If you’re finding that your former mortgage marketing approaches aren’t bringing in steady leads anymore, it’s time for a digital upgrade.

There’s still a place in mortgage marketing for direct mail, word-of-mouth referrals, and TV ads—but the majority of your future borrowers are seeking you out online.

And if you’re not there, they’re going to easily find someone else.

In our digital mortgage marketing guide, we’ll show you how to execute, document, and adjust your plan to fit your specific marketing goals.

We know mortgage—Get 20 years of mortgage lead generation experience with Kaleidico.

What are your digital mortgage marketing goals?

No matter what type of marketing strategy you’re implementing, it needs to stay true to your overall business goals and objectives.

General ideas for your digital marketing goals might include:

- Generating qualified mortgage leads

- Increasing awareness of your products and services

- Boosting your number of referrals or referral partners

- Establishing yourself as an industry expert

- Increasing your number of closings

- Incorporating AI and machine learning into your strategy

Once you establish your goals, you’ll need to determine how you’re going to measure their success. How many leads do you want per week? Per month? How many closings?

What needs to happen for you to know you’re making an impact in the mortgage industry or making an impact in your community?

Your goals and how you’ll measure them don’t need to be perfect, because as you move ahead and build and execute your digital strategy they will most likely need adjustments.

However, establishing these goals will help you stay on track, and most of all will help you stay true to who you are as a mortgage professional.

Digital marketing for mortgages is a big undertaking that’s filled with a lot of competition.

Understanding what it is that makes your business unique will help you stand out among the competition—and generate more mortgage leads.

What kind of borrowers are you targeting?

The next step in the digital mortgage marketing process is to create your client personas.

In other words, you’re going to name and define the types of borrowers you are targeting based on your existing data and client successes.

Examples include:

- Gen Z homebuyers

- Reverse mortgage customers

- Borrowers with a lot of equity

- Refinance clients

- VA loan-qualified buyers

- Current renters

- FHA customers

- Second-home shoppers

- Investors

- Referral partners

Targeting your clients helps you focus on each of their unique needs and interests. This drives the types of content you will create for them.

You also will need to prioritize the homebuyers based on the types you want to target the most. Then, you can create more content specifically for these borrowers, and even create an area for them on your website.

