Everybody knows that M = P [ i(1 + i)n ] / [ (1 + i)n – 1].

Just kidding, nobody knows what that means. Of course, this algebraic formula is used for practically every mortgage calculator online.

So why include a mortgage calculator on your website?

Because today’s mortgage rates are constantly changing, and home buyers are searching for mortgage calculators online — making mortgage calculators a crucial aspect of mortgage marketing.

Given the choice between two potential mortgage lenders — one that offers a mortgage calculator on its website and one that doesn’t, which website do you think will get more engagement and collect more leads? Exactly.

In this article, I’ll talk about how mortgage calculators work, explain the most popular types of calculators and include tips on how you can promote your calculator online to generate the most amount of leads.

How do mortgage calculators work?

Mortgage calculators simplify the entire process for prospective homeowners trying to find their monthly repayment summaries, determine APR, find our amortization schedule, and more. They also allow your readers to play around with different loan types to find the best loan that makes sense for their financial situation.

I referenced the equation “M = P [ i(1 + i)n ] / [ (1 + i)n – 1]” earlier. Let’s actually break down what this is calculating.

- M is for the monthly mortgage payment. This is the ultimate goal — determining the monthly payment.

- i is for the interest rate, shown as the monthly percentage

- P is for principal, the total amount of your loan

- n is the total amount of months to pay off the loan

If you thought running that equation was difficult enough, there are even more factors that should probably be included in your mortgage calculator, such as:

- Home value

- Down payment amount

- Property tax

- PMI

- HOA

- Loan type

Schedule a Discovery Session

Learn how to generate mortgage leads.

How do mortgage calculators generate leads?

If you’re fearful of adding a mortgage calculator to your website thinking it will scare off people when they see high-interest rates, don’t be!

Adding a mortgage calculator to your website can act as a “lead magnet.”

This means that when visitors use your mortgage calculator, they’ll need to enter their email addresses in order to receive their mortgage calculation results.

Of course, you could just provide this information freely when they press the “Calculate” button, but that would be a missed opportunity to generate a lead.

Instead, it’s better to make your reader enter their email address to see their mortgage results. This accomplishes a few things:

- Qualifies your lead because they’re willing to enter their email address

- Collects their email address, adding to your existing email list database

- Kicks off drip email campaigns to automate the lead nurturing process

What are the different types of mortgage calculators available?

Because there is more than one type of mortgage loan, there are multiple types of mortgage calculators.

Below are the most commonly searched mortgage calculators that you should consider adding to your mortgage website.

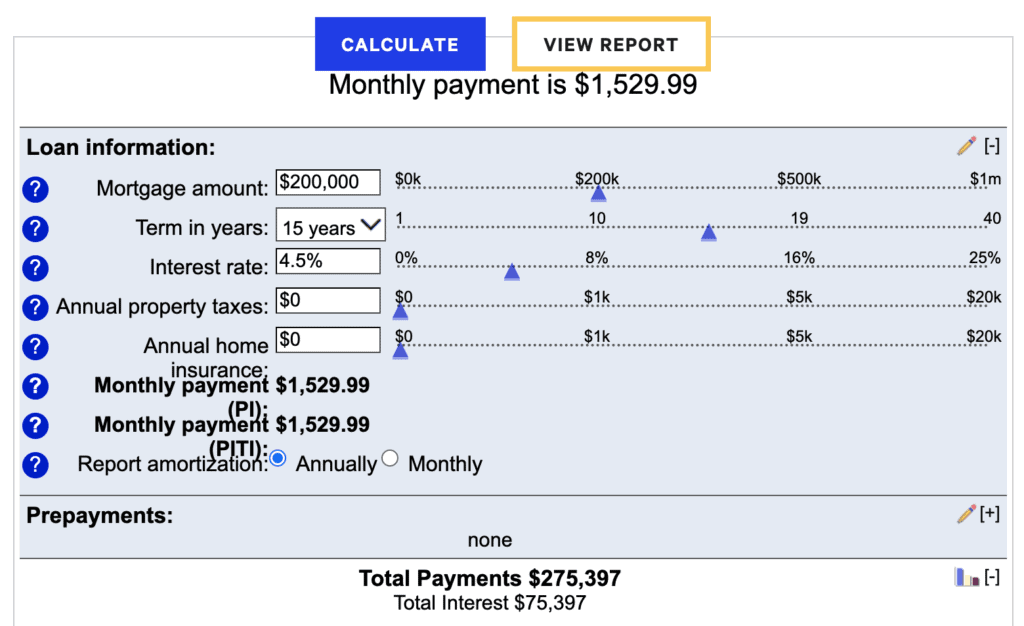

Monthly mortgage payment calculator

The mortgage payment calculator is the most common tool out there that helps prospective buyers estimate their monthly mortgage payments.

Add one of these calculators to your mortgage website to let visitors play around with the numbers to see how much house they can afford.

