Mortgage advertising has always been about standing out from the competition, but this has become more difficult to accomplish in the digital world.

You’re on a level playing field with your competitors, with everyone targeting the same audiences on similar platforms.

Your audience’s feeds are saturated with content, and your sales and marketing teams are exhausted from trying to be bigger, better, and edgier than everyone else.

Here’s the good news: You don’t have to be bigger, better, or edgier than everyone else.

You just have to show up as yourself and tell your unique story in a way only you can.

With a mix of digital and traditional mortgage advertising strategies, you can take a more personal, engaged approach to content that naturally draws the right people to your services.

In this guide, we’ll walk you through mortgage advertising in 2024—from building a foundation to executing high-impact campaigns.

Schedule a Discovery Session

Learn how to attract new leads and clients.

What is mortgage advertising?

Mortgage advertising includes the strategies mortgage brokers, lenders, and loan officers use to promote their products and services to potential homebuyers, refinancers, or investors.

It aims to capture attention and drive action from individuals who are either in the market for a mortgage or will be soon.

What is the goal of mortgage advertising?

Borrowers have more options than ever before.

Whether they’re shopping for competitive rates, specific mortgage products, or advice on the home-buying journey, mortgage professionals need to be able to meet their target customers where they are on their journey.

Your mortgage advertising goals might include:

- Lead generation: Generate a steady stream of qualified leads to maintain a consistent flow of deals

- Brand visibility: Helps your brand stay visible on the platforms where potential clients are already searching, making you a trusted resource when they’re ready to take the next step

- Direct conversions: Advertising delivers faster outcomes, with clear calls to action (CTAs) that prompt potential clients to engage immediately

- Competitive edge: Whether you’re competing against large financial institutions or fellow brokers, successful mortgage marketing ensures you have a seat at the table when borrowers are making decisions

Effective advertising strategies begin by establishing your brand as a trusted industry leader, which will naturally help you attract qualified borrowers.

Elements of successful mortgage advertising campaigns

Successful mortgage advertising campaigns deliver the right message to the right audience at the right time.

No matter which channel you’re focusing on, certain core elements determine whether your campaign will convert leads or fail.

Let’s break down the key elements that make mortgage marketing campaigns successful.

Clear, compelling messaging

Your messaging is how you communicate the value of your mortgage services to potential clients.

Successful campaigns have clear, straightforward messaging that directly addresses your target audience’s needs and pain points.

Audience segmentation

Different audiences have different needs, from first-time homebuyers to real estate investors.

Audience segmentation allows you to divide your target market into groups based on age, income, location, or buying intent, enabling you to deliver more personalized and relevant ads.

Strong visuals and design

In digital advertising, visuals are often the first thing a potential client notices.

Strong visual elements can make your ads stand out in crowded platforms, grabbing attention and encouraging people to engage with your message.

SEO and keyword optimization

Search engine optimization (SEO) plays a major role in getting your ads noticed.

Proper keyword optimization helps ensure that your ads appear in front of the right people when they search for mortgage-related terms.

Landing page alignment

Your ads are only as good as the landing pages they lead to.

When potential clients click on your ad, they should arrive on a page that reinforces your messaging and guides them toward conversion, such as filling out a form or booking a consultation.

Compass Mortgage’s cash-out refinance landing page includes a brief description, a list of benefits, and two CTAs above the fold.

Data-driven decision making

Successful mortgage advertising campaigns are not a one-size-fits-all effort—they require ongoing analysis and refinement based on real data.

By regularly monitoring your campaign performance, you can identify what’s working and what’s not, then adjust accordingly.

Consistency across channels

Mortgage marketing campaigns are often run across multiple channels, including Google, social media, and email.

Maintaining consistency in your messaging, design, and offers across all channels ensures that your audience has a cohesive experience, no matter where they encounter your brand.

Clear and measurable goals

Effective campaigns start with clear goals that define what success looks like.

Whether your objective is to drive more leads, increase brand awareness, or boost your ROI, having measurable goals helps you stay focused.