Use existing client data

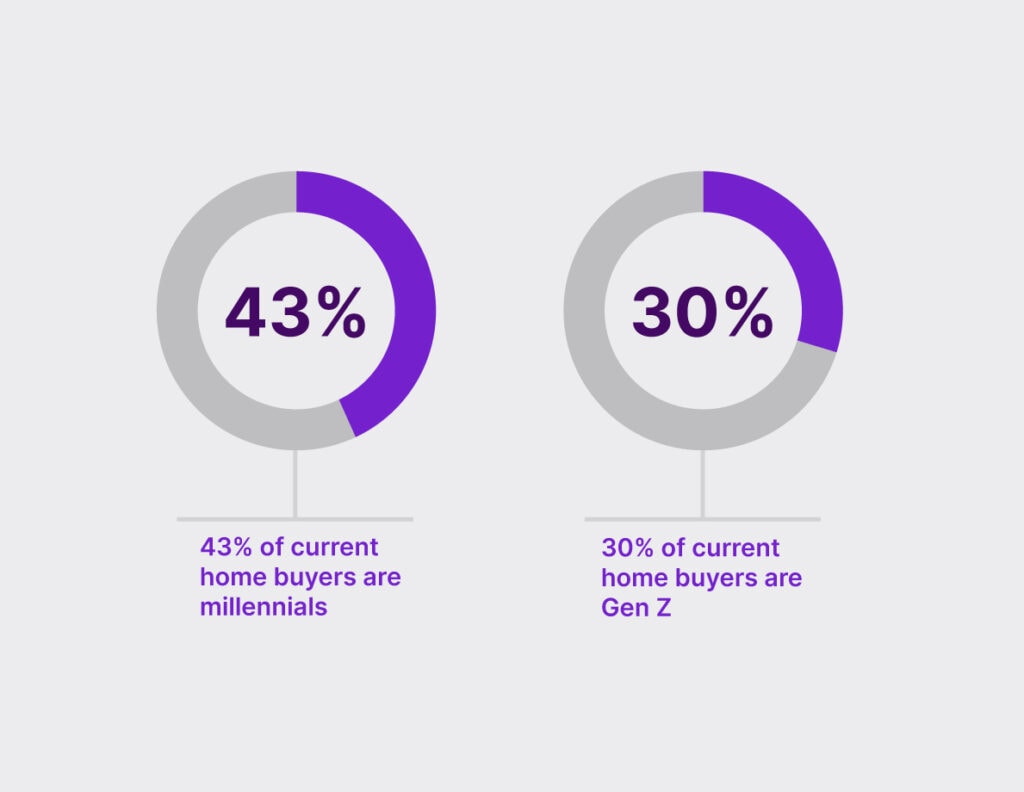

In 2020, millennials were the largest percentage of home buyers at 37%.

Now, they make up at least 43% of current homebuyers.

Throughout the pandemic, Gen Z also had a chance to catch up: 30% of 25-year-olds owned their home in 2022, which is higher than the homeowner rates for both millennials and Gen X at the same age.

What are your current demographics?

Depending on your target audience and location, you may be interested in marketing primarily to Gen Z or millennials as first-time buyers, veterans, or active duty servicemembers with a VA loan or established homeowners with a home equity loan.

You can create separate sections, or landing pages, on your website for particular homebuyer journeys like “buying your first home” or “refinancing your mortgage.”

But first, you’ll need to perform some research on how to reach each of these types of borrowers so you can effectively target them with your marketing.

Determine where to target each client

Once you’ve decided who you’re targeting, list out where and how you’re going to target them online.

A complete mortgage marketing strategy involves many moving parts.

You’ll be driving traffic to your mortgage website via organic and paid content, but this content can be distributed in multiple ways: social media, email marketing, text messages, etc.

Determining where to target depends on your goals. For example, if your goal is to position yourself as an industry expert or boost awareness of your products, you might post videos and thought-provoking posts on LinkedIn or Facebook.

Demographic data can help you understand which platforms are ideal for your audience.

Use this data from Sprout Social to craft your strategy:

- Facebook is still the largest social media platform, with nearly 3 billion active users, but time spent on the platform is falling as other platforms grow

- The largest age group on Facebook is 25-34

- Instagram is the second-largest platform and maintains a “firm hold” on both Gen Z and millennials

- The platform is also shifting into more of an e-commerce hub

TikTok

- TikTok’s largest age group is 18-24, and it continues to experience “unprecedented” growth among its users

- It has the highest average time spent per day of any other platform, with 45.8 minutes

- The largest age group using LinkedIn is 30-39

- The platform continues to grow and is considered a prime source for B2B marketers and lead generation

And what about email marketing? There are more than 4 billion email users across the world, and 96% of users check their email every day. The highest age group using email is aged 25-44.

Use these statistics to guide your targeting strategy for your digital marketing content.

How to execute your digital mortgage marketing plan

Okay—you’ve defined your goals, homebuyers, and channels. Now, we can break down the actual execution of your new digital marketing plan.

Generate high-quality mortgage leads now.

Automated email or text campaigns

Are you familiar with drip campaigns from your previous marketing strategies? It has most commonly been used in direct mail campaigns.

The idea with your digital strategy is to send automated messages to current or potential leads via email, text message, or social media following a specific lead “trigger.”

Drip campaigns also can be a form of lead nurturing once you’ve captured the lead. After all, it can take some people months or years before they’re ready to close on a loan.

Since the messages will need to be specifically targeted to certain clients, you’ll set up separate drips for current clients, prospective clients, and referral partners.

The messages will be prewritten and automatically sent out according to your set schedules using a platform like MailChimp or Active Campaign.

Drip campaign examples

- Send out a welcome email or text when a new mortgage lead first submits their contact information to you via a web form.

- Set up follow-up “drips” based on a specific inquiry, such as information on FHA loans, or recommend other services on your websites like your mortgage calculators or blog.

- Set up a drip campaign to congratulate a client when you close on a loan.

- Nurture clients for a future purchase or refinance by periodically sending out homeowner tips, holiday greetings, or birthday messages.

- Ask satisfied clients to submit reviews or referrals for you.

Mortgage website optimization

Research shows that nearly every potential homebuyer today is starting their search online, or at least using it at some point in their journey.

Optimizing your mortgage website is a guaranteed long-term method for gaining new leads.

