What do the best mortgage marketing campaigns have in common?

Successful campaigns are meticulously planned with a clear understanding of the target audience, compelling messaging, and consistent branding.

But that’s not all.

In this article, we’ll explore the best mortgage marketing campaigns and the key takeaways so you can implement these strategies in your own campaigns.

What makes a mortgage marketing campaign successful?

Successful mortgage marketing campaigns are typically designed around certain objectives, varying depending on the company’s goals and the market context.

Common mortgage marketing campaign objectives include:

- Increasing brand visibility: Strategies aimed at making the brand more recognizable and top-of-mind among potential customers

- Lead generation: Includes converting website visitors into leads or encouraging prospects to make contact through calls or emails, thus filling the sales pipeline with potential clients

- Customer retention: Campaigns might focus on engaging existing customers with personalized communication, offering refinancing options, or providing valuable advice and support

Once you have established your objectives, you must be able to identify your target audience, such as first-time buyers, existing homeowners, or real estate investors.

These target demographics have specific pain points, needs, and interests you can thoroughly address in your campaigns.

Key elements of successful campaigns

Effective campaigns share the following elements:

- Creative messaging and branding: These elements help create a memorable brand identity that resonates with potential customers and distinguishes the brand in a crowded market

- Digital marketing techniques: Strong SEO, content marketing, and social media strategies

- Integration of advanced technologies: Efficient use of customer relationship management (CRM) systems, marketing automation tools, analytics tools, and AI

Together, these elements form the backbone of successful mortgage marketing campaigns, leveraging creativity, digital prowess, and technological integration to effectively reach and convert potential customers.

Key takeaways from the best mortgage marketing campaigns

Now that we’ve examined the elements that make up successful campaigns let’s dive into the best campaigns—and the key takeaways for your own mortgage marketing strategies.

Viral trends

“I’m a loan officer—of course, I’m going to stop you if you tell me you want to buy a car three days before closing!”

The “Of Course” trend, circulating on TikTok, Instagram Reels, and Facebook Reels, playfully leverages stereotypes about professions or identities.

Rocket Mortgage jumped on this trend with the caption, “Just another day in the life of a loan officer—expect the unexpected!”

Key takeaways: Viral trends can be highly effective for mortgage marketing campaigns because they encourage engagement and can increase your brand visibility quickly.

Additionally, by participating in popular trends, mortgage companies can appear more relatable and down-to-earth, which helps build trust with younger demographics who value authenticity and personality in brands.

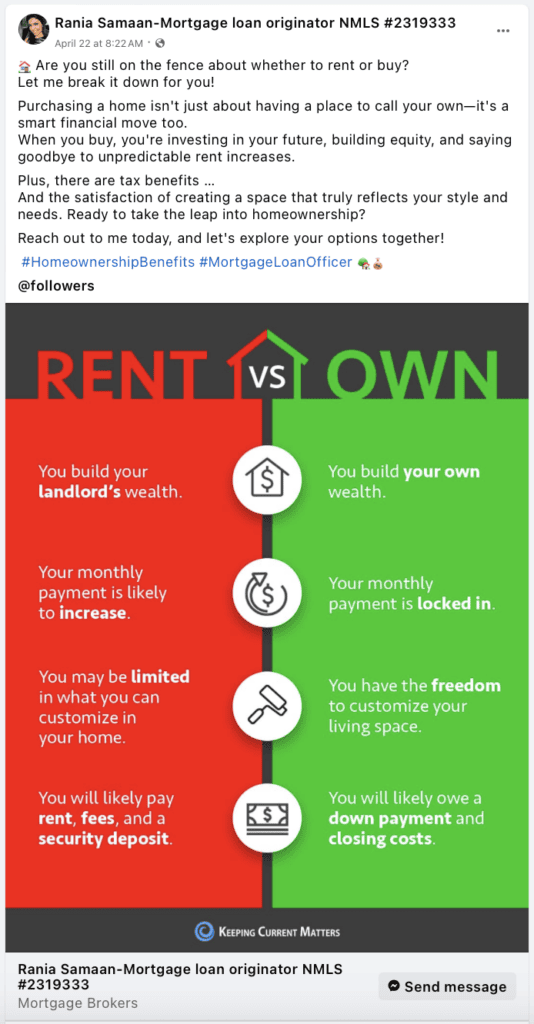

Rent vs. own

The “rent vs. own” theme in mortgage marketing addresses a common pain point for homebuyer hopefuls.

In the current market, many people believe they cannot afford a home and must continue renting.

But how many of these renters can actually afford a home and have just been led astray by misinformation?

