In today’s digital landscape, attracting potential borrowers to your website is just the first step.

Keeping them engaged and converting them into qualified leads is crucial for success in the competitive world of mortgage lending.

Our guide explores seven critical website features specifically designed to generate high-quality mortgage leads and empower you to convert more website visitors into satisfied customers.

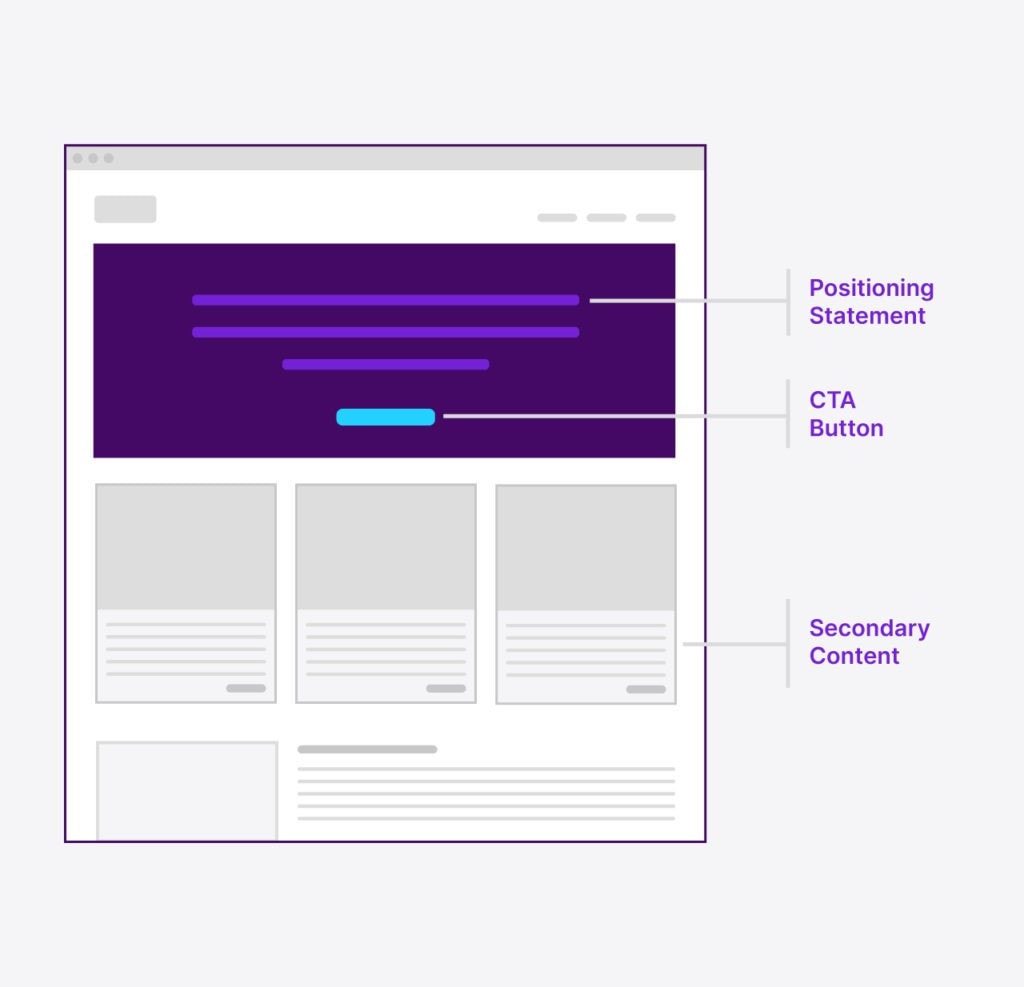

1. A clear and compelling first impression

First impressions matter, especially in the digital world.

When a potential borrower clicks on your website, you have mere seconds to capture their attention and convince them to stay.

Lower your bounce rate by:

- Bold and clear value proposition: Craft a clear and concise positioning statement that instantly communicates the benefits you offer. This could be “Your one-stop shop for affordable mortgage solutions” or “Simplify your homeownership journey with expert guidance.”

- Prominent call-to-actions (CTAs): Make it easy for visitors to take the next step by placing clear and compelling CTAs throughout your website. Examples include “Get a Free Quote”, “Start Your Pre-Approval Today”, or “Schedule a Consultation.”

