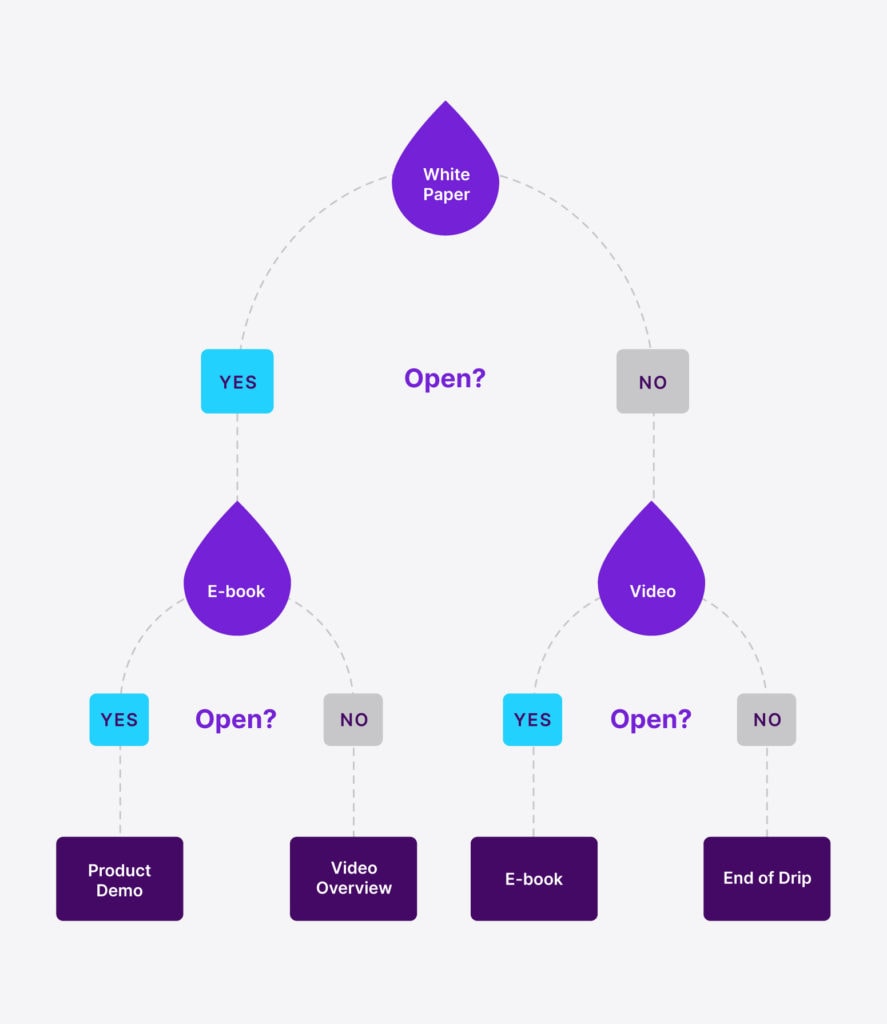

Looking back at our graphic, this intro email is known as the “white paper,” where you introduce yourself, your business, and the problem that your service can solve for your audience.

With a drip campaign, you write the emails ahead of time and use an automated system to personalize them with their name before automatically sending them out.

What is the difference between nurture and drip?

While nurture email campaigns are similar to drip email campaigns, they serve very different purposes.

