What makes your mortgage company unique?

Is it your superior customer service, innovative loan products, or faster processing times?

The best mortgage marketing campaigns highlight these features, work to build trust and credibility with your brand, and ultimately drive lead generation and conversions.

In this article, we’ll look at successful campaigns and strategies within the mortgage industry—so you can get ideas for your marketing efforts.

What are the goals of successful mortgage marketing strategies?

The primary goal of mortgage marketing is to generate leads—potential customers who have expressed interest in obtaining a mortgage loan.

To generate highly qualified leads, effective mortgage marketing aims to:

- Educate potential borrowers about the mortgage process

- Differentiate the lender in the market

- Build lasting relationships

- Drive loan closures

The digital age has shifted from traditional, one-size-fits-all marketing to more targeted, interactive, and responsive strategies that meet the modern consumer’s expectations.

As technology advances, mortgage marketing strategies will likely become more personalized and integrated, emphasizing long-term engagement over short-term gains.

Elements of the best mortgage marketing campaigns

Successful mortgage marketing campaigns are built from the following key elements.

Target audience identification and segmentation

This process involves understanding potential customers, their specific needs, and how best to address them using demographic, behavioral, and geographic data.

Content that emphasizes trust, reliability, and expertise

The cornerstone of effective mortgage marketing is the trustworthiness and credibility communicated through its key messaging.

Since dealing with mortgages involves significant financial decisions, potential clients need to feel confident in their choice of lender.

Integration of digital and traditional marketing methods

Blending digital and traditional marketing methods allows mortgage companies to reach a broader audience and cater to various preferences, enhancing the overall effectiveness of their marketing campaigns.

Digital marketing strategies include content and social media marketing, while traditional marketing includes direct mail and events.

Best mortgage marketing campaigns: Examples

Your business’s best mortgage marketing campaigns will be unique to your goals and objectives.

Look at the following mortgage marketing examples to spark inspiration and creativity for your strategy.

You’ll never believe what this kid learned during the lockdown

Compass Mortgage’s YouTube video features a clever kid explaining their Get Committed program while stuck in the COVID-19 lockdown.

The video racked up over 430,000 views and offered a perspective of hope for the future while potential buyers were stuck at home.

Their prediction was also true—the housing market did get competitive post-lockdown, and prepared borrowers benefited from the message.

When preparing your own content, consider the unique perspective and insights you have to offer to your audience.

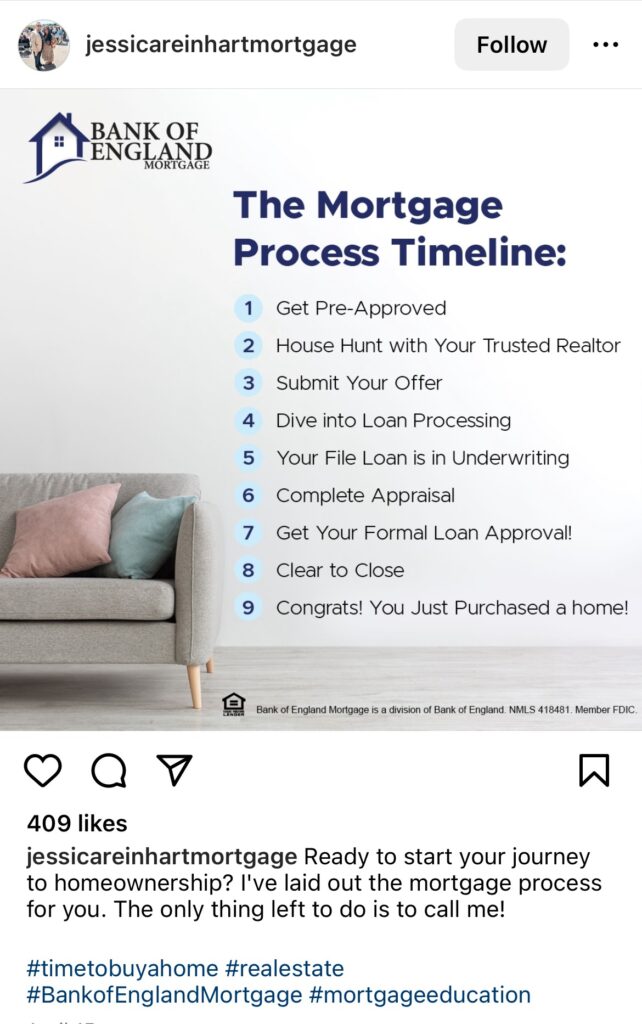

The mortgage process timeline

Not all marketing content needs a high production value—simple infographics provide useful information in an easily digestible format.

Mortgage lender Jessica Reinhart shares educational mortgage content on Instagram that is easily shareable and saveable.

Don’t forget your hashtags!

What challenges do foreign buyers face?

Marquee Funding Group creates YouTube Shorts to address the unique challenges and interests of different audience segments.

YouTube Shorts are an extremely popular video format in 2024.

They can only be up to 60 seconds long, forcing marketers to share the most relevant and important information with their viewers.

The viewer, in turn, loves the quick, simple format that cuts to the chase.

How mortgage lenders try to be sneaky

Nothing gets a viewer to stop and watch faster than an exposé—especially within your industry.

TikToker Theoni The Lender leverages her industry experience and insights to explain to her audience an often-overlooked detail on their loan estimate.

Her page is filled with quick, simple advice on all aspects of the mortgage process.

This type of content empowers your audience and builds trust by showing you are on their side. The video currently has over 1.4 million views.

Should you buy now or wait for rates to drop?

As a mortgage broker, lender, or loan officer, your unique experience and educated opinion is invaluable to your audience.

Many borrowers’ burning question in 2024 is whether they should buy now or wait to see if rates may improve.

Loan originator Kyle Seagraves answers these questions in his YouTube videos and through his education company, Win The House You Love LLC.

While YouTube Shorts certainly have their place in today’s TikTok-obsessed world, long-form videos also have just as valuable space.

The video currently has nearly 23,000 views.

Who says spring is the best time to buy a home?

Mark Davis – This Mortgage Guy on Facebook has a Homebuying Myth series where he addresses a common myth and explains the truth.

In a recent post, he addressed the myth that “Spring is the best time to buy a house,” explaining that the perfect time is whenever the buyer is ready.

A simple series backed by an engaging graphic invites conversation and sharing.

By offering value to your followers through helpful tips, you build trust and position yourself as an expert they can rely on.

Kaleidico can help you create innovative mortgage marketing strategies

Innovative mortgage marketing strategies weave together a strong online presence with effective storytelling and educational content that informs and empowers.

With our tested framework, we know that digital marketing and lead generation strategies need to evolve with your business.

We’re your partner in strategizing where your marketing efforts will get you the best results.

Best mortgage marketing campaigns FAQ

The best places to advertise mortgages include online platforms such as social media sites, search engines using PPC (pay-per-click) campaigns, and local real estate websites.

Additionally, leveraging financial blogs, email marketing, and partnering with real estate agents can significantly expand reach and effectiveness.

To attract more mortgage businesses, build a strong online presence, use SEO to enhance visibility, engage with potential clients through social media, and provide exceptional customer service.

Developing referral programs and partnerships with real estate professionals can lead to more client referrals and business growth.

Mortgage customers seek trust, transparency, and a straightforward process when choosing a lender.

They value clear information about loan options, costs, and terms.

Efficient, personalized service that addresses their specific financial situations and goals is also highly important to them.