SEO and mortgage advertising: Building a strong foundation

Mortgage advertising and SEO go hand in hand.

While paid advertising can generate quick results, combining it with a robust SEO strategy builds long-term, sustainable visibility for your mortgage business.

To build a strong SEO foundation, consider the following strategies:

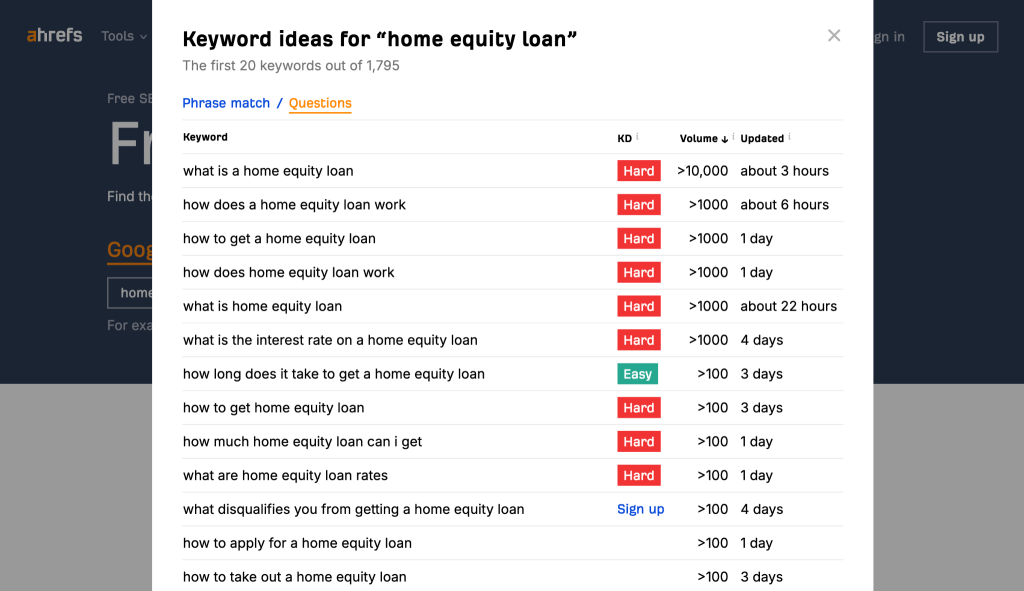

- Perform keyword research: Start with a keyword research tool like Google Keyword Planner, Semrush, or Ahrefs to identify high-traffic keywords relevant to your services.

- Align SEO with paid search campaigns: The keywords you’ve identified through your research should be mirrored in your pay-per-click (PPC) ad copy and targeting.

- Create SEO-optimized content: Develop keyword-rich blog posts, guides, and resources that provide valuable information to your audience.

- Leverage on-page SEO optimization: Make sure your page titles and meta descriptions are compelling and include your target keywords.

- Earn backlinks from authoritative sites: Create high-quality, shareable content like mortgage guides, infographics, and case studies that other websites link to.

Ahrefs’ Free Keyword Generator tool shows users how difficult it may be to rank for a certain keyword phrase or question.

SEO strengthens your overall advertising efforts by helping you attract the right audience and convert them into loyal clients.

AI and automation’s role in today’s mortgage advertising

Artificial intelligence (AI) and automation have become game-changers in mortgage advertising, allowing mortgage professionals to deliver more personalized experiences and achieve better results with less manual effort.

Let’s look at how AI and automation are used in mortgage marketing today.

Personalization at scale

One of the most significant advantages of AI in mortgage advertising is its ability to analyze vast amounts of data to identify the most relevant audiences.

AI algorithms can pinpoint patterns in user behavior, demographics, and online activities, allowing you to target your ads more precisely and personalize them on a large scale.

Content creation and optimization

AI and automation tools can streamline the creation and optimization of mortgage advertising campaigns, significantly reducing the time and effort required to design, launch, and refine ads.

These tools can generate copy, suggest visual elements, and even adjust bids in real-time to improve performance.