- Intuitive navigation: Ensure your website is easy to navigate and visually appealing. Users should be able to find the information they need effortlessly, without feeling overwhelmed by complex layouts or confusing design elements.

- Mobile-friendly design: Remember, nearly 60% of website traffic comes from mobile devices. Ensure your website is fully responsive and optimized for optimal performance on all screen sizes.

2. Engaging lead capture forms

Traditional, lengthy contact forms often lead to frustration and cart abandonment.

Opt for a more streamlined approach through:

- Survey-style lead paths: Implement lead paths that collect information progressively, asking questions in a user-friendly and conversational way. This improves engagement and increases the likelihood of completion compared to traditional forms.

- Responsive design: Lead paths should adapt to visitor responses, eliminating irrelevant or repetitive questions. This personalized approach enhances user experience and encourages visitors to complete the form.

- Multiple lead capture opportunities: Don’t limit yourself to a single contact form on the homepage. Strategically place lead capture opportunities throughout your website, including landing pages, blog posts, and resource sections.

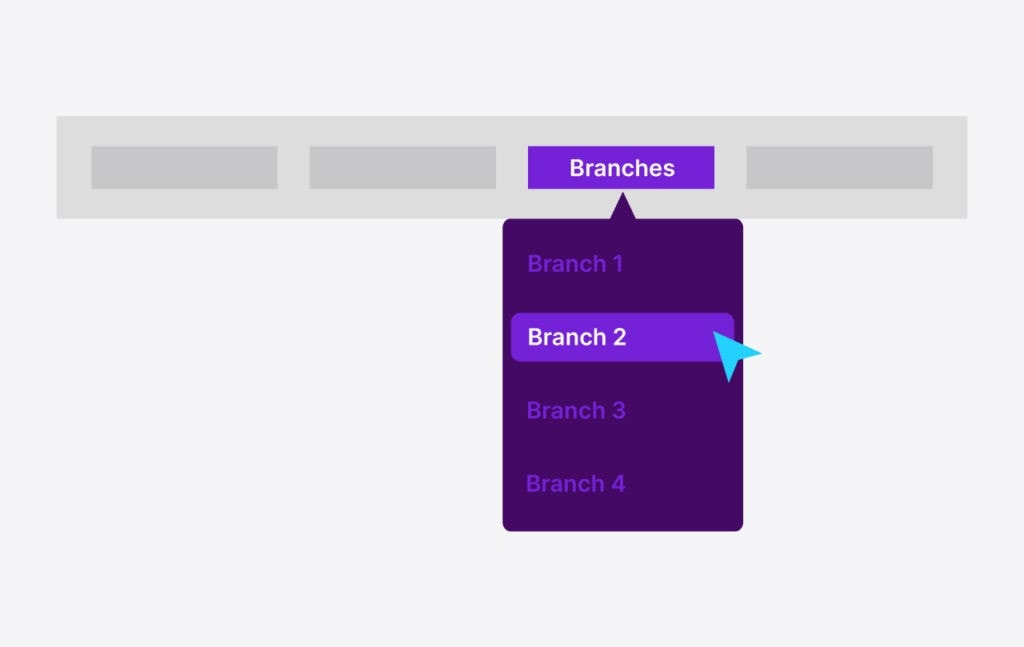

3. Leverage local search optimization

Potential borrowers often search for mortgage lenders in their local area.

Optimize your website for local search by:

- Branch location pages: Create dedicated pages for each branch location, featuring the address, phone number, contact form, and photos of your team members.

- Loan officer profiles: Establish individual profiles for each loan officer, showcasing their experience, expertise, and licensing information. These pages serve as additional entry points for potential leads searching for specific loan officers.

- Targeted keywords: Optimize website content and landing pages with relevant local keywords like “city name + mortgage lender,” “mortgage broker near me,” and “local + refinance options.”

4. Content-rich landing pages

For each loan product or program you offer, create dedicated landing pages that provide comprehensive information and answer common questions.

These pages serve as valuable resources for potential borrowers and boost your search engine ranking for relevant keywords.

Mortgage landing page examples include:

- Conventional Mortgages

- Fixed-Rate Mortgages

- Adjustable-Rate Mortgages

- USDA Loans

- FHA Loans

- Refinance options

5. Leverage the power of content marketing

Create informative and engaging blog content to attract organic traffic and establish yourself as a thought leader in the mortgage industry.