Key takeaways: By taking your own spin on the “rent vs. buy” theme, you can create a content series focused on breaking down homebuyer myths and helping your prospects understand what they can actually afford.

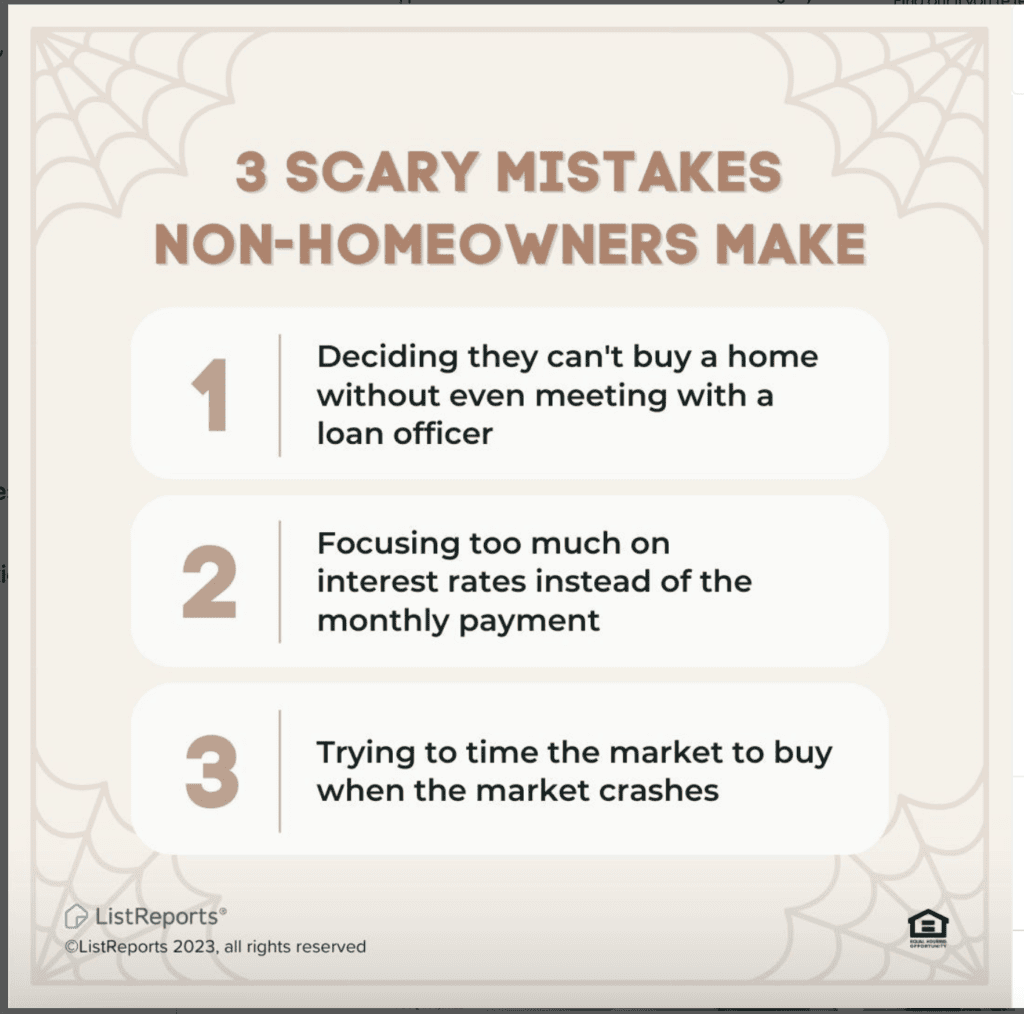

Holiday theme

People tend to be more receptive to messages that are timely and relevant.

Holiday-themed campaigns can capitalize on this by aligning with what is already on people’s minds.

Key takeaways: Holidays offer unique opportunities for creative and visually appealing marketing materials.

Campaigns can feature holiday-themed imagery and messages that stand out, attract attention, and are more likely to be shared, increasing their reach.