Drip email campaigns

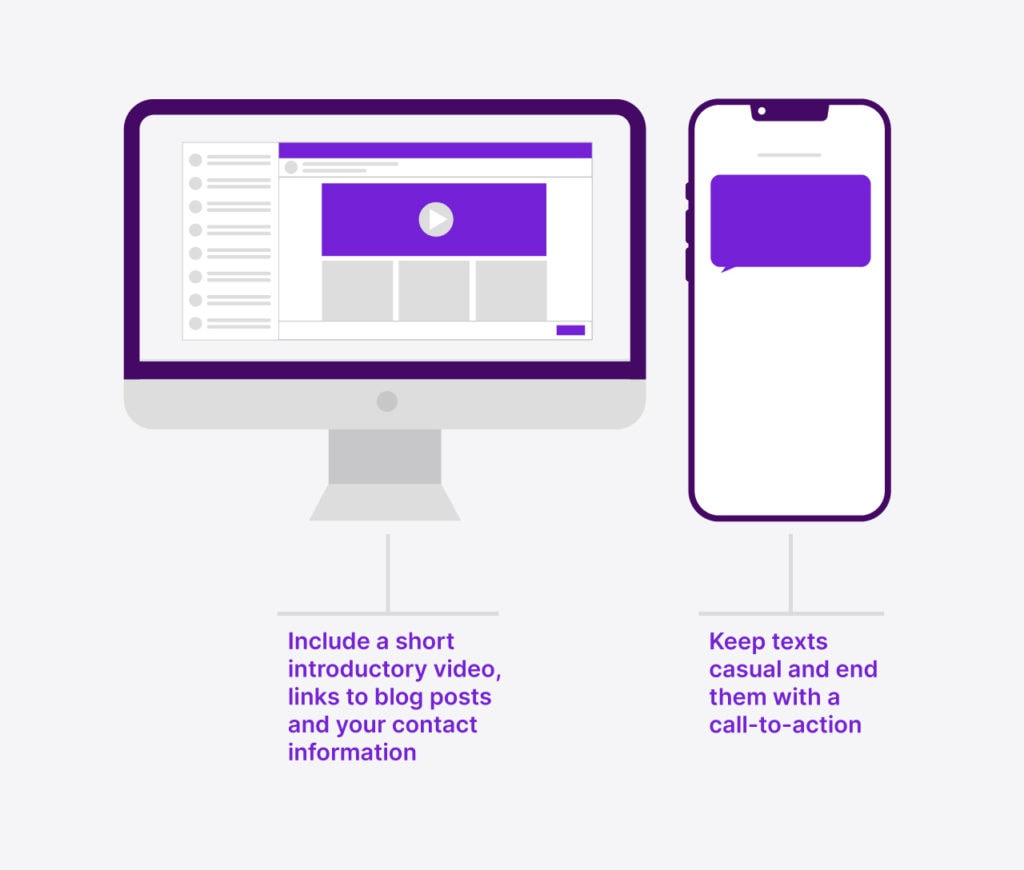

Drip emails lead visitors through their sales funnel with a final conversion goal. Messages in a drip campaign are more commonly sent via email, but text messaging and social messaging can also be effective options. They are sent at the predetermined intervals you have chosen. And (unless they unsubscribe) recipients receive the full set of scheduled messages.

Nurture campaigns

A nurture campaign tends to be more personalized and geared toward specific user behavior. Nurture campaigns rely on analytics and insights into subscribers’ activity, such as which loans they browse, which pages they visit, or which (if any) email links they click. In short, with a nurture campaign, specific subscriber behavior triggers a corresponding email sequence.

How to generate leads using your email drip campaign

An email drip campaign will allow you to build a lasting relationship with a lead by keeping in touch with them and demonstrating the value of your loan products and service until they’re ready to become customers.

Email marketing effectively pushes leads through the entire mortgage borrower lifecycle, from awareness to customer.

With a robust email marketing campaign, you can increase loan product awareness and educate leads while cultivating trust that will ultimately drive them to become customers.

What is a lead?

Anyone who shows interest in your business and what you’re offering is a lead.

Lead generation is gathering a potential lead’s contact information, i.e., name, phone number, or email address.

Lead generation isn’t selling to potential customers. Instead, it’s about encouraging them to continue interacting with you.

If your goal is business growth, you need to prioritize increasing leads. Email drip campaigns can help you generate new mortgage leads—and optimize your broader marketing campaigns, squeezing every possible lead out of your mortgage sales funnel.

Defining your goals for the campaign

When you’re defining your goals for the campaign, it’s important to remember to keep them realistic and indicative of what you can actually achieve—this includes setting realistic benchmarks.

A goal of 100 new visitors daily within a week is an unrealistic benchmark. Whereas 100 new visitors per day by the end of the year is attainable.

The benchmarks we use at Kaleidico for drip email campaigns are 40% open rates, 10% click-through rates, and a 1-5% conversion rate to leads. The important thing to remember with benchmarks is that they’re reasonable goals that you should be working towards by optimizing your deliverables, not necessarily where you’ll start.