Chatbots and lead nurturing

AI-powered chatbots and automation tools can help mortgage professionals nurture leads more effectively by providing instant responses to inquiries and guiding users through the initial stages of the mortgage process.

Chatbots can answer common questions, collect lead information, and even schedule appointments—all without human intervention.

The power of personal branding

In an industry as competitive as mortgage lending, personal branding is a key differentiator for mortgage professionals.

While mortgage rates and loan products may be similar across lenders, personal branding can transform how clients perceive you, moving beyond transactional relationships to foster long-term loyalty.

How to create a personal brand

For mortgage brokers, lenders, and loan officers, personal branding involves communicating your values, expertise, and personality in a way that resonates with your target audience.

Start building your brand with the following steps:

- Identify your unique value proposition (UVP): What do you offer that others don’t? Defining this clearly helps position you in the minds of potential clients.

- Choose your brand tone and messaging: This should align with your UVP, such as a conversational tone to build trust or a more polished tone for luxury investments.

- Stay consistent: Whether running a social media ad, writing a blog post, or sending an email, your audience should always recognize that it’s you behind the message.

Incorporating your brand into your marketing

Every piece of content you create should reflect the key elements of your brand.

The most effective ways to leverage your personal brand in your marketing is by featuring yourself in your content, sharing your personal journey, and showcasing client stories and testimonials.

Social media is also important for strengthening your personal brand and building a loyal following.

How to craft high-impact campaigns

Now that you know the key elements of successful mortgage campaigns and the crucial role of SEO, AI, and personal branding in today’s strategies, let’s dig into the meat of this guide: How to actually create mortgage campaigns that convert.

To succeed, mortgage professionals must focus on strategic planning, messaging, design, and optimization.

This section will break down each step of the process to help you build campaigns that deliver results.

1. Set clear objectives for your campaigns

Successful campaigns begin with a clear understanding of what you want to achieve.

Your objectives will guide the entire campaign, from the messaging you use to the platforms you choose.

Start by:

- Defining your specific goals: Set clear, measurable goals such as increasing lead generation by 20%, lowering cost-per-lead (CPL), or driving 50 new applications in a month.

- Determining your target audience: Identify who you want to reach, such as first-time homebuyers, real estate investors, those looking to refinance, etc.

- Selecting your key performance indicators (KPIs): Decide how you’ll measure success so you can track and optimize performance as the campaign runs.

KPIs for mortgage campaigns might include conversion rates, cost per acquisition, click-through rates, etc.

2. Understand your audience and competitors

To craft effective campaigns, you need to understand not just who your audience is but what they care about, how they search for mortgage information, and how your competitors are positioning themselves.

This will offer you a well-rounded view of who you are targeting, and how your competitors are interacting and engaging with these targets.

Begin with the following strategies:

- Buyer personas: Create detailed buyer personas that outline your ideal clients’ challenges, goals, and motivations, and use this information to personalize your campaigns.

- Audience segmentation: Divide your audience into segments based on demographics, income level, homebuying status, or location.

- Competitor analysis: Study your competitors’ advertising strategies, including their messaging, ad formats, and platforms.

One of the best ways to stand out in a crowded market is to identify gaps in your competitors’ strategies, or areas where you can offer something they don’t.

Create your targeted messages

Your messaging is the most critical element in your campaign, as it determines how your audience perceives your offer and whether they take action.

To craft the most targeted messages, consider the following tips:

- Highlight key benefits, not just features: Instead of focusing solely on your mortgage rates or loan options, explain how those products can solve a problem or fulfill a need (for example, “Secure your dream home with rates as low as X%” or “Refinance to save up to $500 per month”).

- Tailor your messaging for each audience segment: For first-time homebuyers, focus on education and simplicity, and for investors, emphasize ROI and flexibility.

- Create a sense of urgency: Limited-time offers, exclusive rates, or special incentives (for example, “Apply by [date] and lock in today’s low rates” can encourage immediate action).

Create content that captures attention

Eye-catching visuals, clear typography, and strong CTAs are major drivers of engagement in a crowded digital world.