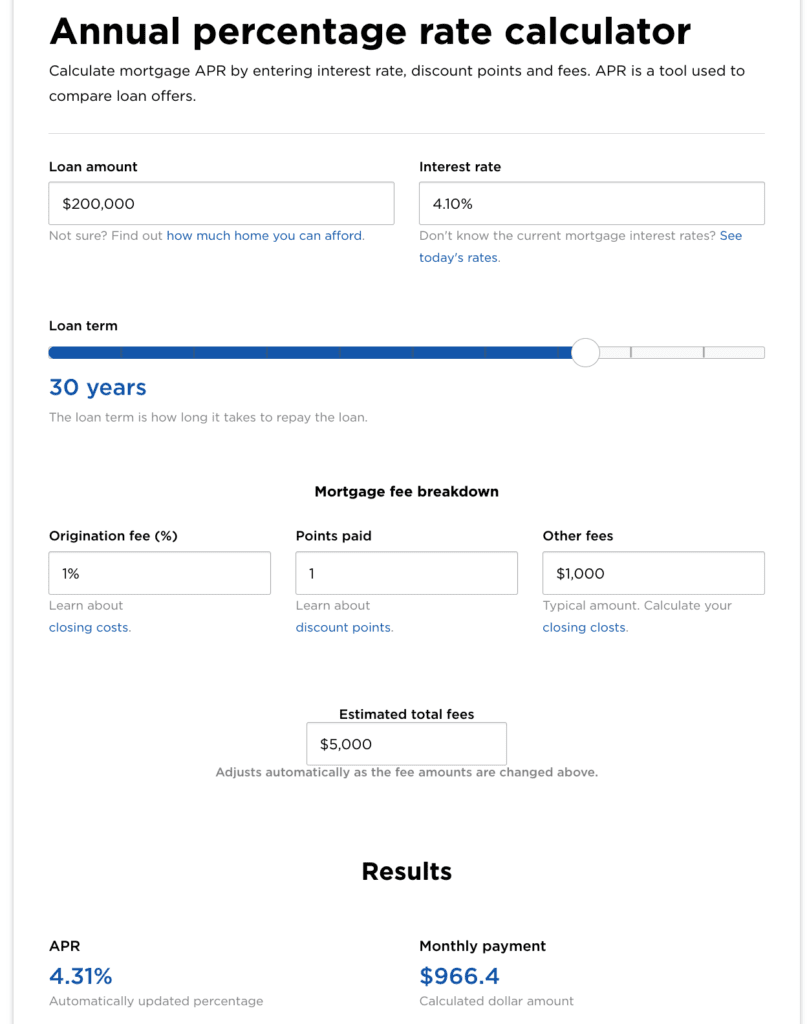

Mortgage annual percentage rate (APR) calculator

One important variable in the mortgage process is determining the annual percentage rate (APR) of the loan.

Use an APR mortgage calculator to type in different interest rates to determine the monthly mortgage repayment schedule.

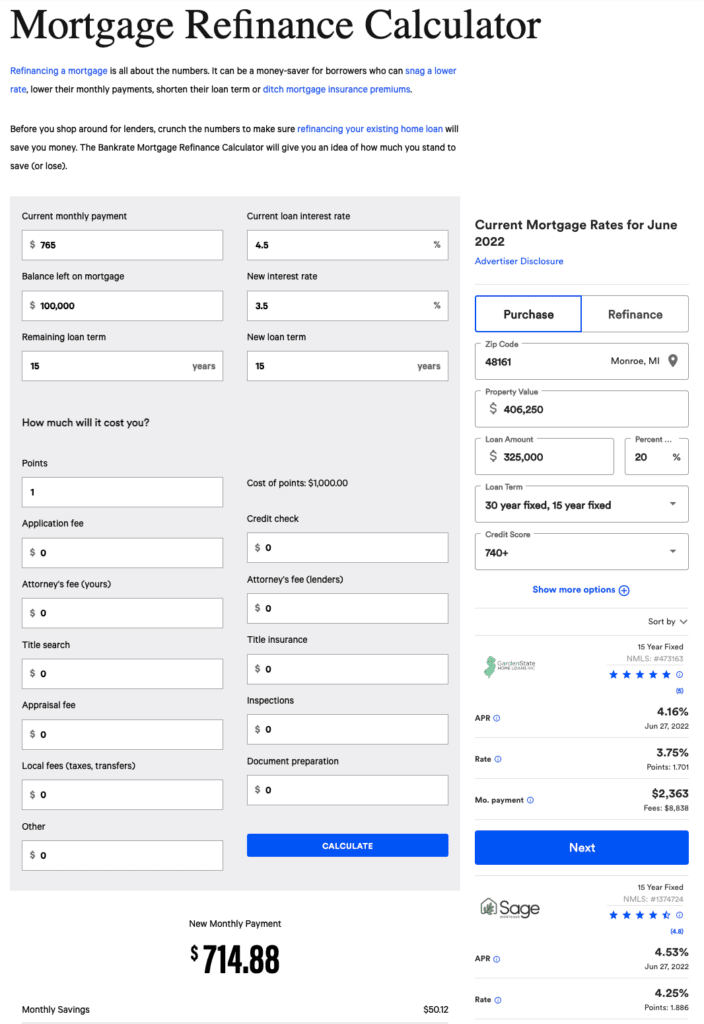

Mortgage refinance calculator

For borrowers looking to refinance their home, offer a mortgage refinance calculator to help them find a lower rate and save them money.