We’ve all experienced “scope creep,” often by struggling to keep up with ever-expanding expectations in a given situation. And that can happen here if you aren’t careful.

Goal creep

Goal creeping (sometimes called scope creeping) describes the continual expansion of your project beyond its initial targets. And it can be detrimental to actually achieving your desired results.

To prevent goal creep from getting its hooks into your project, match your email drip campaign goal to your broader marketing objective.

If your goal is closing more loans, defining an email drip campaign objective of increasing monthly mortgage leads will help you do that.

You could define your goal this way: I want to leverage new subscribers and convert 5% into new mortgage applications within the next three months.

The goal of converting new visitors to applications is an example of a target that aligns with your broader marketing objective of closing more loans. And the three-month term sets a realistic timeframe for you to achieve it.

Use a drip campaign to nurture existing contacts and prompt them to take action

Drip email campaigns aren’t just a marketing tool for new subscribers or potential contacts. They can be an effective method to nurture existing contacts, prompting them to take action.

Your first email in this campaign would introduce subscribers to your new loan product and promote the introductory mortgage rate discount or another perk you’re offering.

Subsequent emails in your drip campaign would:

- Lead your existing clients through the buyer journey by building on their existing awareness of your brand

- Encourage them to take advantage of the current offer and refinance their mortgage or apply for a new one

How many emails should be in my mortgage marketing drip campaign?

There’s no single rule for how many emails you should have in a drip campaign. Different goals can require different campaign lengths.

The number of emails you will need will also lean heavily on your subscribers and where they are in their journey.

Goldilocks had the right idea: not too hot, not too cold—just right.

For success with email marketing, it’s always good to keep the Goldilocks principle in mind. Sending out too many emails can turn prospects away from your services (too hot). But not sending out enough, they can turn away (too cold).

With more than two decades of mortgage marketing, we’ve learned that “just right” generally translates into the following:

- 2-3 emails for the first few weeks

- Then scale back to one email every ten or so days for the next two to three months

- Finally, move to a once every two weeks email

Tell us about your mortgage email goals.

Email writing tips

Before we look at how to write great emails, let’s look at who will likely be reading them.

Millennials make up an estimated 92 million Americans—surpassing Baby Boomers to become the largest generation in U.S. history—and they’ve entered their peak home-buying years.

Since more than 70% of millennials prefer email communication over other methods of communication, nailing your email is crucial to attracting new mortgage leads.

Start with a great subject line

Your subject line is your single most valuable piece of email real estate. 69% of email recipients decide to read or delete an email based solely on subject lines.

A strong subject line will prompt subscribers to open your email. A poor or weak subject line can prompt them to delete your email before they open it. Look for ways to pique reader curiosity or add a touch of urgency to your email subject line.

Be brief

Everyone is busy. You’ll benefit by crafting short emails that subscribers can read right away. Keep messaging clear and save the fluff for your peanut butter sandwich. If you have a long thought you want to share, break it up over several emails.

Stick to a single subject

If you want to talk about refinancing, then talk about refinancing—nothing else. Don’t muddy the waters by discussing unrelated topics, like downpayment assistance programs for first-time homebuyers.

Always proofread your emails

Always. Proof. Read. Your. Emails.

Take advantage of free spelling and grammar checkers like Grammarly to check your emails for errors. You want your reader to focus on your message, not misspelled words. And typos can leave subscribers questioning your ability to help them with a more complex matter, like mortgage approval.

Wrap up with a click-worthy call-to-action (CTA)

You’ve got a great subject line and an info-packed email, but if you forget to include a click-worthy call-to-action (CTA), as the old saying goes, you’re “leaving money on the table.”

Emails that end with a compelling CTA—something that’s hard for them to ignore but easy for them to execute—is essential.

The best CTAs are short and sweet, between three and five words.

Use action words: “Get your introductory mortgage rate,” “Start your application,” “Refinance today,” etc.

FOMO (fear of missing out): Scarcity is knowing there’s a limited supply or duration of something, and the fear of missing out on something in scarce supply can help your emails. Creating a feeling of scarcity leads subscribers to “Act now” and “Apply Today” before the offer expires, and they miss out.