Far too many businesses overlook their website or let it grow stale and outdated. A fresh website is your digital home base, so it should be a top priority in your digital mortgage marketing plan.

If you have a clean, bold, inviting website, you’re going to keep your potential clients on it for far longer—meaning consistent new leads.

Let’s take a look at the key features and design elements your website needs to keep your visitors engaged and following your lead paths.

Clearly-branded content

A well-designed website is not only more attractive and easier to read for your future mortgage clients but for Google, too!

Google and your visitors are scanning the web for your website’s readability, relevancy, use of graphics and images, and overall quality. Google just might be a bit more technical about it.

Make sure you use your company’s colors, fonts, and logos across all of your pages to ensure a clean, consistent look—including your calls-to-action (CTAs).

Your calls-to-action should stand out in the form of a bold, colorful button that directs the user to a specific action.

CTAs on mortgage websites might look like the following:

- Apply now

- Contact us

- Purchase a home

- I want to refinance my home

- Get a rate quote

- Get started

Your CTAs should lead the user to a simple web form, or progressive form, that will take them through a series of questions, including the property type, where they’re at in the process, their zip code, and more.

Consider treating your websites like an extension of your branded printed items, such as your business cards, stationery, pens, folders, and more.

Web design is hard work, so team up with a quality web designer or full-service marketing agency to execute your designs online.

Mortgage calculators

Mortgage calculators inform and empower your visitors by handing them the tools they need to be successful.

Today’s mortgage seekers are hungry for information. If they don’t find it with you, they’ll find it with someone else.

Make sure it’s with you by including all the most popular mortgage marketing tools in use today, including mortgage calculators for the following purposes:

- Purchase

- Refinance

- Loan comparison

- Monthly payments

- Amortization schedule

- HELOC

These simple calculators allow users to play around with the numbers.

Include a blurb next to the calculator that briefly explains how it works, and encourages the user to click the call-to-action button to submit their information to you for an accurate loan estimate and options based on their unique loan scenario.

Mortgage calculators pique the visitor’s interest while providing them with real insight into how the process works.

This will encourage them to take the next simple step—applying with you for real results.

Valuable lead magnets

Lead magnets are valuable pieces of content that you offer in exchange for a visitor’s contact information.

For a lead magnet to be effective, you will have to aim it at one of your homebuyer targets.

Examples of lead magnets for mortgage websites include:

- Homebuyer or refinance checklists

- Guides to the mortgage process

- Mortgage calculators

- Budgeting worksheets

- Link to video series

- Access to previous webinar

Lead magnets are marked by a clear, bold call-to-action, such as “apply now,” “download your free guide,” or “get a rate quote,” and should be sprinkled throughout your website and blog posts.

Be creative with your lead magnets. They should be unique to your services, expertise, target clients, and business goals.

Once your web visitor becomes a lead via a lead magnet, the email drip campaign you set up for this type of lead should automatically jump into action based on this trigger and begin sending out relevant emails or texts.

Website optimized for mobile

Around 60% of all website traffic worldwide is from mobile phones.

If you’re not mobile-optimized, you could potentially be losing out on a significant amount of mortgage leads from this traffic.

Bottom line: Optimize your website for mobile to ensure more leads!

An experienced web developer can easily help you optimize your website for mobile, but you’ll need to make some adjustments to the content to ensure it meets this new audience.

Most mortgage professionals will decide to perform an overhaul on their desktop website and mobile site at the same time, to ensure both display a clean, concise design.

That means removing pop-ups, videos, or other plug-ins that are weighing your site down and making the user experience more difficult.

It also means shortening text and ensuring your CTA boxes stand out clearly on both displays. You don’t want anything to be cut off or difficult to access, because that will affect your number of mobile leads.

Testimonials page

If you expect a visitor to your website to hand over their information willingly, you’re going to have to prove to them that you’re a legitimate mortgage loan officer, lender, or broker — especially if you’re an online mortgage lender.

One way to do this is by adding a landing page for testimonials or reviews.

The mortgage process involves a lot of personal details and information. Reading testimonials from other people who have had a good experience working with you will build trust and credibility.

The easiest way to work in testimonials is by creating loan officer profile pages on your website.