The following strategies can help you achieve the attention you need:

- Focus on visuals that resonate with your audience: Personalized photos create emotional connections—use images that reflect the homebuying journey.

- Keep it simple: Avoid clutter—a clear message, a striking visual, and a compelling CTA are all you need.

- Incorporate branding: Use consistent colors, fonts, and your logo to reinforce brand recognition across platforms.

- Use dynamic ad formats: On social media, experiment with formats like carousel ads, video ads, or Instagram Stories to capture attention and keep viewers engaged longer.

Optimize your landing pages for conversions

No matter how compelling your content is, it must have a strong purpose.

With mortgage advertising, your content should ideally lead to optimized landing pages, encouraging users to take the next step.

The landing page should be designed with conversion in mind, including:

- Consistency between ad and landing page: The messaging, visuals, or offer to align with a landing page that provides the same details.

- Simple design: Your landing page is free of distractions, intending to encourage the user to fill out a form, schedule a consultation, or apply for a loan.

- Strong CTA: The landing page CTA is prominently displayed and uses clear, action-oriented language, such as “Get Pre-Approved Today” or “See How Much You Qualify For.”

- Mobile-optimized: Many users will visit your landing page from their mobile devices, so make sure the design is responsive and loads quickly.

Leverage the formats and platforms that work

Not all platforms or ad formats are equally effective for mortgage advertising.

Identify which formats work best for your audience and use them strategically.

The strongest formats and platforms for mortgage audiences include:

- PPC campaigns

- Social media advertising

- Video

- Retargeting ads

In the next section, we’ll dig into each of these formats and platforms in more detail.

7. Test, adjust, and scale

High-impact campaigns require ongoing testing and optimization to maximize performance.

You can refine your strategy and scale what works by testing and analyzing campaign data, including A/B testing, monitoring key metrics, and allocating your budget to the most effective platforms and formats.

Ad formats and platforms that convert

Different platforms offer unique advantages, and your chosen formats should align with your campaign goals, target audience, and desired outcomes.

This section will explore the most effective ad formats and platforms that consistently convert in the mortgage industry.

PPC campaigns (Google Ads)

PPC campaigns on Google Ads are an effective way to capture high-intent leads who are actively searching for mortgage solutions.

These ads appear at the top of search engine results pages (SERPs), making them highly visible to potential clients.

Google Ads allows you to target specific search queries, ensuring that your ads reach users looking for terms like “best mortgage rates,” “home loan options,” or “mortgage lenders near me.”

Strategies for success

- Focus on long-tail keywords to attract more qualified leads with higher intent, such as “low down payment mortgage in [city].”

- Write compelling ad copy that directly addresses the searcher’s need and offers a solution, such as “Get pre-approved in minutes with our low interest rates.”

- Optimize bids to ensure your ads appear in premium positions for high-intent searches.

Organic SEO efforts can take time, while PPC campaigns provide instant visibility for your services and ensure your brand appears when potential clients are searching.

Social media advertising

Social media platforms offer highly targeted advertising options based on demographics, interests, and behaviors.

Facebook, Instagram, and LinkedIn ads allow mortgage professionals to reach specific audiences while building brand awareness.

Key benefits of social media advertising

- Precise targeting: Social media platforms allow for detailed targeting based on a user’s location, age, income level, home-buying interests, and more.

- Visual and engaging formats: Social media ads can include images, videos, carousels, and Stories, allowing you to create visually compelling content that captures attention and encourages interaction.

- Retargeting: Social media excels at retargeting, allowing you to reach users who have visited your website or interacted with your content and encouraging them to return and convert.

Carousel ads, video content, and audience segmentation are three killer strategies for showcasing mortgage products and client success stories to the right people at the right time.

Video ads

Video ads are one of the most engaging formats, providing an opportunity to connect with potential clients through dynamic storytelling.

Video is a superior content format for the following strategies:

- Explaining complex topics: Mortgage products can be complicated, and video is a great medium for breaking down the process in an easily digestible format

- Building trust: Video helps humanize your brand, allowing potential clients to see and hear from you directly, building trust and credibility

Tips to maximize engagement on social media

- Keep videos concise (30-60 seconds), and make sure they include a clear CTA, such as “Get Pre-Approved Now” or “Learn More About Our Rates.”