What your mortgage drip campaign should look like

Standing apart from the competition isn’t nice to have; it’s essential for success as a mortgage lender. And that means leveraging a range of marketing strategies, including automated email marketing.

These campaigns use a client-centric approach while taking advantage of technology to attract more prospects—and convert them into mortgage customers.

Let’s look at some drip campaign and mortgage email templates to help you get started.

Welcome emails

Welcome emails are often the first interaction or touchpoint you have with a new potential client. Therefore, welcome emails should be friendly and warm while providing clear and concise information.

Welcome emails have an exceptionally high open rate—80% —more than four times the number of opens and ten times the number of clicks of other emails.

Onboarding emails that explain how you do what you do and how they can get the most out of your services are common welcome email formats.

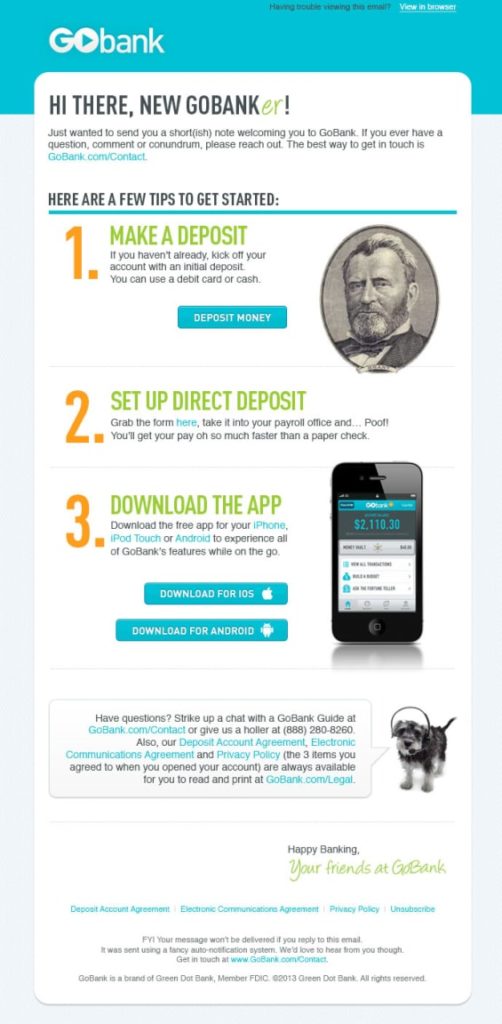

GoBank does a great job of welcoming their new subscribers while showing them how to set up direct deposit. Check out their great CTA buttons. (Did you notice all three of their CTAs use action words and are between 2-3 words!).

Lead generating emails

Did you know that email marketing surpasses other marketing channels, with an average 122% return on initial investment? Or how about 50% of recipients buy from marketing emails at least once a month?

Lead generation emails are designed to continue the conversation you began with your welcome email.

Lead Gen Email #1—Homebuyer Guide

Subject line: The Ultimate Home-buying Guide for First-Time Homebuyers

Just wanted to share our new Ultimate Homebuying Guide for First-Time Homebuyers. This comprehensive guide can help you navigate the road to home ownership with ease. It covers everything from mortgage pre-approval (and why you need it) to closing on your new place, including

- Organizing your finances

- What documents do first-time borrowers need?

- How do I get mortgage pre-approval?

[Download Now]

{{signature_block}}

Lead Gen Email #2—Loan officer introduction letter

Subject Line: Let’s buy a home together

Hi, [first name(s)],

Welcome to {{mortgage lender firm}}. As a loan officer with more than 20 years of experience in the mortgage industry, I’m confident I can assist you with your home-buying needs.

What’s a good time to call you?

Or reply to this email to start the conversation.

{{signature_block}}

Lead Gen Email #3—Congratulations on Closing

Subject Line: Congratulations, [first name(s)],

Thank you for letting me be part of your home-buying journey. It was a pleasure to work with you. Clients like you don’t come along every day. I’m glad we crossed paths. And if you ever need anything else, you know where to find me.

Congratulation on your new home.