Topics could include:

- First-time homebuyer guides

- Mortgage application process explained

- Comparing different loan options

- Benefits of refinancing

By consistently producing high-quality content, you demonstrate your expertise, build trust with potential borrowers, and improve your website’s ranking in search engine results pages (SERPs).

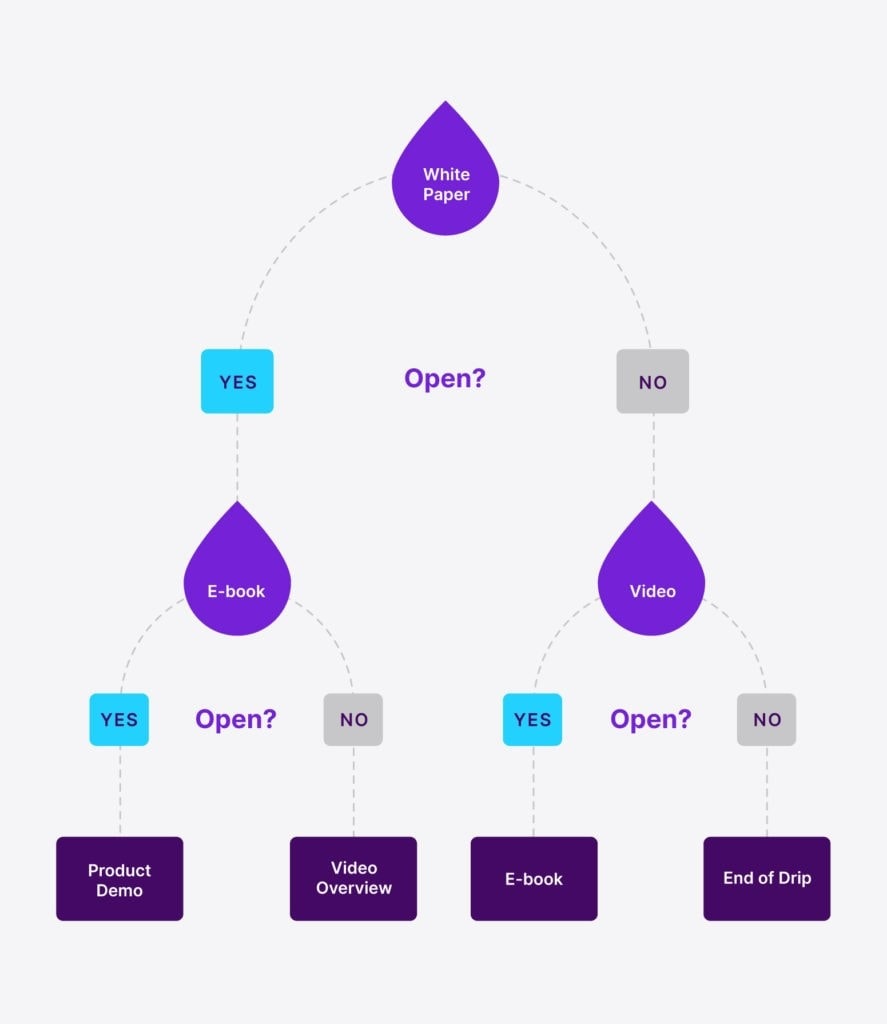

6. Turn visitors into leads with lead magnets

Not all visitors are ready to contact you directly. Offer valuable “lead magnets” in exchange for their email address.

Your lead magnet could be:

- An Ebook on specific mortgage topics

- Checklists for home buying or refinancing

- Mortgage application templates

Lead magnets provide valuable information to potential borrowers while allowing you to capture their contact information and nurture them through targeted email marketing campaigns.

Get Our 90-Day Mortgage Marketing Plan

7. Social proof and transparency

- Showcasing reviews: Display positive customer reviews and testimonials prominently on your website. This builds trust and credibility with potential borrowers.

- Mortgage rates and transparency: Maintain a dedicated page with updated mortgage rates and a news feed. Offer forms for visitors to request personalized quotes and encourage them to learn more about pre-approval options.

Schedule a Discovery Session

Learn how to attract new leads and clients.

Get a top-quality lead-generating mortgage website with Kaleidico

By implementing these seven critical website features, you can create a user-friendly and lead-generating platform that attracts potential borrowers, fosters trust and ultimately converts them into satisfied customers.

Remember, success in the ever-evolving landscape of mortgage marketing hinges on delivering exceptional user experience.