On these profile pages, you can include the following:

- Reviews and testimonials

- Profile picture

- Biography

- NMLS number

- Contact information

Reviews streaming in from another source that users trust, such as Zillow, is also helpful for proving legitimacy.

Pay-per-click mortgage advertising

The two main marketing search strategies are:

- Organic

- Pay-per-click (PPC)

Strong marketing for mortgages involves a strategic combination of both.

Organic search is non-paid advertising, based on search engine optimization (SEO).

SEO involves optimizing your website so search engines like Google will rank you higher.

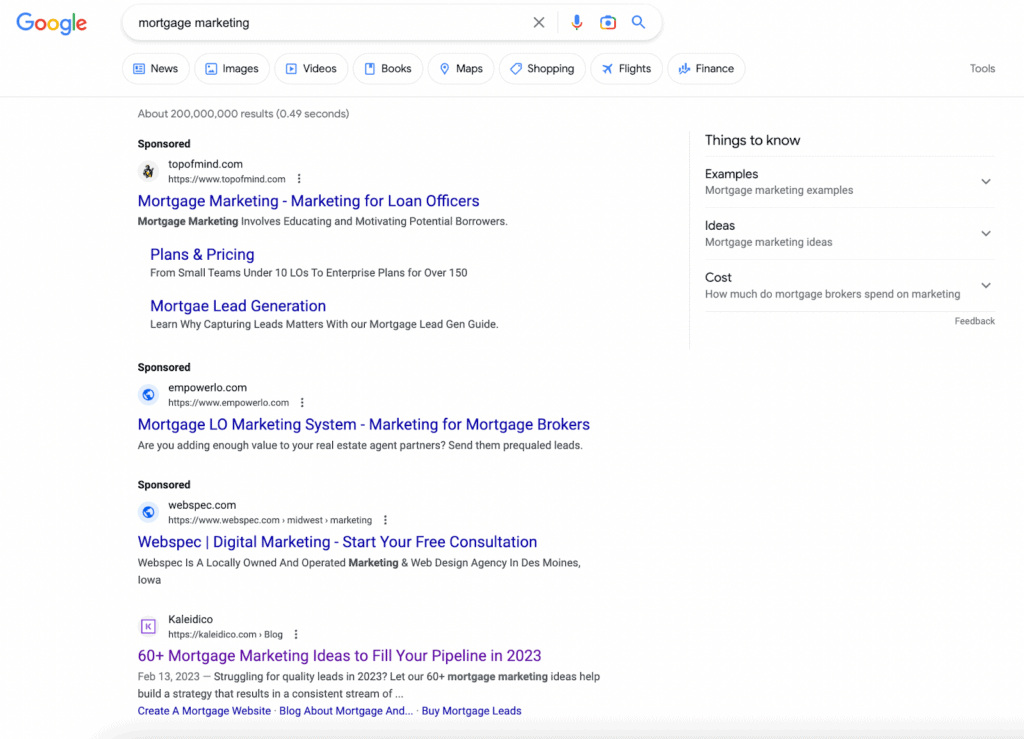

PPC is highly targeted to a specific keyword or phrase, and the results will show up above the organic search results on the search engine result page (SERP). You’ll pay a fee each time someone clicks on your ad.

PPC advertising is a quick and easy way to get potential borrowers with high intent.

See the Google search results below for the keyword “mortgage marketing.”

The first three results are paid. Note the “Sponsored” label above the URLs.

The first non-paid, organic result is from Kaleidico: 60+ Mortgage Marketing Ideas to Fill Your Pipeline in 2023.

Google Ads and Meta Ads — formerly known as Facebook Ads — are two of the most popular PPC platforms. Let’s take a look at the differences between these platforms.

Google Ads

Currently, if you start with $5,000 a month in Google Ad spend, you can expect to generate between 50-80 exclusive leads per month.

To ensure you’re spending your campaign’s budget wisely, stay geo-targeted around branches to avoid competing with the big lenders.

More sophisticated marketers and Google Ads managers also perform keyword research to see the specific terms their audience is looking for and learn which keywords their competitors are bidding on.

Now, we’ll warn you—Google Ads’ platform is overwhelming, and the online mortgage space is insanely competitive.

Learning the complete platform is a full-time job and is one of the hardest aspects of digital marketing for mortgage companies.

This is one of the many reasons why lenders rely on experienced digital mortgage marketing companies.