- Feature client testimonials or success stories in your video ads to show real-world results.

- Use YouTube targeting to reach users based on their search history, demographics, and behavior.

This type of ad tends to have higher engagement rates than static images or text-based ads.

Platforms like YouTube, Facebook, and Instagram offer prime spaces to capture user attention.

Retargeting ads

Retargeting ads are displayed to users who have previously visited your website or engaged with your content but haven’t yet converted.

These ads keep your mortgage services at the top of your mind and encourage users to return and take action.

Why is retargeting effective?

Retargeting strategies yield the following benefits:

- Personalized follow-ups: Retargeting lets you remind users of the services they viewed, offering them additional information or incentives to return and convert.

- Higher conversion rates: Since retargeting ads target users who have already shown interest in your services, they are more likely to convert than first-time visitors.

- Cross-platform reach: Retargeting can be used across multiple platforms, helping your brand stay visible wherever users spend their time online.

Strategies for success with retargeting

- Use dynamic retargeting ads that display content based on the specific pages or services a user viewed.

- Offer special incentives, such as discounts on closing costs or rate guarantees, to encourage users to return and complete the action.

- Set frequency caps to avoid overwhelming users with too many retargeting ads.

Email marketing

Email marketing remains one of the most effective platforms for nurturing leads and converting them into clients.

By delivering personalized, relevant content directly to potential borrowers, you can build trust and guide them through the mortgage process.

Top benefits of email marketing

- Personalization: Email allows you to send tailored content to specific audience segments, such as first-time homebuyers or those wanting to tap into their home equity.

- Lead nurturing: Email is an excellent tool for keeping potential clients engaged over time, such as someone who isn’t ready to apply for a mortgage immediately but will be in the future.

- High ROI: Email marketing has one of the highest returns on investment of any marketing channel, making it a cost-effective way to maintain contact with leads.

The most important strategies for email marketing are to:

- Segment your list based on lead status or interest.

- Use automated sequences to follow up with leads after they perform certain trigger actions, such as after they’ve filled out a form.

Don’t forget to include strong, clear CTAs in every email, such as “Schedule a Consultation” or “Find Out How Much You Can Save.”

Tracking and optimizing your campaign performance

Once you’ve launched your mortgage advertising campaigns, the real work begins: tracking their performance and making necessary adjustments to maximize results.

Tracking key performance metrics helps you identify what’s working, what needs improvement, and where to optimize your ROI.

Continuous optimization ensures your campaigns remain relevant, efficient, and cost-effective.

Let’s evaluate the steps to track and optimize your mortgage advertising campaigns for maximum impact.

1. Identify your KPIs

KPIs are the metrics that indicate how well your campaign is performing.

Identifying the right KPIs helps you measure success accurately—and optimize accordingly.

Some of the most important KPIs you may want to track include:

- Cost per lead (CPL): This metric tracks how much you spend to acquire each new lead. A lower CPL indicates that your ads effectively drive interest at a lower cost.

- Click-through rate (CTR): CTR measures the percentage of people who click on your ad after seeing it. A higher CTR indicates that your ad copy, visuals, or targeting resonates with your audience.

- Conversion rate: This tracks how many of the leads generated by your campaign take the desired action, whether filling out a form, scheduling a consultation, or applying for a loan. A strong conversion rate means your landing pages and overall ad messaging are aligned with your audience’s needs.

- Return on ad spend (ROAS): ROAS measures the revenue generated for every dollar spent on your ads. For example, if you spend $1,000 on a campaign and generate $5,000 in loan originations, your ROAS is 5:1.

- Lead quality: Not all leads are created equal. Tracking lead quality involves understanding the long-term value of leads, the likelihood of them converting into clients, and how closely they match your ideal buyer profile.

2. Use analytics tools to track campaign performance

Analytics tools provide real-time insights into how your campaigns perform across different platforms.