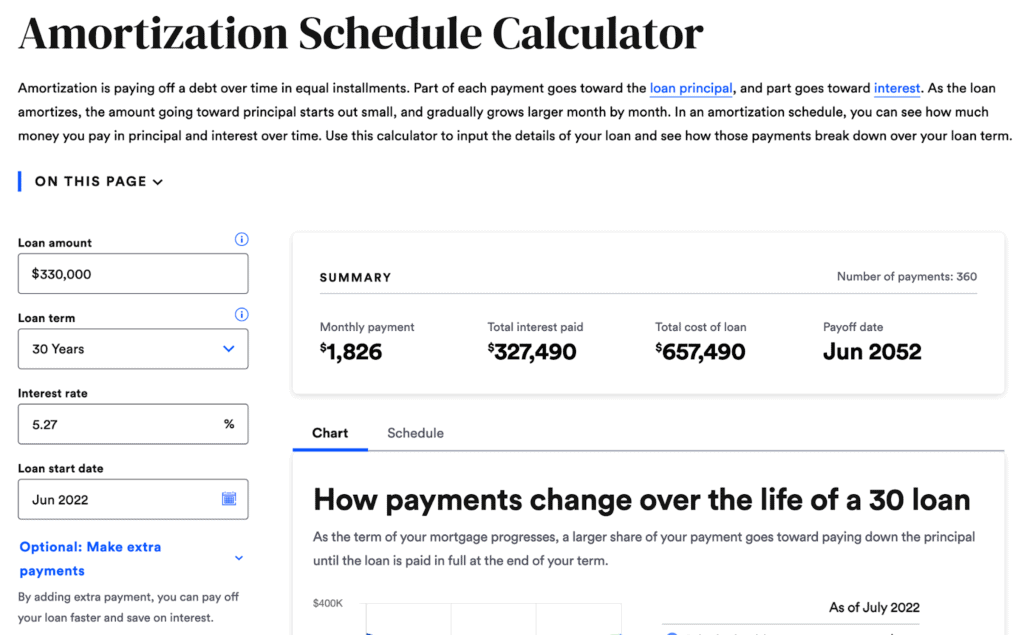

Amortization schedule calculator

Adding an amortization schedule calculator can let your prospective leads estimate the amount they will pay in principal and interest over time in equal installments.

How to create a mortgage calculator for your mortgage website

These days there are many plugins and widgets that can easily be “dragged and dropped” into most CMS-style websites, including WordPress and Squarespace.

Simply find the specific mortgage calculator widget and add it to your mortgage calculator landing page.

If you’re offering different loan types, then consider adding a different mortgage calculator to each loan’s individual landing page, in order to collect more leads from each page.

I will say that many mortgage calculator widgets are pretty ugly and generic, which might make your website look a bit tacky. If that is a concern, you can hire a mortgage marketing agency that can employ developers to create custom Excel formulas and transform them into beautiful calculators that will impress your audience.

How to get the word out about your mortgage calculator

Adding a mortgage calculator to your lending website is a good first step, but you’ll need to optimize your website to get the most traffic.

Follow these mortgage marketing strategies to promote your mortgage calculator tool across various channels online.

Optimized landing pages for SEO

Create individual web pages for each specific type of mortgage calculator that you want to add to your website.

For example, create a page that’s optimized around the keyword “Mortgage Payoff Calculator” or “Mortgage APR Calculator” and add the specific calculator to each page.

This will improve your website’s search engine optimization (SEO) so that when people search for a mortgage payoff calculator, your website will be a relevant search result because of your mortgage calculator page.

Content marketing (blogging)

The next best thing after optimizing landing pages is blogging about your mortgage calculator.

Write a 1,000-word blog post about each type of mortgage calculator you offer, and why they’re important. These blog posts will show up in Google searches when people are searching for mortgage calculators.

PPC ads

The last step you can take is to create PPC ads based on the word mortgage calculators so that when people search online, they’ll see a paid ad that can direct them back to your website, where you can generate a new lead.

Learn more

Kaleidico — a marketing agency for mortgage lenders

Kaleidico is a full-service marketing and lead generation agency for mortgage lenders, law firms, and fintech companies.

We help loan officers generate more leads through custom websites and lead generation strategies that include blogging, PPC ads, email marketing, lead magnets, mortgage calculators, and more.

Schedule your Discovery Session today and watch us increase your monthly mortgage leads.

Photo by RODNAE Productions.