We know mortgage—Get 20 years of mortgage lead generation experience with Kaleidico.

Meta Ads

Depending on which mortgage lenders you ask, they might have a preference for leads created by Google Ads vs. Meta Ads.

Google leads are actively searching for mortgage terms, while Meta leads stumble upon sponsored posts scrolling through their News Feed as a form of “interruption marketing.”

This may result in lower quality leads because their intent isn’t as urgent, but Facebook’s PPC costs may be lower than Google’s and can result in a higher quantity of leads.

Other platforms

While Google and Facebook may be the most popular spaces to advertise, your business could see more success using other platforms, such as Instagram (which is also owned by Facebook), LinkedIn, or even TikTok.

SEO blogging for your website

SEO is important for your entire website, but the biggest traffic generator is going to be your SEO blog posts.

Your fresh, consistent, relevant blogs packed with appropriate keywords and images are how you’ll rank in Google and earn your free traffic.

Google’s top-ranking factors include:

- Mobile-optimized experience

- Overall user experience

- Content quality, relevance, and length (optimized content)

- Page speed

- Internal and external links

- Business information (Google Business Profile)

Your website’s placement in Google’s SERP is based entirely on your skills in planning and researching keywords, understanding your competitive space, and cranking out consistently great content using the same language your audience uses.

Of course, SEO, content marketing, and PPC advertising all tie into each other.

Keyword planning and search intent

Using a Keyword Planning Tool, you can actually see the frequency of search terms related to your industry.

You can see which search terms are the most popular and least popular, and use this as a starting point for developing blog posts and content using these search terms.

In oversaturated markets, you can use Keyword Planning to find underutilized search terms—those terms that don’t get that much traffic but show a great deal of intent. As a result, they often cost less to bid on, which helps stretch your campaign’s budget further.

There’s a big difference in intent when somebody searches for an “FHA loan,” vs. “help, I need a mortgage fast.”

Learn how to do a little keyword research, even if you just search Google.

Remember this one key rule: Be consistent and continuously produce content. It takes Google months to recognize this content and categorize it.

Besides blogging, here are some other types of engaging content you can get busy producing and optimizing:

- YouTube videos

- TikTok videos

- Instagram Reels

- Facebook surveys or polls

- Reddit posts

- Infographics

- Podcasts

- Webinars

- Quizzes

- Ebooks

- Newsletters

Let’s dig into more social media and video marketing content.

Social media

Social media marketing should be considered a branch of content marketing rather than its own separate entity.

That’s because social media is simply another platform for you to plan and share your content around and bring in more leads to your website.

There are dozens of social media websites, so don’t feel like you need to be an expert on all of them.

Some of the most popular websites include:

- YouTube

- TikTok

- Snapchat

As you get deeper into your digital mortgage marketing strategy, you’ll begin to learn more about the customers you’re targeting and where you’re likely to find them.

Use the social media research we listed earlier as a guide for where your clients are most likely to be based on age, but also perform your own research.

Survey your existing clients via email, your website, or one of your current social media platforms to ask them which channels they prefer.

You can even ask the clients who walk through your door which channels they use the most to gain insight into where you’re most likely to find and engage with them.

To get started, pick the ones you personally use, and you will naturally engage with your audience better.

Just like email marketing and content marketing, you’ll need to post fairly regularly. You can use your social media channel to share your website’s new blog post or provide timely news about changing mortgage rates.

Attract more qualified mortgage leads to your business with our results-driven marketing services.

Message responsiveness

Check your channel regularly. On many sites, message responsiveness matters and can help you stand out. You can use a social media marketing platform, such as Sprout Social, to help keep all comments and messages in one place.

For example, according to Facebook, the “very responsive to messages” badge shows people which pages respond quickly and consistently to private messages.

To get the badge, your page must achieve both of the following over the last seven days:

- A response rate of 90%

- A response time of 15 minutes

It helps tremendously to respond quickly to comments on your posts. I can’t tell you how many times I’ve discounted an unfamiliar business because they never appeared to check or reply to the comments and questions on their posts.

You also can use your social media channels to post good reviews or testimonials from happy clients.

Video marketing

Fortunately, video marketing is more accessible than ever, thanks to smartphones that can capture high-quality clips.

Most social media channels today are focused on video above all else because it yields impressive results.