These tools can help mortgage professionals make data-driven decisions that enhance your campaigns.

Top analytics tools in 2024 include:

- Google Analytics: This tool gives you the ability to track traffic to your landing pages, monitor user behavior, and see which campaigns are driving the most traffic, how long users stay on your page, and whether they complete desired actions.

- Ad platform dashboards: Platforms like Google Ads, Meta Ads Manager, and LinkedIn Campaign Manager provide detailed performance data, including impressions, clicks, CTR, and conversions.

- CRM integration: Integrate your Customer Relationship Management (CRM) system with your ad platforms to track leads as they move through the sales funnel.

- Heatmaps and user behavior tools: Heatmaps show where users click, how far they scroll, and which elements capture attention, which can be used to optimize landing page design for better conversion.

3. A/B testing to optimize campaign elements

A/B testing, or split testing, allows you to test different variations of your ads or landing pages to see which performs better.

You can test headlines, descriptions, CTAs, visuals, and landing page layouts to determine which elements resonate most with your audience.

Run each test for a set period or until you’ve gathered enough data to make a statistically significant decision.

4.Optimize ad budget and bidding strategies

Optimizing your budget and bidding strategy ensures you get the most out of your ad spend.

It involves making data-driven adjustments to how much you’re willing to pay for clicks or conversions and reallocating your budget to the best-performing campaigns.

Suggestions for improving your strategies

- Adjust bids for high-performing keywords

- Lower bids for underperforming ads

- Reallocate budget to top-performing platforms

5. Monitor audience engagement and adjust targeting

Audience behavior can change over time, so it’s important to regularly monitor engagement and refine your targeting to ensure your ads remain relevant and effective.

This might involve:

- Adjusting your audience segments: Analyze which audience segments are converting the most and which aren’t

- Excluding irrelevant audiences: If certain demographic groups or locations are consistently underperforming, consider excluding them from your campaigns to avoid wasting ad spend

- Retargeting engaged users: Use retargeting to stay in front of leads who have already interacted with your ads or visited your website and create segmented retargeting ads based on their previous behaviors

6. Optimize ad creatives and messaging

The creative elements of your ad, such as headlines, images, videos, and CTAs, play a key role in engagement and conversion.

Regularly reviewing and refreshing your creatives can prevent ad fatigue and ensure you deliver relevant messages.

Swap out your old visuals for fresh images or videos, update your ad copy to reflect what’s currently relevant to your audience, and take advantage of seasonal or timely offers.

7. Continuously analyze and improve

Optimization is an ongoing process.

To maintain high-performing campaigns, you must regularly review performance data and make changes to improve your results.

Schedule weekly or bi-weekly reviews of your campaign performance. Focus on key metrics and identify areas for improvement.

Even if your campaign is performing well, there’s always room for improvement—continuously test new messaging, creatives, and targeting to find new opportunities for optimization.

Ready to close more loans and grow your business?

It all starts with the right leads.

Successfully managing and converting those leads requires smart sales techniques and strategic marketing efforts.

That’s where we come in.

With our hands-on team of experts, you’ll get the desired results—generating internet leads and moving them through the sales funnel to close more loans.

Frequently asked questions about mortgage advertising

Mortgage marketing refers to the strategies and techniques mortgage professionals use to promote their services and attract potential borrowers.

It includes digital marketing tactics like SEO, social media, email campaigns, paid ads, and traditional methods like direct mail and networking.

Yes, mortgage rates can be advertised, but complying with regulations is important.

Ads must clearly state key terms, and lenders should avoid misleading claims.

Rates can be promoted through digital ads, websites, email, and print materials, but must be presented transparently.

You can market your mortgage business through digital channels like SEO, social media, paid advertising, and traditional methods like direct mail and referral programs.

Creating valuable content, building a strong personal brand, and engaging with your target audience can boost visibility and attract leads.

Focus on lead generation through SEO, PPC ads, and social media marketing to get more clients.

Build strong relationships through networking, referral programs, and personalized email campaigns.

Providing value through educational content and creating trust through excellent customer service is also key to attracting more clients.