{{signature_block}}

P.S. If you have family, friends, or colleagues who might be thinking about purchasing or refinancing, please pass along my info.

Touching base email—celebrate special occasions

Birthdays, home closing anniversaries, and other special events offer an opportunity to follow up and touch base with an existing or former client. They also build an association between your name/ brand and a positive experience.

A simple birthday greeting with a link to your mortgage lender’s website does the job.

Measuring your drip campaign’s results

When a drip is done well, they build trust between you and your potential customers while creating a foundation for converting prospects into customers.

Drips offer a slew of quantifiable marketing methods. You can track anything you consider relevant, from who opened your email to what link they clicked and everything else in between.

What’s the best way to decide if your email drip campaign has been successful?

Yes, you can dig into key performance indicators (KPI), like

- Open rate

- Link click rate

- Reply rate—how many people responded to your email

- Bounce rate—emails that didn’t reach a person and ‘bounced’ back

- Unsubscribe rate

With so many possible data points and analytics options available, getting the precise info you need to determine the success of your campaign might seem overwhelming. But it doesn’t have to be.

While all of the areas listed above—and many more—help assess campaign effectiveness, there’s a simpler way to know if your email drip campaign has been a success.

Ask yourself this one question:

Did I reach my goal(s)?

Revisit the goals you originally set, did you meet them?

Originally, we used the goal of leveraging new subscribers and converting 5% into new mortgage applications within the next three months.

To answer the question, “Did I reach my goal?” compare the number of new subscribers to the number of new mortgage applications.

If you collected 20 mortgage leads, but none of them completed a mortgage application, then the campaign failed to reach its goals.

On the other hand, if you collected 20 mortgage leads and got two new mortgage applications, you converted 10% of your new subscribers—double your initial goal—and a drip campaign success.

The best websites to create mortgage email drip campaigns

When it comes to email campaigns, automation is king. Drip email campaigns—aka automated email campaigns—not only help build relationships with customers but can also save you time.

Drip emails allow you to set it up and then, essentially, forget about it. Once you establish the workflow, the system you choose will roll out the emails in the precise order and cadence you put in place.

There are several websites that mortgage lenders can use to create drip email campaigns. Let’s look at a few popular choices.

Mailchimp

Mailchimp is an automated, all-in-one online tool that allows you to manage mailing lists, make email templates, and nurture entire email marketing campaigns.

When it comes to the best email service for creating email drips, Mailchimp is usually the first name that comes to mind. And with good reason.

The stalwart of email marketing is easy to use and offers a wide variety of features to suit almost every business need. Mailchimp has established itself as the standard tool for dynamic email marketing campaigns by continuing to grow, improve, and innovate the entire mail marketing landscape.

New Mailchimp features include subscriber behavior targeting and landing pages. And the best news is, for users with up to 2,000 contacts, Mailchimp is free. Paid plans start at $10 per 500 contacts above 2,000.

Why Kaleidico uses Mailchimp

At Kaleidico, we combine our two decades of mortgage marketing experience and expertise with Mailchimp’s customizable features, in-depth reports, and analytics to roll out an effective email drip campaign that generates mortgage leads.

Constant Contact

Constant Contact is a marketing automation program that allows users to build a web presence in addition to email marketing.

The nice thing about their website builder is that it has marketing tools built-in, making it very user-friendly. While they offer good marketing tools, their biggest drawback is no free plan. Constant Contact fees start at $9.99 a month.

Salesforce

Salesforce is a popular cloud-based client relationship management (CRM) platform that aims to support sales and marketing teams in businesses of any size. Salesforce helps businesses better connect with new customers and manage existing customer relationships.

Salesforce offers automated email marketing, SMS marketing, real-time communications, and a slew of other marketing tools. Like Constant Contact, they don’t offer a free membership level, but they do have a free 30-day trial.

Generate mortgage leads by partnering with Kaleidico

When you partner with Kaleidico, we put everything we’ve learned and mastered over the past twenty years to help you generate more mortgage leads.

But don’t take our word for it.

Find out for yourself how we can help you reach your mortgage marketing goals.

Set up an intro meeting with Kaleidico.

Photo by Andrea Piacquadio