Video marketers get 66% more qualified leads each year!

Ideally, you’ll use simple videos as your main driver in any social media channel you pick.

Videos give you the highest likelihood of success, and for good reason. You’re showing your face and your personality, and you’re forming an instant connection that is more powerful than just words.

Video content topics might include:

- Loan product informational videos

- Latest mortgage news and what it means for your clients

- Tutorials (how to apply for a mortgage, etc.)

- Video series on an in-depth mortgage topic or product

- Video testimonials

- Personal holiday messages or birthday greetings

You can pack a lot of information into a short video, which is what makes sharing and engagement so high with this type of content.

Check out the YouTube video above for an example of a mortgage professional using video to unpack the complexity of reverse mortgages for potential clients.

Film your videos in a comfortable, well-lit space, and be sure to practice if you’re not used to being in front of the camera. You want to come across as natural, friendly, and approachable as possible to turn those views into leads!

Local SEO on Google Business

To give your business’s local rank a boost, you’ll need to set up a Google Business Profile.

When someone types “mortgage lender near me” into Google search, Google will bring up local business results under “Places,” based on the user’s location.

You can significantly improve your ranking by simply creating a Business Profile and filling it out completely.

That means you’ll include the following information in your listing:

- Address

- Phone number

- Category

- Attributes

- Hours

- Photos

It also means that you will make sure to update it frequently as your business information changes, including address, phone number, or hours (including holiday hours), and that you reply to your Google reviews.

According to Google, your local ranking is based on distance, relevance, and prominence. The algorithm will take into account which factors best suit the search intent.

For example, if someone searches for a “VA loan mortgage lender,” and your business profile includes VA loans somewhere in the listing, your business is likely to show up ahead of a lender who is closer yet doesn’t call out VA loans.

Online mortgage companies can also set up an account if you service a specific location.

Plan regular checks to make sure all the information on your Business Profile is correct, to add new photos, or to check on the latest reviews. This simple step can keep a steady stream of leads flowing from local searches.

Mortgage advertising compliance

While you’re pulling together your digital mortgage marketing plan, don’t forget about compliance.

Mortgage professionals must be aware of the regulations surrounding mortgage advertising, including those found in Regulation Z and Regulation N.

The Truth in Lending Act, or Regulation Z, was enacted to make sure terms are disclosed and not misleading to consumers.

It involves transparency surrounding interest rates and the true costs of credit, plus information about the right to cancel certain loans within a set period.

Regulation N, or the Mortgage Acts and Practices Advertising Rule, is meant to prevent deceptive claims in advertising, such as an ad containing a low rate that doesn’t disclose that it’s only temporary.

If you’re not familiar with these laws, make sure you read them thoroughly. Some mortgage CRMs have tools to aid with compliance, or you can connect with an experienced digital marketing agency that understands mortgage advertising.

Failure to comply can result in a fine or worse, so make sure you’re following the rules.

Generate high-quality mortgage leads now.

Document your digital mortgage marketing plan

There’s a ton of information, ideas, and goals packed into a mortgage lending marketing plan.

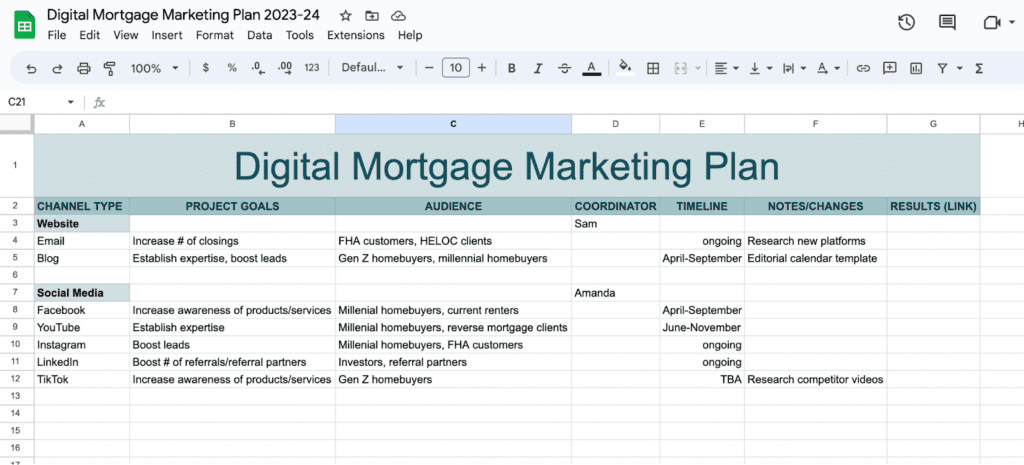

As you’re planning, start creating a spreadsheet that details these goals, channels, audiences, who’s in charge, and more.