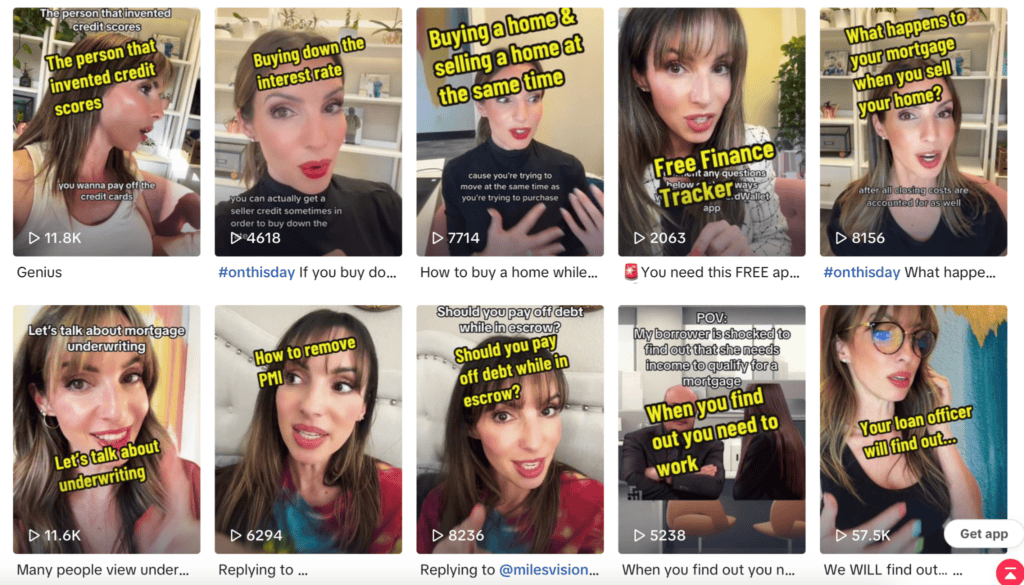

Education

TikToker @mortgagemandy creates educational content to simplify the mortgage process and bust common myths in an engaging and entertaining format.

Past topics include:

- Do lenders charge to pull your credit?

- Can you refinance without an appraisal?

- What the mortgage process looks like if you’re self-employed

- Day in the life of a loan officer

The quick, simple TikTok format is easily digestible for scrollers and provides valuable information in an informal setup.

Key takeaways: Mortgage brokers, lenders, and loan officers should remember the wealth of knowledge they have gained from years of experience.

What may seem like a no-brainer to you could be a source of major anxiety for a prospect.

Take stock of the common and strange questions you have gotten as a mortgage professional to use for future content.

The point is to make the mortgage process accessible to build trust.

Direct mail

Direct mail is an underrated strategy in 2024.

According to PostcardMania, both older and younger groups respond “overwhelmingly well” to direct mail and say it influences their buying behavior. Direct mail resonates with younger audiences because they have grown up with digital messaging and find mail unique.

In the example above, a local broker sends a regular “Home Guide” newsletter with home trends, tips, and advice—plus a recipe on the back.

Key takeaways: Physical mail stands out to recipients and keeps you in mind.

If nothing else, they will be more likely to recognize your face or logo when they’re someday seeking your services.

FAQ series

FAQs answer potential clients’ most common questions and concerns about mortgages.

By addressing these directly, a mortgage company can alleviate uncertainties and make the home buying or refinancing process more approachable.

In the above series, mortgage lender Allison Larson has created a playlist on YouTube that includes individual videos answering questions like, “What is earnest money?” and “When do I lock my interest rate?”

Of course, video is just one of many suitable formats for an FAQ. You can use these topics to create articles, infographics, or other engaging content.

Key takeaways: Providing clear, helpful, and accurate information establishes a company as a credible authority in the mortgage industry.

Trust is crucial in financial matters, and an informative FAQ series can position the company as a reliable source of mortgage information.

Events

In-person or virtual events allow mortgage companies to engage directly with potential clients.

This interaction helps build relationships and trust, crucial in the mortgage industry, where personal connections often influence client decisions.

In the above series, mortgage lender Allison Larson has created a playlist on YouTube that includes individual videos answering questions like, “What is earnest money?” and “When do I lock my interest rate?”

Of course, video is just one of many suitable formats for an FAQ. You can use these topics to create articles, infographics, or other engaging content.

Key takeaways: Providing clear, helpful, and accurate information establishes a company as a credible authority in the mortgage industry.

Trust is crucial in financial matters, and an informative FAQ series can position the company as a reliable source of mortgage information.

Events

In-person or virtual events allow mortgage companies to engage directly with potential clients.

This interaction helps build relationships and trust, crucial in the mortgage industry, where personal connections often influence client decisions.

Best mortgage marketing campaigns FAQ

To increase mortgage business, enhance online presence through effective SEO, engage potential clients with educational content, leverage social media platforms, and maintain strong relationships with current clients for referrals.

Hosting informative events can also significantly boost visibility and credibility.

Mortgage customers primarily seek clarity, reliability, and competitive rates.

They value transparent communication about the mortgage process, a straightforward application procedure, and personalized service that addresses their specific financial situations and needs.

Recent mortgage trends include the increasing use of technology like AI and machine learning for streamlined processing and risk assessment, a rise in demand for more flexible and personalized mortgage products, and a growing preference among younger homebuyers for digital-first home buying experiences.