Take a look at the spreadsheet template below for an example.

You can make the template as simple or involved as you need to be. It just needs to work for you, your team, and your goals.

In the example, we included the channel type, project goals, audience, coordinator, timeline, and notes.

As your strategy evolves, you will likely need to update the template frequently to add more advertising information, campaigns, the web development process, and the months you are running the campaigns.

Eventually, you may need a spreadsheet like the one above to keep tabs on all projects, and a separate loan officer marketing plan template for each individual project.

Editorial calendars

Editorial calendars are an example of those separate templates/sheets you may eventually need to create to keep tabs on all your content and projects.

An editorial calendar will help you coordinate content such as blog posts, social media content, advertisements, campaigns, and more.

You can create separate tabs within the calendar for each type of project, plus keep track of your keyword research, ideas, comments, and more.

Give calendar access to all relevant members of your team, because you can assign them tasks in the calendar and keep track of the statuses and due dates.

Of course, there are also many “all-in-one” project management tools and platforms available today that allow you to communicate with your team, collaborate, share documents, assign tasks, and much more, including:

- Asana

- ClickUp

- Trello

- Basecamp

- Monday.com

A simple spreadsheet may do the trick at first, but eventually, you may want to move your project planning to a more robust platform.

Adjust your digital marketing plan according to market trends

As you know, the mortgage industry is always changing.

Your mortgage loan marketing plan will need to follow the changes and adapt to the types of content and audiences that are most in demand during these changes.

The industry experienced a rapid transformation during and following the COVID-19 pandemic, and there’s no doubt you have experienced other massive changes throughout your career.

Keeping this in mind, understand that as the market changes, your audience’s needs will change, and your digital marketing plan will need some updates.

For example, we mentioned earlier that Gen Z became a significant percentage of homebuyers in 2022. Could you have predicted that based on the trends at the time? How did you respond to that shift?

How did you respond when home prices skyrocketed and customers rushed to cash out their equity?

Maybe you were too busy with leads to even navigate your mortgage company marketing strategy, but next time around, you’ll be prepared with a mortgage business plan for during and after the rush.

Fortunately, you can use your channels and your current clients to gain insight into these needs.

Surveys and questionnaires can also help you understand what your clients’ new pain points are, and how you can swoop in to help.

Major mortgage marketing trends in 2023

In addition to your industry’s trends, keep a close eye on general marketing trends and mortgage marketing trends.

Are you incorporating any of these top 2023 trends into your strategy?

- Personalized content

- Brand authenticity

- Influencer marketing

- Video content

- Voice search optimization

- Marketing automation

- Lead nurturing

One major trend in 2023 is artificial intelligence. What was once the stuff of science fiction is becoming more of a reality, and businesses big or small can take advantage of these tools.

Mortgage marketers are currently using AI in the following ways:

- Generating content ideas

- Automating tasks

- Analyzing data

- Analyzing loan applicants

- Improving customer service

Chatbots and conversational AI allow your customers to reach you 24 hours a day while also collecting valuable data you can use to provide more personalized content and campaigns.

If AI feels a little scary or inauthentic, just know that it’s only as good as what you’re putting into it. Use it to help you brainstorm or collect data, take what you can use, and disregard the rest.

Repeat what works and leave the rest to us

Rinse and repeat. Once you solidify your current digital mortgage marketing strategy, you can get to work crafting short, engaging videos, writing your drip campaign emails, writing relevant blogs, and keeping in touch with customers via social media.

If this seems like a lot to maintain, you’re right.

That’s why digital marketing agencies like Kaleidico exist. We understand the mortgage lending business and know how to generate leads for your company.

Our services include:

- Web design and development

- Lead generation

- Brand strategy

- Content marketing agency

We know mortgage—Get 20 years of mortgage lead generation experience with Kaleidico.

Photo by Karolina Grabowska from Pexels